Transfer Death Designation Beneficiary Form

Understanding the Transfer Death Designation Beneficiary

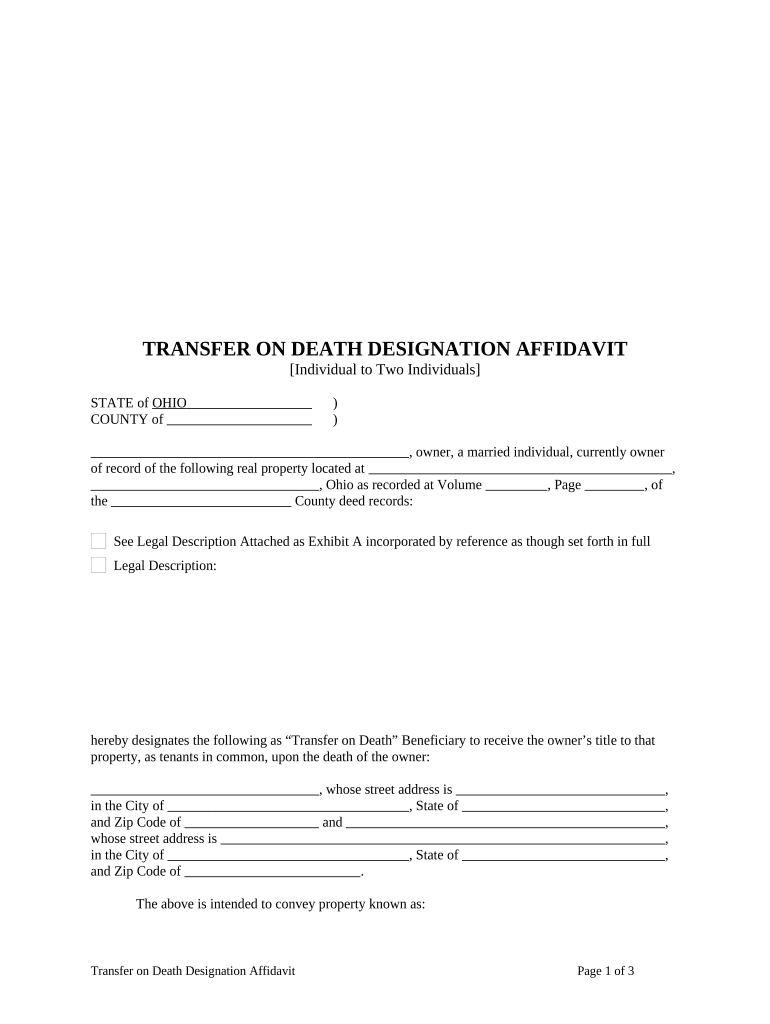

The Transfer Death Designation Beneficiary is a legal document that allows an individual to designate beneficiaries who will receive specific assets upon their death. This form is particularly relevant in estate planning, as it simplifies the transfer of property without the need for probate. By completing this form, individuals can ensure that their assets are passed directly to their chosen beneficiaries, streamlining the process and potentially reducing estate taxes.

Steps to Complete the Transfer Death Designation Beneficiary

Completing the Transfer Death Designation Beneficiary involves several key steps:

- Gather necessary information about the assets you wish to designate, including property titles and account details.

- Identify and list the beneficiaries, ensuring you have their full names and contact information.

- Fill out the form accurately, providing all required details about the assets and beneficiaries.

- Sign and date the form, ensuring compliance with state-specific requirements.

- Submit the completed form to the appropriate institution or agency that holds the assets.

Legal Use of the Transfer Death Designation Beneficiary

The legal use of the Transfer Death Designation Beneficiary is governed by state laws, which dictate how the form must be completed and submitted. It is crucial to ensure that the form meets all legal requirements to be considered valid. This includes proper signatures, witness requirements, and notarization, if necessary. Understanding these legal stipulations helps prevent disputes among heirs and ensures that the transfer of assets occurs smoothly.

State-Specific Rules for the Transfer Death Designation Beneficiary

Each state in the U.S. may have different rules regarding the Transfer Death Designation Beneficiary. It is essential to familiarize yourself with the specific regulations in Ohio, as they may dictate how the form is filled out and submitted. For example, some states may require notarization or specific language to be included in the form. Consulting with a legal professional can provide clarity on these state-specific requirements.

Key Elements of the Transfer Death Designation Beneficiary

The key elements of the Transfer Death Designation Beneficiary include:

- Asset Description: Clearly identify the assets being designated.

- Beneficiary Information: Include complete details of the beneficiaries, such as names and addresses.

- Signature: The form must be signed by the individual making the designation.

- Date: The date of signing is crucial for establishing the validity of the form.

Examples of Using the Transfer Death Designation Beneficiary

Examples of using the Transfer Death Designation Beneficiary can include:

- Designating a spouse as the beneficiary of a home or bank account.

- Assigning children as beneficiaries for a life insurance policy.

- Transferring ownership of a vehicle to a trusted friend or family member upon death.

Quick guide on how to complete transfer death designation beneficiary

Complete Transfer Death Designation Beneficiary effortlessly on any gadget

Digital document management has become a trend among companies and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documents, as you can obtain the necessary form and safely keep it online. airSlate SignNow provides you with all the resources required to create, alter, and eSign your documents promptly without delays. Handle Transfer Death Designation Beneficiary on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The simplest method to modify and eSign Transfer Death Designation Beneficiary with ease

- Obtain Transfer Death Designation Beneficiary and then click Get Form to initiate.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just moments and has the same legal significance as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your preference. Modify and eSign Transfer Death Designation Beneficiary and guarantee excellent communication at any phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Ohio death form?

An Ohio death form is a legal document required to record the passing of an individual in the state of Ohio. It includes essential information such as the deceased's personal details, cause of death, and the signature of a physician. Completing this form accurately is crucial for legal and administrative purposes.

-

How can airSlate SignNow help me with the Ohio death form?

airSlate SignNow simplifies the process of filling out and signing the Ohio death form by providing an easy-to-use electronic signing platform. You can easily upload necessary documents, fill them out digitally, and obtain signatures without the hassle of paper forms. This makes it convenient and efficient for funeral homes and families alike.

-

Is there a cost associated with using airSlate SignNow for the Ohio death form?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for users. Our pricing plans are tailored to accommodate different needs, ensuring that individuals and businesses can manage the Ohio death form without breaking the bank. You can explore our pricing plans to find one that works for you.

-

Can airSlate SignNow integrate with other applications for managing Ohio death forms?

Absolutely! airSlate SignNow offers seamless integrations with various applications to enhance your document management process, including CRM software and cloud storage solutions. This means you can streamline how you handle the Ohio death form and connect it with your existing workflows effortlessly.

-

What are the benefits of using airSlate SignNow for the Ohio death form?

Using airSlate SignNow to complete the Ohio death form offers several benefits, including increased efficiency, reduced paperwork, and secure storage of sensitive documents. The platform allows for quick access and easy tracking of the form's status, ensuring that you have everything you need when dealing with such a delicate matter.

-

Is airSlate SignNow secure for handling sensitive information like the Ohio death form?

Yes, airSlate SignNow prioritizes security, implementing advanced encryption and data protection measures to keep your information safe. When handling sensitive documents like the Ohio death form, you can trust that your data is secure and protected from unauthorized access.

-

How do I get started with airSlate SignNow for the Ohio death form?

Getting started with airSlate SignNow for the Ohio death form is simple! Just create an account on our website, choose a suitable plan, and you can begin uploading and preparing your documents for eSignature. Our intuitive interface will guide you through the process, making it a breeze to manage your Ohio death form.

Get more for Transfer Death Designation Beneficiary

- T i e s exhibits order form the state historical society of north history nd

- Alternative noise mitigation plan application nyc gov form

- Download pdf version of form 525 ohio secretary of state sos state oh

- Dean cochran form

- Addendum to tr 320cr 320 cant afford to pay fine form

- 211386tacalifornia court interpreter complaint form and instructionstagaloga3zformatted dr

- Tax relief for the elderly and disabled form

- Tax relief application for disabled veterans form

Find out other Transfer Death Designation Beneficiary

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online