Insurance Carrier Annual Tax Form 200Industrial

What is the Insurance Carrier Annual Tax Form 200Industrial

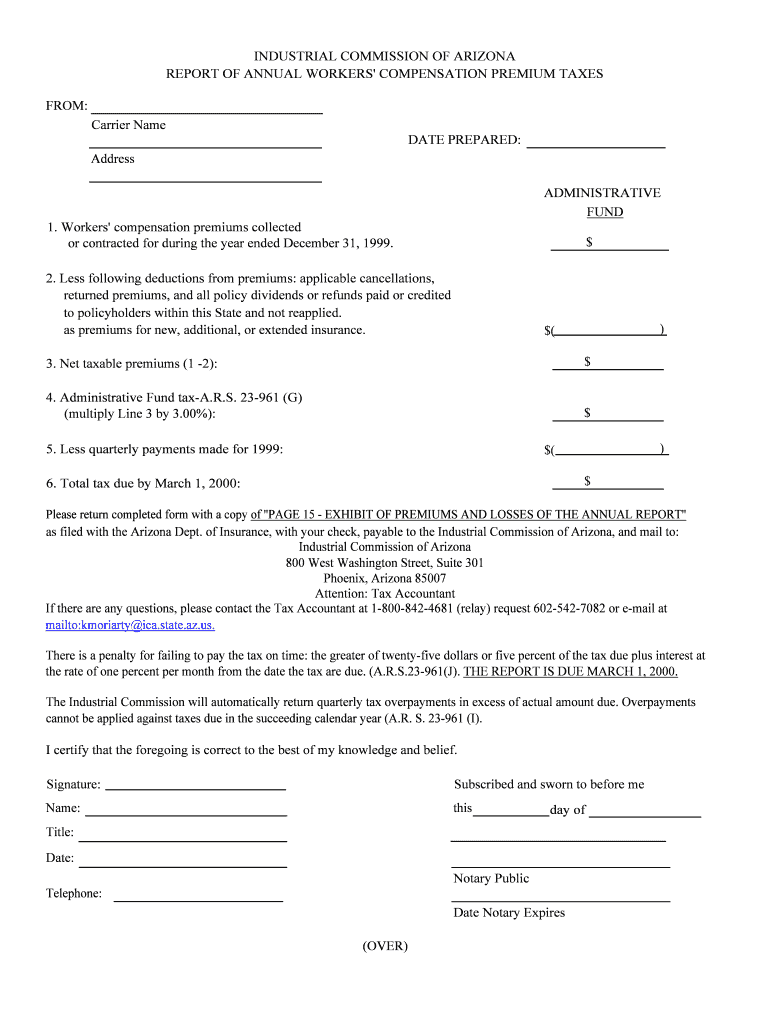

The Insurance Carrier Annual Tax Form 200Industrial is a specific tax form used by insurance carriers in the United States to report their annual financial information to the Internal Revenue Service (IRS). This form helps ensure compliance with federal tax regulations and provides essential data regarding the carrier's operations, including premiums collected, claims paid, and other financial metrics. Understanding this form is crucial for insurance companies to maintain transparency and adhere to legal requirements.

How to use the Insurance Carrier Annual Tax Form 200Industrial

Using the Insurance Carrier Annual Tax Form 200Industrial involves several steps. First, gather all necessary financial information, including income statements and balance sheets. Next, accurately fill out the form by entering the required data in the designated fields. It is important to ensure that all figures are correct and that the form is signed by an authorized representative of the insurance carrier. Once completed, the form can be submitted to the IRS either electronically or via traditional mail, depending on the carrier's preferences.

Steps to complete the Insurance Carrier Annual Tax Form 200Industrial

Completing the Insurance Carrier Annual Tax Form 200Industrial requires careful attention to detail. Follow these steps:

- Gather relevant financial documents, including profit and loss statements and previous tax filings.

- Review the form's instructions to understand the specific requirements for each section.

- Fill in the form with accurate financial data, ensuring that all calculations are correct.

- Double-check the entries for accuracy and completeness.

- Obtain the necessary signatures from authorized personnel.

- Submit the completed form to the IRS by the designated deadline.

Legal use of the Insurance Carrier Annual Tax Form 200Industrial

The legal use of the Insurance Carrier Annual Tax Form 200Industrial is governed by IRS regulations. This form must be filled out accurately and submitted on time to avoid penalties. The information provided in this form is used to assess the insurance carrier's tax obligations and compliance with federal tax laws. Failure to submit the form or providing false information can lead to legal consequences, including fines and audits.

Filing Deadlines / Important Dates

Filing deadlines for the Insurance Carrier Annual Tax Form 200Industrial are crucial for compliance. Typically, the form must be filed by March fifteenth of the year following the tax year being reported. However, extensions may be available under certain circumstances. It is essential for insurance carriers to be aware of these deadlines to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Insurance Carrier Annual Tax Form 200Industrial can be submitted through various methods. Carriers have the option to file electronically using approved e-filing software, which can streamline the submission process and ensure faster processing times. Alternatively, the form can be mailed directly to the IRS. In-person submissions are generally not an option for this specific form, making electronic filing or postal submission the most viable methods.

Quick guide on how to complete insurance carrier annual tax form 200industrial

Complete Insurance Carrier Annual Tax Form 200Industrial effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the features you require to create, modify, and eSign your documents swiftly without delays. Manage Insurance Carrier Annual Tax Form 200Industrial on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-based process today.

The easiest way to alter and eSign Insurance Carrier Annual Tax Form 200Industrial with zero hassle

- Obtain Insurance Carrier Annual Tax Form 200Industrial and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your files or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Insurance Carrier Annual Tax Form 200Industrial to ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Insurance Carrier Annual Tax Form 200Industrial?

The Insurance Carrier Annual Tax Form 200Industrial is a required document that insurance companies submit annually for tax reporting. This form includes critical information related to insurance premiums and taxes owed, ensuring compliance with regulatory requirements. Utilizing airSlate SignNow simplifies the process of preparing and submitting this form.

-

How can airSlate SignNow help with the Insurance Carrier Annual Tax Form 200Industrial?

airSlate SignNow offers a user-friendly platform for preparing, signing, and managing the Insurance Carrier Annual Tax Form 200Industrial. Our solution provides templates, automated workflows, and eSignature capabilities to streamline the entire process. This helps businesses complete their tax documentation efficiently and accurately.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes looking to manage their Insurance Carrier Annual Tax Form 200Industrial. Our pricing is competitive and scales based on features and usage. Contact our sales team to find the best plan tailored to your needs.

-

Does airSlate SignNow provide integrations with accounting software for tax forms?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage your Insurance Carrier Annual Tax Form 200Industrial. These integrations allow for automated data entry, document storage, and additional compliance features. You can streamline your workflow and eliminate manual errors in your tax preparation process.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow comes equipped with various features essential for document management, especially for the Insurance Carrier Annual Tax Form 200Industrial. Users can benefit from templates, version control, and secure cloud storage. Additionally, the platform provides tracking, reminders, and notifications to ensure you never miss deadlines.

-

Is airSlate SignNow secure for sensitive tax documents?

Absolutely! Security is our top priority at airSlate SignNow, especially when dealing with sensitive documents like the Insurance Carrier Annual Tax Form 200Industrial. Our platform uses advanced encryption, secure access controls, and regular security audits to protect your data and ensure compliance with industry regulations.

-

What customer support options does airSlate SignNow provide?

airSlate SignNow offers comprehensive customer support to assist users with their queries related to the Insurance Carrier Annual Tax Form 200Industrial. You can access our support through live chat, email, or phone, and we also provide an extensive knowledge base with helpful resources and tutorials to guide you through the process.

Get more for Insurance Carrier Annual Tax Form 200Industrial

- Adopt a school memorandum of understanding mou form

- Jr smith roof drains form

- Washington dc sign dcra consent form tenant

- Skade verslag voorbeeld form

- Queens college commitment deposit form

- Third party payment declaration form

- Vehicle purchase declaration form

- Injection wells permitting and compliance forms h5 handout rrc state tx

Find out other Insurance Carrier Annual Tax Form 200Industrial

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast