Printable Deposit Slips Downloads Form

What is a Printable Deposit Slip?

A printable deposit slip is a document used by individuals and businesses to deposit funds into a bank account. This form typically includes essential information such as the account holder's name, account number, and the amount being deposited. By using a deposit slip template, users can easily fill in their details and print the form for submission at their bank. The convenience of a printable deposit slip allows for quick and efficient transactions, especially in a digital age where many prefer to handle banking matters online.

Key Elements of a Deposit Slip Template

When using a deposit slip template, several key elements must be included to ensure it is completed correctly. These elements typically consist of:

- Account Holder's Name: The name of the individual or business making the deposit.

- Account Number: The specific bank account number where the funds will be deposited.

- Date: The date when the deposit is being made.

- Deposit Amount: The total amount of money being deposited, including cash and checks.

- Signature: The account holder's signature to authorize the transaction.

Including all these elements ensures that the deposit slip is valid and can be processed without any issues.

Steps to Complete a Deposit Slip Template

Filling out a deposit slip template is a straightforward process. Follow these steps to ensure accuracy:

- Download or Print the Template: Obtain a blank deposit slip template from a reliable source.

- Fill in Your Information: Enter your name, account number, and the date at the top of the slip.

- List the Deposit Amount: Specify the amount of cash and checks being deposited. Ensure the total matches the sum of the individual amounts.

- Sign the Slip: Add your signature to authorize the deposit.

- Submit the Slip: Take the completed deposit slip to your bank, either in person or through an ATM.

By following these steps, you can ensure that your deposit is processed smoothly and efficiently.

Legal Use of a Deposit Slip Template

Using a deposit slip template is legally acceptable as long as it is filled out accurately and complies with your bank's requirements. Digital signatures may also be used if permitted by the bank, providing an additional layer of convenience. It is essential to ensure that the information provided is truthful and that the slip is signed by the authorized account holder to avoid any legal complications.

Examples of Deposit Slip Templates

There are various examples of deposit slip templates available, tailored to different banking needs. Common formats include:

- Standard Deposit Slip: Used for most personal and business deposits.

- Specialized Deposit Slip: Designed for specific types of accounts, such as savings or business accounts.

- Online Deposit Slip: Digital versions that can be filled out and submitted electronically.

These examples help users choose the right template that fits their banking requirements.

How to Obtain a Deposit Slip Template

Obtaining a deposit slip template is easy and can be done in several ways. Users can:

- Download Online: Many banks provide downloadable templates on their websites.

- Create Your Own: Use word processing software to design a custom deposit slip based on the required elements.

- Request from Your Bank: Visit your local bank branch and ask for printed deposit slips.

By utilizing these methods, individuals can easily access the necessary forms for their banking needs.

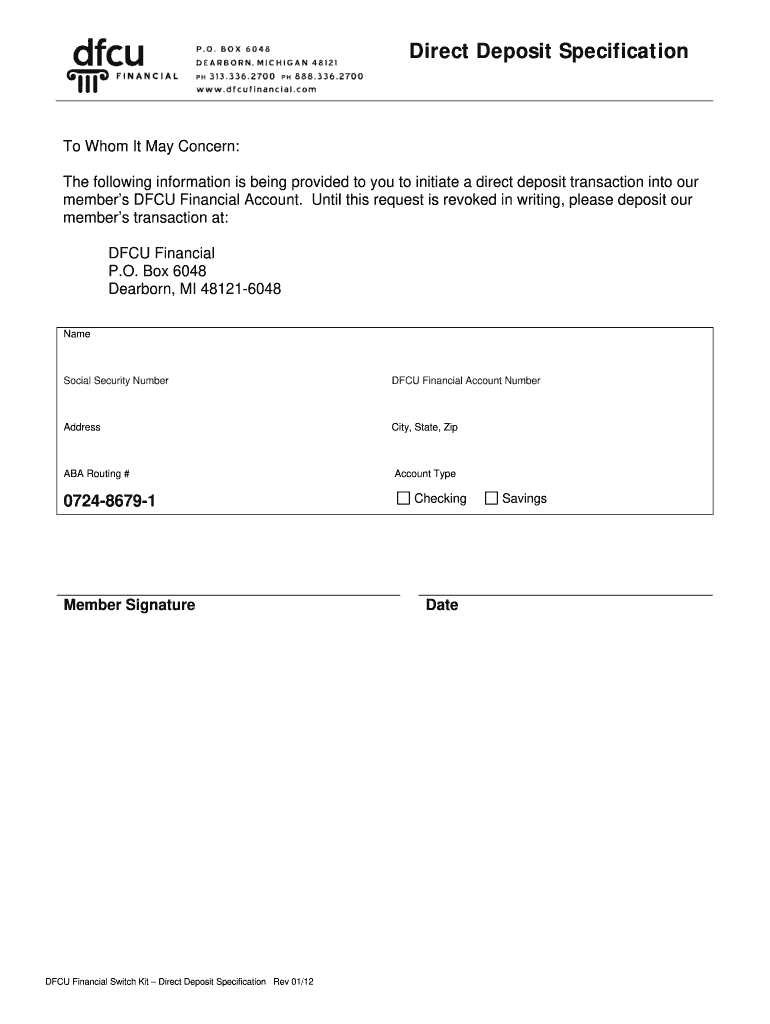

Quick guide on how to complete deposit slip dfcu form

Complete Printable Deposit Slips Downloads effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed paperwork, allowing you to locate the right template and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage Printable Deposit Slips Downloads on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Printable Deposit Slips Downloads with ease

- Find Printable Deposit Slips Downloads and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or mislaid documents, tiresome form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from your selected device. Modify and electronically sign Printable Deposit Slips Downloads and guarantee outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out a deposit slip?

You go to the bank of your choice, preferably where you have an account, and ask for a deposit slip. You then technically do a “fill in the blank” and then write the number of notes of relevant denomination note. Like thisCredit: http://mindpowerindia.com/sbi.phpNow go and deposit your Rs. 500 and Rs. 1000 notes, if you are in India :-)EDIT: As rightly pointed out by Lara Taylor sorry for being judgemental.

-

How can I fill out a savings deposit slip?

“How can I fill out a savings deposit slip?”Do you have some savings to deposit?Do you have a savings account?Do you know the savings account number?Do you have a way to obtain a savings deposit slip?Do you have a pen with which to fill out the savings deposit slip?Are you physically able to enter the appropriate information on the slip?When you’ve answered these questions, then someone can probably provide an appropriate answer to your question.

-

How do I fill out a bank deposit slip?

You would have to show up in person at a branch location that belongs to your bank where your bank account is open. Most banks have a lines for the customers to get in line and wait for their turn to talk to the bank teller. Most banks will have a section in the middle of this section where they have a bunch of blank documents and a deposit slip is included there.There is specific information that you need to know in order to fill the bank deposit slip correctly and you don't have to spend time memorizing it or take documents of that information with you. All you have to do is just write it down in a piece of paper and then reap into pieces the paper when you are done. The information that you need to fill out the deposit slip is your account number. What is it that you are depositing a check or cash and what is the exact amount to be deposited. The deposit slip should include your name and your signature.In type of deposit slip, you would have to also check whether you are depositing the funds into your bank checkings account or into your bank savings account and your address. The signature section is a part that can only be signed in the presence of a bank teller. You would also have to write the date on which this deposit takes place.Some deposit slips differ in one or two things from the others but for the most part they all are very similar in many ways. In this deposit slip, you would not have to write the date or your address or whether it goes to a savings or checking accounts but all other information still applies.Note that in the two types of the deposits samples there is a section that says “subtotal” and another that says “less cash”. Those two sections are only applicable when you present a check to be cash but you also want part of that check to deposit into your account. For example, let us say that you present a check with the total funds of 1458 but you want to receive 800 in cash and the remaining balance is two be deposited. In that case, the subtotal would say “1458” and the “less cash” section would say “800” the the “total” section would say “658”. Those types of deposit slips are provided to you free of charge at the bank.The deposit slip shown above is another type of bank deposit slip which is more convenient and you have less possibilities of making entry errors because those types of deposit slips are already personalized and they already have your bank account, name and address printed on them. All you have to do is fill out the amount that you depositing into your bank account and whether it is a check or cash. However, the personalized deposit slips costs money.At the end of the successful deposit transaction, you should received from the bank teller a deposit receipt which summarizes the how much was deposited and your new bank account balance. Some advanced banks will even print a receipt with an image of the check that was deposited.

-

What are the steps to fill out a deposit slip?

There are following steps to fillout a deposit slip:1.fill your branch name in which you have maintained your account.2. your name3.Your bank account no.4.Rupees with denominations and then in words5.your mobile no.6.your signature

-

Am I suppose to fill out a deposit slip or is it okay to give the teller my debit card (I’ve always given my card to deposit before, is it okay?)?

Most banks no longer require a deposit slip. You would have to present your ATM card so your proper account is credited.

-

What is the legal importance of deposit slips of banks?

Hello,I could not understand the word "Deposit Slip" & I presume it to be - the "counter foil" given by the Bank Shroff having accepted your cash or cheque & proceeding to answer.1.Make it a habit to have an Acknowledgement for everything that you deal with a Bank or for that matter with any anybody or any organization.2. When you deposit cash in Bank, with cash denomination details (Cheque details for cheque deposits) on the back of the challan as well as on the back of counter foil, the counter foil is given back to the depositor duly authenticated bythe Bank. Keep it safe till such time that you see that deposit entry in your Statement of Account. There after it does not serve any purpose since the deposit made already found its place in the Account.3. Legally sanctity: When a Cash/Cheque deposit entry is missing in the Statement of Account (which is a very remote possibility), this comes handy for your depositing of cash/ cheque, the same can be accepted as proof of deposit in a Court of Law. If it is a genuine Counterfoil, based on that, an enquiry could be made in the bank. It facilitates easy processing of your complaint and helps both to find/ trace out the transaction.Hope this helps & Thanks for reading.

-

What will happen to my check, as I filled out the wrong amount in figures on the deposit slip in the right corner of the slip?

Bank will ask you to correct it. It is a record of account activity and they need it for record purpose for audit/compliance to other laws.But if it escapes the eyes of your banker,your cheque would get credited.Some of them may actually correct it themselves if they notice it later,but then same may not and ask you to do it.

-

If a cheque deposit slip is wrongly filled out, what happens?

The issues can be visualized this way. (1) The name on the cheque and the deposit slip differs. (2) The amount written on the cheque and the deposit slip differs. In the first case the bank will not collect the cheque as it is not clear to the Bank as to whether the payee of the cheque is a customer of the Bank or not. Banks are expected to collect the cheques for their customers only. In the second case, banks may round off the amount written on the deposit slip and rewrite the correct amount on it and collect the amount of the cheque. Your account will be credited by the amount of the cheque only and not what you have written on the deposit slip.

Create this form in 5 minutes!

How to create an eSignature for the deposit slip dfcu form

How to make an eSignature for your Deposit Slip Dfcu Form online

How to make an electronic signature for the Deposit Slip Dfcu Form in Google Chrome

How to create an eSignature for putting it on the Deposit Slip Dfcu Form in Gmail

How to generate an electronic signature for the Deposit Slip Dfcu Form straight from your smart phone

How to create an electronic signature for the Deposit Slip Dfcu Form on iOS

How to generate an electronic signature for the Deposit Slip Dfcu Form on Android

People also ask

-

What is a deposit slip example?

A deposit slip example is a template or formatted document used to deposit money into a bank account. It includes details like the account number, the amount being deposited, and the date. Utilizing a deposit slip example can simplify the deposit process for both individuals and businesses.

-

How can I create a deposit slip example using airSlate SignNow?

With airSlate SignNow, you can easily create a deposit slip example by utilizing our customizable templates. Simply select a template, fill in the necessary details, and customize it according to your business needs. This makes the process of document creation efficient and straightforward.

-

What are the benefits of using a deposit slip example?

Using a deposit slip example streamlines the banking process, ensuring that all necessary information is accurately captured. It also minimizes the risk of errors when depositing funds. By implementing a deposit slip example in your workflow, you save time and increase overall efficiency.

-

Is there a cost associated with using airSlate SignNow for deposit slips?

AirSlate SignNow offers a cost-effective solution for eSigning and document management, with different pricing plans to suit various business needs. You can create a deposit slip example as part of your document workflow without incurring additional costs. Check our pricing section for detailed information.

-

Can I integrate airSlate SignNow with other applications for deposit slips?

Yes, airSlate SignNow supports various integrations with popular applications, allowing you to enhance the functionality of your deposit slip example. You can connect with accounting software, CRMs, and other tools to streamline your processes. This integration capability makes managing documents even easier.

-

How secure is the use of a deposit slip example in airSlate SignNow?

Security is a top priority at airSlate SignNow. When you use a deposit slip example, all data is encrypted to protect your sensitive information. Our platform also complies with industry standards, ensuring your documents remain secure throughout the signing and sharing process.

-

Can I edit a deposit slip example after it’s created?

Absolutely! AirSlate SignNow allows you to edit any deposit slip example after it has been created. You can make changes to the details whenever necessary, ensuring that the document always reflects the correct information before submission or signing.

Get more for Printable Deposit Slips Downloads

- Commercial contractor package florida form

- Excavation contractor package florida form

- Florida contractor form

- Concrete mason contractor package florida form

- Demolition contractor package florida form

- Security contractor package florida form

- Insulation contractor package florida form

- Paving contractor package florida form

Find out other Printable Deposit Slips Downloads

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed