Nanny Performance Evaluation Form Nanny Taxes

What is the nanny performance evaluation form?

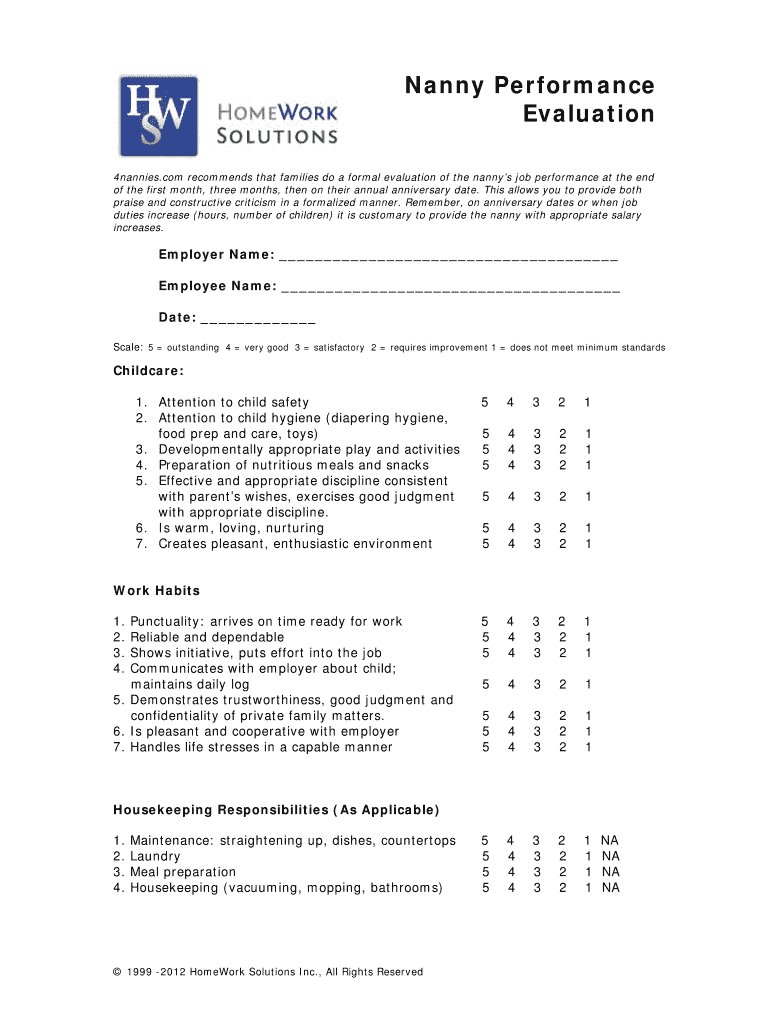

The nanny performance evaluation form is a structured document designed to assess the effectiveness and quality of care provided by a nanny. This form typically includes various sections that cover key performance areas, such as child safety, communication skills, and adherence to the family's guidelines. By utilizing this form, families can provide constructive feedback to their nannies, ensuring that expectations are clear and fostering a productive working relationship. Additionally, this evaluation serves as a formal record that can be referenced during future discussions or evaluations.

Key elements of the nanny performance evaluation form

A comprehensive nanny performance evaluation form includes several critical components to ensure a thorough assessment. Key elements often found in the form include:

- Personal Information: Details about the nanny, such as name, contact information, and employment dates.

- Performance Criteria: Specific areas of evaluation, including child engagement, discipline methods, and safety practices.

- Rating Scale: A system for rating performance, often ranging from unsatisfactory to excellent.

- Comments Section: Space for additional feedback, observations, or suggestions for improvement.

- Signatures: Areas for both the nanny and the employer to sign, acknowledging the evaluation's completion.

Steps to complete the nanny performance evaluation form

Completing the nanny performance evaluation form involves several straightforward steps. Here is a guide to ensure an effective evaluation process:

- Gather Information: Collect any relevant notes or observations about the nanny's performance over the evaluation period.

- Fill Out Personal Information: Enter the nanny's details at the top of the form to identify the individual being evaluated.

- Assess Performance Criteria: Review each performance area and provide ratings based on your observations.

- Provide Comments: Use the comments section to elaborate on specific strengths or areas for improvement.

- Review Together: Schedule a meeting with the nanny to discuss the evaluation, ensuring clarity and mutual understanding.

- Sign and Date: Both parties should sign and date the form to formalize the evaluation process.

Legal use of the nanny performance evaluation form

The nanny performance evaluation form can have legal implications, particularly if disputes arise regarding employment terms or performance. To ensure its legal validity, the form must be completed accurately and signed by both parties. It is essential to maintain a copy for personal records, which may be useful in case of future disagreements. Additionally, adhering to any state-specific labor laws regarding employment evaluations can further solidify the form's legal standing.

How to use the nanny performance evaluation form

The nanny performance evaluation form serves multiple purposes beyond mere assessment. To effectively use this form, consider the following approaches:

- Regular Reviews: Schedule evaluations at consistent intervals, such as quarterly or bi-annually, to track progress over time.

- Feedback Tool: Use the form as a basis for constructive feedback discussions, helping the nanny understand areas of strength and opportunities for growth.

- Documentation: Keep the completed forms as part of the nanny's employment record, which can be beneficial for future references or employment opportunities.

Examples of using the nanny performance evaluation form

Utilizing the nanny performance evaluation form can vary based on individual family needs. Here are a few examples of how families might implement this form:

- Annual Performance Review: Conduct a comprehensive evaluation at the end of the year to assess overall performance and set goals for the upcoming year.

- Incident Review: After a specific incident, such as a safety concern, use the form to evaluate the nanny's response and adherence to safety protocols.

- New Nanny Orientation: For new hires, an initial evaluation after a probationary period can help establish expectations and provide feedback early in the employment relationship.

Quick guide on how to complete nanny performance evaluation form nanny taxes

Complete Nanny Performance Evaluation Form Nanny Taxes seamlessly on any device

Digital document management has gained signNow traction among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed forms, as you can easily find the necessary document and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without any holdups. Manage Nanny Performance Evaluation Form Nanny Taxes on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The simplest way to modify and eSign Nanny Performance Evaluation Form Nanny Taxes effortlessly

- Obtain Nanny Performance Evaluation Form Nanny Taxes and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of the documents or conceal confidential information using the tools airSlate SignNow offers specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you'd like to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or disorganized documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow manages all your document management requirements with just a few clicks from any device you prefer. Edit and eSign Nanny Performance Evaluation Form Nanny Taxes and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Do you have to pay taxes and provide benefits for a full time live out nanny?

Pay taxes, absolutely; provide benefits, no. (Although because most benefits can be provided on a nontaxable basis, that can be a way of reducing the taxes on both you and the nanny.)I’m assuming you are in the US . . .

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

Is it going too far to ask a potential girlfriend to fill out a potential partner evaluation form?

You have, of course, offered her your version of the same form (or equivalent), filled out with all your answers, right?I just applied for a job I may decide I don’t want because their application process is so 1999. Allow that your prospective partners will be evaluating your date selection process while they fill out the form. It is possible that some women will relish a more straightforward, apparently data-driven approach and find it more comfortable to write answers than to talk.This might actually be the best way to weed out incompatible partners, for you.You will have to accept that this WILL weed out incompatible partners, of course. As long as you can live with that fall out, I’m all for reducing the field of candidates to manageable numbers as fast as possible.You might want to have the form reviewed by someone you trust who can help you evaluate how you have worded the various questions and make sure that the data you are seeking is actually relevant to your criteria.(And you do have criteria, of course.)

-

How much should I hold out for taxes on $500 a week in Texas? I’m a Nanny for a family and they don’t take taxes out of my pay?

Assuming you are single and take a standard deduction, according to this tax estimation program, you’ll owe $1,874 for the year in federal income taxes.From your $500 per week, you should set aside about $36 ($1,874/52).Additionally, you’ll need to pay self employment tax (medicare and social security), which is 15.3%.$26K per year x 15.3%= $3 978. That’s about about $76.50 per week.You are fortunate to live in Texas, which has no state income tax. Had you lived in California, you would not be so fortunate.So, let’s tally everything up. $36 (federal tax) plus $76.50 (self employment tax) equals $112.50 or 22.5% of your gross pay.federal tax calculator here > Tax Calculator - Estimate Your Tax Liability

-

How can my employer charge me taxes when I didn't fill out any form (like W2, W4, or W9)?

**UPDATE** After my answer was viewed over 4,100 times without a single upvote, I revisited it to see where I might have gone wrong with it. Honestly, it seems like a reasonable answer: I explained what each of the forms asked about is for and even suggested getting further information from a licensed tax preparer. BUT, I’m thinking I missed the underlying concern of the querent with my answer. Now I’m reading that they don’t care so much about the forms as they do about the right or, more accurately, the obligation of their employer to withhold taxes at all.So let me revise my answer a bit…Your employer doesn’t charge you taxes - the government does. The government forces employers to withhold (or charge, as you put it) taxes from the earnings of their employees by threatening fines and even jail time for failing to do so (or for reclassifying them as independent contractors in order to avoid the withholding and matching requirements). Whether you fill out any forms or not, employers will withhold taxes because they don’t want to be fined or go to jail.Now the meta-question in the question is how can the government tax its citizen’s income? Well, that’s a big debate in America. Tax is the only way governments make money and they use that money to provide services for their constituency. Without funding, no federal or state or county program, or employee, would exist. But still, some people believe taxation is illegal, unjustified, and flat out wrong. They believe that free market forces should fund the military, the Coast Guard, Department of Defense, Veterans Affairs, Border Patrol, the FBI, CIA, DEA, FDA, USDA, USPS, the Federal Prison Complex, the National Park Service, the Interstate Highway System, air traffic control, and the Judiciary (just to name a few things). They even believe paying politicians for the work they do, like the President and Congress, is wrong.Others (luckily, most of us) appreciate paying taxes, even if they seem a bit steep at times. We’re happy to benefit from all the things our tax dollars buy us and we feel what we pay gives us back returns far greater than our investment. If you’re on the fence about this issue, consider how expensive health care is and how much you’re getting out of paying for it privately (out of your own paycheck). Same with your education or that of your children. Do you pay for private schools? Private colleges? Do you pay for private child care too? All expensive, right?Well what if we had to pay for private fire fighting? Or all mail had to be shipped via FedEx or UPS? Or if the cost of a plane ticket to anywhere doubled because we had to pay out-of-pocket for air traffic control? What about the military, border control and veterans? How much are you willing to pay out of every paycheck DIRECTLY to the department of defense AND veterans affairs? If we privatized the military, would we still be able to afford $30 billion dollar fighter jets? Who would pay to defend us?I bet people living paycheck to paycheck would be hard pressed to find extra money to pay for the military, when they’re already spending so much for teachers, schools, health care, local emergency response, food safety inspections, social workers, the criminal justice system, road repairs and construction, bridge inspection and maintenance, and natural disaster remediation (just to name a few things).Think about if all the national and local parks were privatized. Visiting one would cost as much or more than it does to go to Disneyland. Think about how much more food would cost if farmers weren’t subsidized and food wasn’t inspected for safety. Imagine how devastating a pandemic would be without the Center for Disease Control to monitor and mitigate illness outbreaks.We all take for granted the myriad of benefits we get from paying taxes. We may like to gripe and moan but taxes aren’t just for the public good, they’re for our own. (That rhymes!)**END OF UPDATE**W-9 forms are what you fill out to verify your identification, or citizenship status, for your employers. They have nothing to do with payroll taxes other than being the primary tool to from which to glean the correct spelling of your name and your Social Security number.W-2 forms are issued by employers to employees for whom they paid the required payroll taxes to the government on their behalf. The W-2 also details the amount of a person’s pay was sent to the government to fund their Social Security and Medicare accounts. W-2 forms are necessary for people when filing their personal income taxes so they can calculate if they under or overpaid.W-4 forms are filled out by employees to assure that the appropriate amount of pay is being withheld (and transferred on their behalf) by their employers to the government. If you don’t fill out a W-4 then your employer withholds the standard default amount for a single individual. You can update your W-4 at any time with your employer and you may want to when the size of your household changes.Even if you aren’t an employee (like you get paid without taxes being withheld for you) and are issued a 1099-MISC form instead of a W-2, you’re STILL responsible for paying your taxes as you earn that money - in no greater than quarterly installments. If you go over three months without paying taxes when you’re making money - whether your employer is withholding it and paying it on your behalf or you just made the money and no one took any taxes out for you - you’ll be fined and charged interest on your late tax payments.Talk with a licensed tax preparer and they can help you better understand what it all means. Good luck and happy tax season!

-

How do you fill out the 1080 form when filing taxes?

There is no such form in US taxation. Thus you can not fill it out. If you mean a 1098 T you still do not. The University issues it to you. Please read the answers to the last 4 questions you posted about form 1080. IT DOES NOT EXIST.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

Create this form in 5 minutes!

How to create an eSignature for the nanny performance evaluation form nanny taxes

How to generate an electronic signature for the Nanny Performance Evaluation Form Nanny Taxes in the online mode

How to generate an eSignature for your Nanny Performance Evaluation Form Nanny Taxes in Chrome

How to make an electronic signature for putting it on the Nanny Performance Evaluation Form Nanny Taxes in Gmail

How to create an eSignature for the Nanny Performance Evaluation Form Nanny Taxes from your mobile device

How to generate an electronic signature for the Nanny Performance Evaluation Form Nanny Taxes on iOS devices

How to make an electronic signature for the Nanny Performance Evaluation Form Nanny Taxes on Android

People also ask

-

What is the Nanny Performance Evaluation Form and how does it relate to Nanny Taxes?

The Nanny Performance Evaluation Form is a crucial document that helps parents assess their nanny's performance. This assessment is essential for determining appropriate compensation and ensuring compliance with Nanny Taxes. By using this form, families can streamline the evaluation process, making it easier to manage their nanny's employment and tax obligations.

-

How can I implement the Nanny Performance Evaluation Form for my nanny?

Implementing the Nanny Performance Evaluation Form is simple with airSlate SignNow. You can customize the form to fit your specific needs and send it directly to your nanny for evaluation. This process not only helps in assessing performance but also aids in understanding the financial implications related to Nanny Taxes.

-

What features does airSlate SignNow offer for the Nanny Performance Evaluation Form?

airSlate SignNow offers a variety of features for the Nanny Performance Evaluation Form, including easy eSignature options, document templates, and customizable fields. These features ensure that the evaluation process is efficient and compliant with Nanny Taxes. Additionally, the platform provides tracking capabilities, so you can monitor the status of your documents.

-

Is the Nanny Performance Evaluation Form easy to use?

Yes, the Nanny Performance Evaluation Form on airSlate SignNow is designed for ease of use. The intuitive interface allows you to create, send, and eSign documents effortlessly, making it accessible even for those unfamiliar with digital tools. This ease of use is especially beneficial when managing Nanny Taxes, allowing you to focus on your nanny's performance.

-

What are the benefits of using airSlate SignNow for the Nanny Performance Evaluation Form?

Using airSlate SignNow for the Nanny Performance Evaluation Form provides numerous benefits, including time savings and enhanced compliance with Nanny Taxes. The platform simplifies the document management process, allowing you to focus on evaluating your nanny's contributions without the hassle of paperwork. Plus, digital signatures ensure authenticity and security.

-

How does airSlate SignNow help with compliance regarding Nanny Taxes?

airSlate SignNow assists with compliance related to Nanny Taxes by providing templates and documentation that are structured to meet legal requirements. The Nanny Performance Evaluation Form can help you keep track of performance metrics that influence tax calculations. This ensures that you remain compliant while effectively managing your nanny's employment.

-

Can I integrate airSlate SignNow with other tools for managing Nanny Taxes?

Yes, airSlate SignNow offers seamless integrations with various accounting and payroll software that can help manage Nanny Taxes. By integrating these tools, you can streamline the entire process from performance evaluation to tax filing. This holistic approach ensures that all aspects of your nanny's employment are handled efficiently.

Get more for Nanny Performance Evaluation Form Nanny Taxes

- Notice of intent to enforce forfeiture provisions of contact for deed georgia form

- Final notice of forfeiture and request to vacate property under contract for deed georgia form

- Buyers request for accounting from seller under contract for deed georgia form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed georgia form

- Ga contract form

- Ga seller form

- Ga disclosure form

- Ga contract 497303579 form

Find out other Nanny Performance Evaluation Form Nanny Taxes

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template