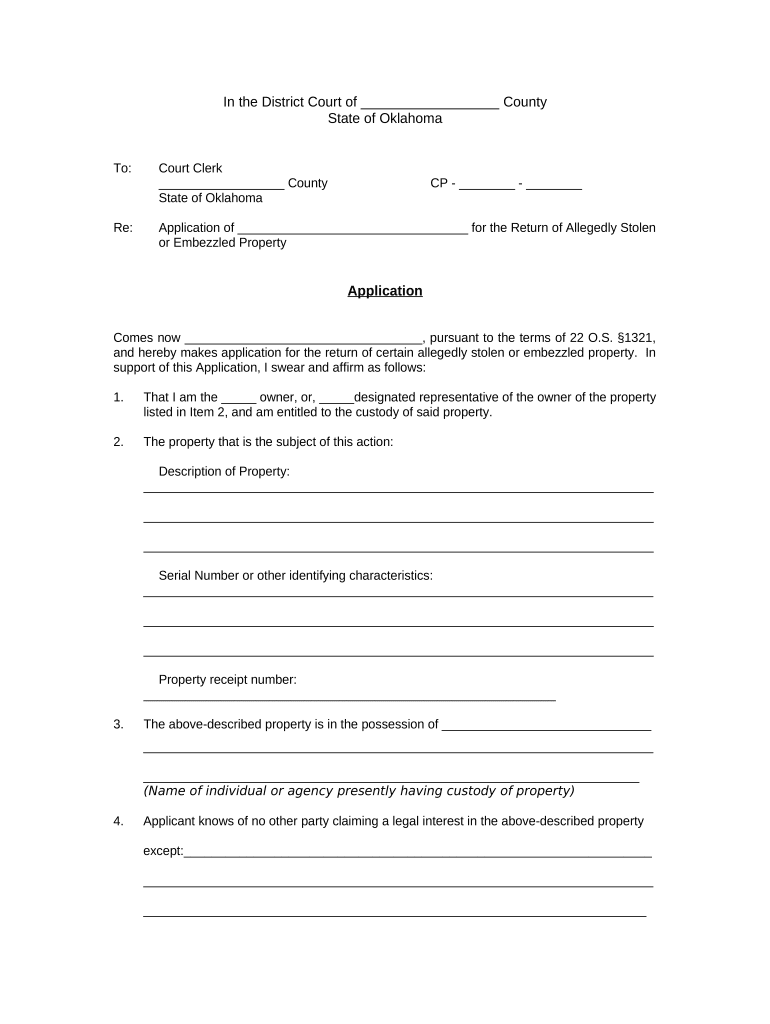

Oklahoma Return Property Form

Understanding the Household Composition Statement

The household composition statement is a crucial document that outlines the members of a household. This statement is often required for various applications, including housing assistance, tax credits, and other governmental programs. It serves to verify the number of individuals living in a residence and their relationships to one another. Understanding how to accurately complete this statement is essential for ensuring compliance with eligibility requirements.

Key Elements of the Household Composition Statement

When filling out a household composition statement, several key elements must be included:

- Full Names: List the full names of all household members.

- Relationship: Describe the relationship of each member to the primary applicant, such as spouse, child, or relative.

- Date of Birth: Provide the date of birth for each member to verify age and eligibility.

- Social Security Numbers: Include social security numbers where applicable, as they may be required for verification purposes.

Steps to Complete the Household Composition Statement

Completing the household composition statement involves several straightforward steps:

- Gather necessary information about all household members, including names, relationships, and social security numbers.

- Fill out the statement accurately, ensuring all required fields are completed.

- Review the statement for accuracy and completeness before submission.

- Submit the completed statement according to the specific guidelines provided by the requesting agency.

Legal Use of the Household Composition Statement

The household composition statement is legally binding when submitted as part of applications for assistance or benefits. Providing false information can lead to penalties, including denial of services or legal repercussions. It is essential to ensure that all information is truthful and up to date to avoid complications.

Filing Deadlines and Important Dates

Each program requiring a household composition statement may have specific filing deadlines. It is crucial to be aware of these dates to ensure timely submission. Missing a deadline can result in delays in processing applications or loss of benefits. Always check the specific requirements of the agency requesting the statement.

Required Documents for Submission

In addition to the household composition statement, other documents may be required for submission. These can include:

- Proof of income for all household members.

- Identification documents, such as driver's licenses or state IDs.

- Proof of residency, such as utility bills or lease agreements.

Examples of Household Composition Statements

Examples of household composition statements can vary depending on the agency or program. Typically, these statements will include sections for each household member's information, along with an attestation section where the primary applicant affirms the accuracy of the information provided. Reviewing examples can help applicants understand how to structure their own statements effectively.

Quick guide on how to complete oklahoma return property

Prepare Oklahoma Return Property effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent environmentally-friendly substitute for conventional printed and signed paperwork, allowing you to acquire the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Handle Oklahoma Return Property on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Oklahoma Return Property with ease

- Obtain Oklahoma Return Property and then click Get Form to initiate.

- Use the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Review all the information carefully and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Oklahoma Return Property to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a household composition statement example?

A household composition statement example outlines the members of a household and their relationships to one another. This document is often required for various purposes, such as applying for housing assistance or financial aid. By using airSlate SignNow, you can easily create and eSign your own household composition statement using customizable templates.

-

How can airSlate SignNow help with creating a household composition statement?

airSlate SignNow simplifies the process of creating a household composition statement example by providing intuitive document templates and an easy-to-use interface. You can quickly fill in necessary details about your household members and their relationships. Additionally, the platform allows for hassle-free eSigning, ensuring your document is legally binding.

-

Is there a cost to use airSlate SignNow for household composition statements?

Yes, airSlate SignNow offers several pricing plans based on your business needs. You can choose from our competitive pricing options, which provide access to features for creating and managing documents, including household composition statement examples. We also offer a free trial, allowing you to explore the platform before committing.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a variety of features such as customizable templates, secure eSigning, document sharing, and real-time tracking. These features ensure that creating a household composition statement example is efficient and secure. Additionally, you have access to integrations that enhance your workflow and productivity.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow supports integrations with popular applications like Google Drive, Salesforce, and various CRM systems. This allows you to streamline your document management processes, including organization and sharing of household composition statement examples, directly through your preferred platforms.

-

What are the benefits of using airSlate SignNow for document eSigning?

Using airSlate SignNow for document eSigning offers numerous benefits, including enhanced security, reduced turnaround time, and improved efficiency. You'll find it easy to eSign your household composition statement example and other documents without the need for printing or scanning. The platform's user-friendly interface also minimizes errors and ensures accurate data capture.

-

Is airSlate SignNow suitable for individual users as well as businesses?

Yes, airSlate SignNow is designed to cater to both individual users and businesses of any size. Whether you need to create a household composition statement example for personal use or for a large organization, the platform is flexible and scalable. Our features make it easy for anyone to manage and eSign documents effectively.

Get more for Oklahoma Return Property

- Texas department of agriculture wdi post construction form

- Form 5870a tax on accumulation distribution of trusts form 5870a tax on accumulation distribution of trusts 772091082

- Permission to work and volunteering for asylum seekers form

- Day rate contract template form

- Daycare employee contract template form

- Ddlg contract template form

- Dcaa brief contract template form

- Deal contract template form

Find out other Oklahoma Return Property

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy