Living Trust for Individual as Single, Divorced or Widow or Widower with No Children Oklahoma Form

What is the Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children Oklahoma

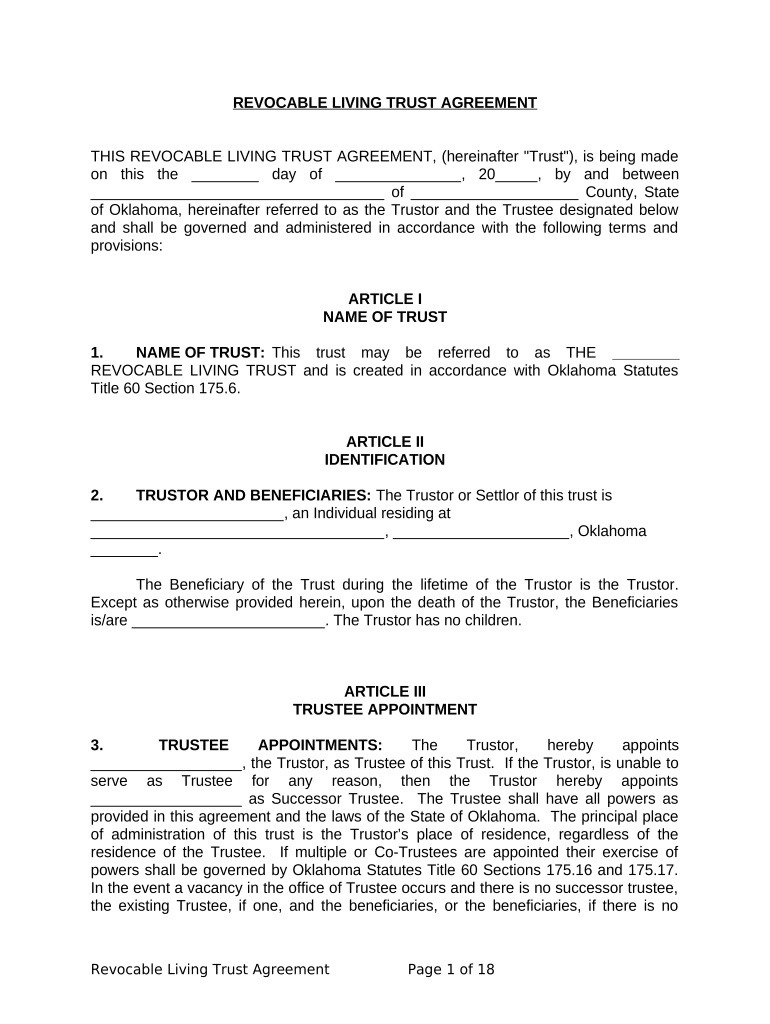

A living trust for an individual who is single, divorced, or a widow or widower without children in Oklahoma is a legal document that allows a person to manage their assets during their lifetime and specify how those assets should be distributed after death. This type of trust can help avoid probate, which is the legal process of validating a will and distributing assets. It provides flexibility in managing assets and can be modified or revoked at any time while the individual is alive. The trust becomes irrevocable upon the individual's death, ensuring that the assets are distributed according to their wishes.

How to use the Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children Oklahoma

Using a living trust involves several steps. First, you need to create the trust document, which outlines the terms of the trust, including the assets to be included and the beneficiaries. Next, you will transfer ownership of your assets into the trust, which may include real estate, bank accounts, and personal property. This transfer is crucial as it ensures that the trust controls these assets. Finally, you will designate a trustee, who will manage the trust according to your instructions. This can be yourself during your lifetime, and you can appoint a successor trustee to take over after your death.

Steps to complete the Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children Oklahoma

Completing a living trust involves a systematic approach:

- Determine your assets: Make a comprehensive list of all assets you wish to include in the trust.

- Draft the trust document: You can use templates or consult with an attorney to ensure it meets Oklahoma laws.

- Transfer assets: Change the title of your assets to the name of the trust, which may require additional paperwork.

- Designate a trustee: Choose someone you trust to manage the trust after your death.

- Review and update: Regularly review the trust to ensure it reflects your current wishes and financial situation.

Legal use of the Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children Oklahoma

The legal use of a living trust in Oklahoma is governed by state laws that outline how trusts must be created and managed. This includes ensuring that the trust document is properly executed, which typically requires the signature of the trustor and witnesses. The trust must also comply with the Oklahoma Uniform Trust Code, which provides guidelines on the rights and responsibilities of trustees and beneficiaries. A properly executed living trust is recognized as a valid legal entity that can hold and manage assets.

Key elements of the Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children Oklahoma

Key elements of a living trust include:

- Trustor: The individual creating the trust.

- Trustee: The person or entity responsible for managing the trust assets.

- Beneficiaries: Individuals or entities designated to receive the trust assets upon the trustor's death.

- Assets: The property and financial accounts included in the trust.

- Terms: Specific instructions on how the assets should be managed and distributed.

State-specific rules for the Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children Oklahoma

In Oklahoma, state-specific rules for living trusts include the requirement for the trust document to be in writing and signed by the trustor. Witnesses may be necessary to validate the trust, depending on the type of assets involved. Additionally, Oklahoma law allows for the revocation of a living trust at any time while the trustor is alive, provided the trust document includes such provisions. It's important to familiarize yourself with these regulations to ensure compliance and the effectiveness of your trust.

Quick guide on how to complete living trust for individual as single divorced or widow or widower with no children oklahoma

Complete Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children Oklahoma effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without any holdups. Handle Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children Oklahoma across any device with airSlate SignNow's Android or iOS applications and streamline your document workflow today.

How to modify and eSign Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children Oklahoma with ease

- Locate Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children Oklahoma and click Get Form to begin.

- Make use of the tools provided to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and possesses the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate the worries of lost or disorganized files, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children Oklahoma, ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for Individual as Single, Divorced or Widow or Widower With No Children in Oklahoma?

A Living Trust for Individual as Single, Divorced or Widow or Widower With No Children in Oklahoma is a legal arrangement that holds your assets during your lifetime and facilitates their transfer upon your death without the need for probate. This ensures a smooth transition of assets and can help save on estate taxes and fees.

-

How does a Living Trust benefit individuals without children?

For individuals who are single, divorced, or widowed without children, a Living Trust provides an effective way to manage and protect your assets. It allows you to designate beneficiaries, ensuring your assets go to those you choose, such as friends or relatives, removing the uncertainty and costs associated with probate.

-

What are the costs involved in setting up a Living Trust in Oklahoma?

The costs of establishing a Living Trust for Individual as Single, Divorced or Widow or Widower With No Children in Oklahoma can vary depending on the complexity of your estate and if you choose to use an attorney or an online service. Generally, the cost can range from a few hundred to several thousand dollars, making it a worthwhile investment for long-term asset management.

-

Can I create a Living Trust on my own, or should I consult a professional?

While it is possible to create a Living Trust for Individual as Single, Divorced or Widow or Widower With No Children in Oklahoma on your own using templates, consulting a professional can ensure that it meets legal requirements and is tailored to your specific needs. An experienced attorney can provide insights and guidance, helping to avoid potential pitfalls.

-

What assets can be included in a Living Trust?

You can include various assets in your Living Trust for Individual as Single, Divorced or Widow or Widower With No Children in Oklahoma, such as real estate, bank accounts, investments, and personal property. By placing these assets in the trust, you can more easily manage them and ensure they are distributed according to your wishes after your death.

-

What happens if I move out of Oklahoma after establishing my Living Trust?

If you move out of Oklahoma after establishing your Living Trust for Individual as Single, Divorced or Widow or Widower With No Children, your trust is still valid. However, it is advisable to review and potentially update the trust to ensure compliance with your new state's laws and address any changes in circumstances.

-

Are there any tax benefits associated with a Living Trust in Oklahoma?

A Living Trust for Individual as Single, Divorced or Widow or Widower With No Children in Oklahoma can offer certain tax benefits, such as avoiding probate taxes and potentially lowering estate tax exposure. However, it's essential to consult a tax professional for personalized advice based on your financial situation.

Get more for Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children Oklahoma

Find out other Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children Oklahoma

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy