Financial Account Transfer to Living Trust Oklahoma Form

What is the Financial Account Transfer To Living Trust Oklahoma

The Financial Account Transfer To Living Trust Oklahoma form is a legal document used to transfer ownership of financial accounts into a living trust. This process ensures that the assets are managed according to the trust's terms, allowing for more efficient estate management and potentially avoiding probate. It is essential for individuals in Oklahoma who wish to secure their financial assets and ensure a smooth transition of wealth to beneficiaries upon their passing.

Steps to complete the Financial Account Transfer To Living Trust Oklahoma

Completing the Financial Account Transfer To Living Trust Oklahoma involves several key steps:

- Review your living trust document to confirm that it is up-to-date and accurately reflects your wishes.

- Gather all relevant financial account information, including account numbers and institution details.

- Fill out the Financial Account Transfer To Living Trust form, ensuring all required fields are completed accurately.

- Sign the form in accordance with your state’s requirements, which may include notarization.

- Submit the completed form to your financial institutions, either online or via mail, as per their submission guidelines.

Legal use of the Financial Account Transfer To Living Trust Oklahoma

The legal use of the Financial Account Transfer To Living Trust Oklahoma form is governed by state laws regarding trusts and estate planning. It is crucial to ensure that the form complies with Oklahoma regulations to be considered valid. This includes proper execution, which may require notarization and adherence to specific signing protocols. Consulting with a legal professional can help confirm that the transfer aligns with all legal requirements.

State-specific rules for the Financial Account Transfer To Living Trust Oklahoma

In Oklahoma, specific rules apply when transferring financial accounts to a living trust. These rules may include:

- Verification of the trust's validity, which may involve providing a copy of the trust document.

- Requirements for signatures, which may include the need for witnesses or notarization.

- Institution-specific policies that may dictate how transfers should be submitted and processed.

Understanding these state-specific rules is essential for ensuring a smooth transfer process.

Key elements of the Financial Account Transfer To Living Trust Oklahoma

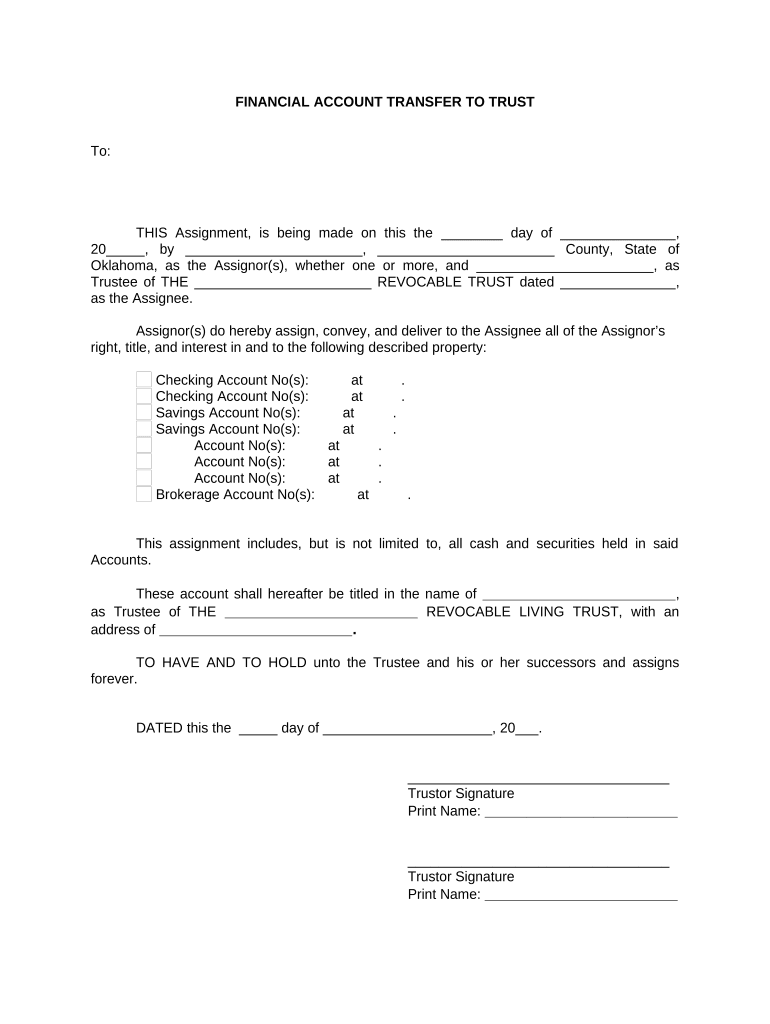

Key elements of the Financial Account Transfer To Living Trust Oklahoma form include:

- The name and details of the trust, including the trustee's information.

- Identification of the financial accounts being transferred, such as bank accounts, investment accounts, or retirement accounts.

- Signature lines for the account holder and any required witnesses or notaries.

- Instructions for submission to the relevant financial institutions.

How to use the Financial Account Transfer To Living Trust Oklahoma

Using the Financial Account Transfer To Living Trust Oklahoma form involves following a structured approach:

- Obtain the form from a reliable source, ensuring it is the most current version.

- Fill out the form with accurate information regarding the trust and the accounts being transferred.

- Review the completed form for any errors or omissions before signing.

- Submit the form to the financial institutions as directed, keeping copies for your records.

Quick guide on how to complete financial account transfer to living trust oklahoma

Effortlessly set up Financial Account Transfer To Living Trust Oklahoma on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Financial Account Transfer To Living Trust Oklahoma on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and eSign Financial Account Transfer To Living Trust Oklahoma effortlessly

- Locate Financial Account Transfer To Living Trust Oklahoma and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs in just a few clicks from a device of your choice. Modify and eSign Financial Account Transfer To Living Trust Oklahoma and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Financial Account Transfer To Living Trust in Oklahoma?

A Financial Account Transfer To Living Trust in Oklahoma involves transferring ownership of your financial accounts into a living trust. This process helps ensure that your assets are managed according to your wishes upon your passing. Using airSlate SignNow makes this transfer easier and more streamlined.

-

Why should I consider a Financial Account Transfer To Living Trust in Oklahoma?

Transferring your financial accounts to a living trust in Oklahoma can help avoid probate delays and costs, ensuring a smoother transition of your assets. This arrangement also provides more privacy compared to a will. Our solution at airSlate SignNow simplifies the process of creating and managing these documents.

-

How much does it cost to facilitate a Financial Account Transfer To Living Trust in Oklahoma?

The cost of a Financial Account Transfer To Living Trust in Oklahoma can vary based on legal fees and the complexity of your assets. With airSlate SignNow, you can reduce costs by efficiently managing your documentation online. Sign up for our services to get a transparent pricing structure.

-

What are the benefits of using airSlate SignNow for Financial Account Transfer To Living Trust?

Using airSlate SignNow to facilitate your Financial Account Transfer To Living Trust in Oklahoma provides you with a user-friendly platform for electronic signatures and document management. It saves you time and ensures accuracy in your paperwork. Our solution is designed to be both cost-effective and secure.

-

Can I integrate airSlate SignNow with other platforms for managing my living trust?

Yes, airSlate SignNow offers integrations with various platforms to enhance your experience with managing a Financial Account Transfer To Living Trust in Oklahoma. These integrations allow for seamless access to your documents and better collaboration with legal professionals. Check our integrations list to find the right tools for you.

-

Is it necessary to hire a lawyer for a Financial Account Transfer To Living Trust in Oklahoma?

While it's not mandatory to hire a lawyer for a Financial Account Transfer To Living Trust in Oklahoma, consulting one can provide reassurance and ensure legal compliance. However, airSlate SignNow provides the tools and resources to guide you through the process effectively. You have the option to DIY or seek professional legal advice.

-

What types of financial accounts can be transferred to a living trust in Oklahoma?

Most types of financial accounts, such as bank accounts, investment accounts, and retirement accounts, can be transferred to a living trust in Oklahoma. This ensures that these assets are managed according to your directives. AirSlate SignNow can assist in preparing the necessary documents for these transfers.

Get more for Financial Account Transfer To Living Trust Oklahoma

Find out other Financial Account Transfer To Living Trust Oklahoma

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer