Oklahoma Installments Fixed Rate Promissory Note Secured by Residential Real Estate Oklahoma Form

What is the Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate Oklahoma

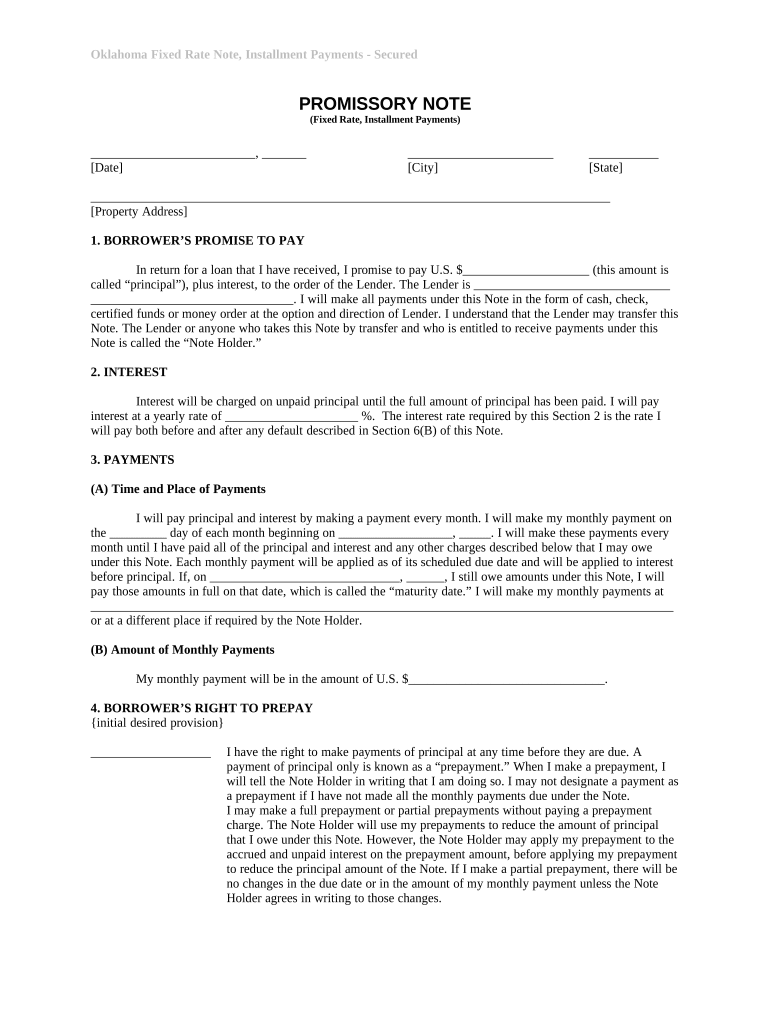

The Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines a borrower's promise to repay a loan with fixed interest over a specified period. This note is secured by residential real estate, meaning that the property serves as collateral for the loan. If the borrower defaults, the lender has the right to take possession of the property through foreclosure. This type of promissory note is commonly used in real estate transactions to provide clarity and security for both parties involved.

Key Elements of the Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate Oklahoma

Several key elements are essential for the validity of the Oklahoma Installments Fixed Rate Promissory Note. These include:

- Borrower and Lender Information: The full names and addresses of both parties must be included.

- Loan Amount: The total amount being borrowed should be clearly stated.

- Interest Rate: The fixed interest rate must be specified, detailing how it will be applied over the loan term.

- Repayment Schedule: This section outlines the payment amounts, frequency, and duration of the loan.

- Default Terms: Conditions under which the borrower may default and the lender's rights in such cases should be clearly defined.

- Signatures: Both parties must sign the document to validate the agreement.

Steps to Complete the Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate Oklahoma

Completing the Oklahoma Installments Fixed Rate Promissory Note involves several steps:

- Gather necessary information, including personal details of the borrower and lender.

- Determine the loan amount and fixed interest rate.

- Outline the repayment schedule, specifying payment amounts and intervals.

- Include terms related to default and any other relevant conditions.

- Review the document for accuracy and clarity.

- Both parties should sign the document, preferably in the presence of a witness or notary.

Legal Use of the Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate Oklahoma

The legal use of this promissory note is primarily to ensure that both the borrower and lender have a clear understanding of their obligations. It serves as a binding contract that can be enforced in a court of law. To be legally valid, the document must comply with Oklahoma state laws regarding promissory notes and secured transactions. This includes adhering to regulations related to interest rates, repayment terms, and the rights of both parties in the event of default.

How to Use the Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate Oklahoma

Using the Oklahoma Installments Fixed Rate Promissory Note involves several practical steps:

- Ensure that both parties understand the terms before signing.

- Use a reliable platform for digital signing to enhance security and compliance.

- Keep copies of the signed document for both the borrower and lender.

- Regularly review payment schedules and communicate any changes in circumstances.

State-Specific Rules for the Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate Oklahoma

Oklahoma has specific laws that govern the creation and enforcement of promissory notes. These include requirements for interest rates, which must not exceed state usury limits, and stipulations regarding the foreclosure process if the borrower defaults. Familiarity with these regulations is critical for both lenders and borrowers to ensure compliance and protect their rights. It is advisable to consult with a legal professional to navigate any complexities related to state-specific rules.

Quick guide on how to complete oklahoma installments fixed rate promissory note secured by residential real estate oklahoma

Prepare Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate Oklahoma effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly and without delays. Manage Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate Oklahoma on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate Oklahoma effortlessly

- Locate Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate Oklahoma and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form—via email, text message (SMS), or invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate Oklahoma and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate in Oklahoma?

An Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate in Oklahoma is a legally binding document that outlines the repayment terms for a loan secured by residential property. This note specifies a fixed interest rate and structured installment payments, making it a reliable option for lenders and borrowers. It offers security for lenders while providing clear repayment expectations for borrowers.

-

What are the benefits of using an Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate in Oklahoma?

The main benefits of an Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate in Oklahoma include predictable payments due to the fixed interest rate and the security of collateral. This arrangement enhances trust between the borrower and lender, facilitating transparent transactions. Additionally, it can simplify the loan process, making it easier for all parties involved.

-

How can I create an Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate in Oklahoma?

Creating an Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate in Oklahoma is straightforward with airSlate SignNow's digital tools. You can use customizable templates that require minimal input, allowing you to generate professional documents quickly. The eSigning feature ensures that all parties can sign the note securely and efficiently, streamlining the loan process.

-

Is it cost-effective to use airSlate SignNow for drafting my Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Yes, using airSlate SignNow to draft your Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate in Oklahoma is a cost-effective solution. With affordable pricing plans and a variety of features, you can manage your documentation with ease. Our platform eliminates the need for expensive legal services, saving you time and money.

-

What features does airSlate SignNow offer for managing Oklahoma Installments Fixed Rate Promissory Notes?

airSlate SignNow provides several features ideal for managing Oklahoma Installments Fixed Rate Promissory Notes. These include customizable templates, eSigning capabilities, secure storage, and tracking for document completion. These features ensure that your notes are efficiently handled from creation to signing and archiving.

-

Can I integrate airSlate SignNow with other tools for Oklahoma Installments Fixed Rate Promissory Notes?

Absolutely! airSlate SignNow offers integrations with popular business applications, enhancing your workflow for Oklahoma Installments Fixed Rate Promissory Notes. You can connect with platforms like CRM systems, cloud storage services, and more, ensuring a seamless experience for document management and eSigning.

-

What should I consider when drafting an Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

When drafting an Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate in Oklahoma, consider the interest rate, repayment schedule, and terms of collateral. Ensure that all parties understand the obligations defined in the note, including late payment penalties. Clarity is key to avoid potential disputes and ensure a smooth transaction.

Get more for Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate Oklahoma

- Dmv form 168a

- Statement compliance form

- De 542 2007 form

- Cf 1r form

- Form 806 fppc ca

- Early mediation opt out form the superior court of california merced courts ca

- Access for infants and mothers application managed risk medical mrmib ca form

- Advanced series of nonwovens training courses fabric property and characterization registration form registration form april

Find out other Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate Oklahoma

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure