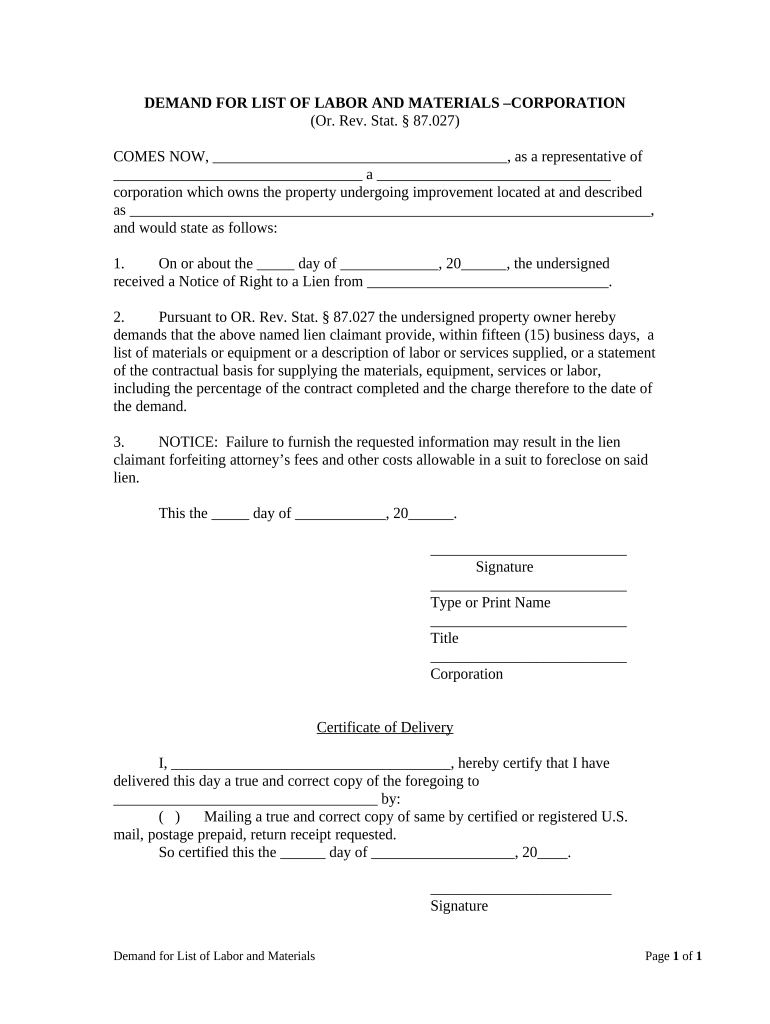

Oregon Corporation Form

What is the Oregon Corporation Form

The Oregon Corporation Form is a legal document required for establishing a corporation in the state of Oregon. This form serves as the official application for incorporation and must be filed with the Oregon Secretary of State. It includes essential information about the corporation, such as its name, registered agent, business purpose, and the number of shares authorized. Completing this form accurately is crucial for ensuring compliance with state regulations and for the legal recognition of the corporation.

How to use the Oregon Corporation Form

Using the Oregon Corporation Form involves several steps. First, gather all necessary information about your corporation, including its name, address, and the details of its incorporators. Next, fill out the form with accurate and complete information. It is important to review the form for any errors before submission. Once completed, the form can be submitted online or via mail to the appropriate state office. Ensuring that the form is filled out correctly will help avoid delays in the incorporation process.

Key elements of the Oregon Corporation Form

The Oregon Corporation Form includes several key elements that must be addressed for proper filing. These elements typically include:

- Corporation Name: Must be unique and not misleading.

- Registered Agent: An individual or business designated to receive legal documents.

- Business Purpose: A brief description of the corporation's intended activities.

- Incorporators: Names and addresses of individuals who are forming the corporation.

- Share Structure: Information about the number and types of shares authorized.

Each of these elements plays a vital role in the formation and operation of the corporation, ensuring it meets state legal requirements.

Steps to complete the Oregon Corporation Form

Completing the Oregon Corporation Form involves a systematic approach to ensure all required information is accurately provided. Follow these steps:

- Choose a unique name for your corporation that complies with Oregon naming rules.

- Designate a registered agent who will handle legal correspondence.

- Provide the business purpose of your corporation in a clear and concise manner.

- List the names and addresses of all incorporators involved in the formation.

- Outline the share structure, including the total number of shares and their classifications.

- Review the completed form for accuracy and completeness.

- Submit the form online or by mail along with the required filing fee.

Legal use of the Oregon Corporation Form

The legal use of the Oregon Corporation Form is essential for establishing a corporation that is recognized by the state. Filing this form correctly ensures that the corporation is compliant with Oregon's business laws. Once filed, the corporation gains legal status, allowing it to operate, enter contracts, and conduct business activities. It is important to maintain compliance with ongoing requirements, such as annual reports and tax filings, to preserve the corporation's legal standing.

Form Submission Methods

The Oregon Corporation Form can be submitted through various methods to accommodate different preferences. These methods include:

- Online Submission: The quickest method, allowing for immediate processing.

- Mail Submission: Sending a printed form with payment via check or money order.

- In-Person Submission: Delivering the form directly to the Secretary of State's office.

Each submission method has its own processing times and requirements, so it is advisable to choose the one that best fits your needs.

Quick guide on how to complete oregon corporation form

Complete Oregon Corporation Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Oregon Corporation Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Oregon Corporation Form with ease

- Locate Oregon Corporation Form and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow specially provides for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal authority as a traditional ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that require printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Oregon Corporation Form and ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Oregon corporation form and why do I need it?

An Oregon corporation form is a legal document required to establish a corporation in the state of Oregon. It includes essential information about your business, like its name, registered agent, and business structure. Filing this form is crucial for ensuring your corporation is recognized legally and can operate within Oregon.

-

How can airSlate SignNow help me file my Oregon corporation form?

airSlate SignNow provides an easy-to-use platform to electronically fill out and eSign your Oregon corporation form. With our intuitive interface, you can quickly input your business details and submit your form securely online. This streamlines the filing process, saving you time and ensuring accuracy.

-

What features does airSlate SignNow offer for managing Oregon corporation forms?

With airSlate SignNow, you get features like document templates, electronic signatures, and cloud storage for your Oregon corporation form. These tools simplify the preparation and submission process, allowing you to manage all your required forms in one place while ensuring compliance with state regulations.

-

Is airSlate SignNow cost-effective for filing Oregon corporation forms?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, making it cost-effective for filing Oregon corporation forms. Our subscription model includes access to all features, helping you save on the costs associated with traditional filing and document management.

-

Can I integrate airSlate SignNow with other tools for my Oregon corporation?

Absolutely! airSlate SignNow integrates seamlessly with various business tools, such as CRMs and project management software. This integration allows you to streamline processes related to your Oregon corporation form and manage your business operations more efficiently.

-

What are the benefits of using airSlate SignNow for my Oregon corporation form?

Using airSlate SignNow for your Oregon corporation form offers numerous benefits, including efficiency, convenience, and compliance. Our platform ensures that your documentation is completed and submitted correctly, minimizing errors and facilitating a smoother incorporation process.

-

How do I ensure my Oregon corporation form is filed correctly?

To ensure your Oregon corporation form is filed correctly, use airSlate SignNow's guided platform, which provides tips and validation checks as you complete your form. Additionally, double-check all entered information and consider consulting with a legal expert to ensure compliance with state laws.

Get more for Oregon Corporation Form

Find out other Oregon Corporation Form

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word