Report of Gross Annual Income Oregon Form

What is the Report Of Gross Annual Income Oregon

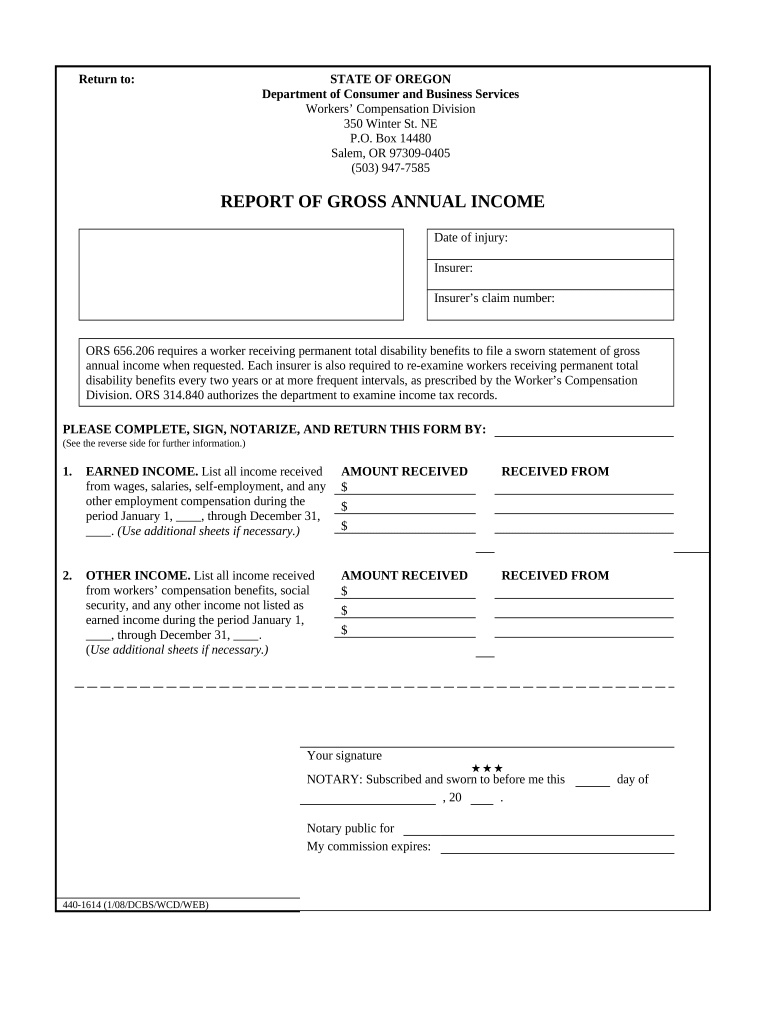

The Report Of Gross Annual Income Oregon is a crucial document for individuals and businesses in the state of Oregon. It serves as an official declaration of total income earned over the past year, which may include wages, salaries, bonuses, and any other sources of income. This report is often required for various purposes, including tax filings, loan applications, and eligibility for government assistance programs. Understanding the specifics of this form is essential for compliance with state regulations and to ensure accurate reporting of financial information.

How to use the Report Of Gross Annual Income Oregon

Using the Report Of Gross Annual Income Oregon involves several steps to ensure accuracy and compliance. First, gather all relevant financial documents, such as pay stubs, bank statements, and tax returns, to provide a comprehensive view of your income. Next, fill out the form with accurate figures, ensuring that all sources of income are included. Once completed, the report can be submitted to the appropriate entity, whether for tax purposes or other official needs. Utilizing electronic signature solutions can streamline this process, making it easier to submit the report securely and efficiently.

Steps to complete the Report Of Gross Annual Income Oregon

Completing the Report Of Gross Annual Income Oregon requires careful attention to detail. Follow these steps for a smooth process:

- Gather all necessary documentation, including income statements and previous tax returns.

- Fill out the form accurately, ensuring all income sources are reported.

- Review the completed form for any errors or omissions.

- Sign the document electronically or manually, depending on submission requirements.

- Submit the report to the designated authority, either online, by mail, or in person.

Legal use of the Report Of Gross Annual Income Oregon

The legal use of the Report Of Gross Annual Income Oregon is governed by state regulations. This document must be filled out truthfully and accurately, as it may be subject to verification by tax authorities or other agencies. Misrepresentation of income can lead to legal consequences, including penalties or fines. Therefore, it is crucial to ensure that all information provided is correct and that the form is submitted within any applicable deadlines to maintain compliance with state laws.

State-specific rules for the Report Of Gross Annual Income Oregon

Oregon has specific rules regarding the Report Of Gross Annual Income that must be adhered to. These include guidelines on what constitutes gross income, the types of income that must be reported, and the deadlines for submission. Additionally, there may be unique requirements for different types of taxpayers, such as self-employed individuals or corporations. Familiarizing yourself with these state-specific rules is essential for accurate reporting and to avoid potential issues with tax authorities.

Required Documents

To complete the Report Of Gross Annual Income Oregon, certain documents are required. These typically include:

- W-2 forms from employers for wage earners.

- 1099 forms for independent contractors or freelancers.

- Bank statements reflecting interest or dividends earned.

- Any additional documentation that verifies other sources of income.

Having these documents ready will facilitate the accurate completion of the report and ensure compliance with state requirements.

Quick guide on how to complete report of gross annual income oregon

Complete Report Of Gross Annual Income Oregon effortlessly on any device

Online document management has gained popularity with businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, alter, and electronically sign your documents swiftly without delays. Manage Report Of Gross Annual Income Oregon on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

How to modify and electronically sign Report Of Gross Annual Income Oregon without stress

- Find Report Of Gross Annual Income Oregon and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize relevant parts of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal authority as a traditional ink signature.

- Review all the information and click on the Done button to secure your changes.

- Choose how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Report Of Gross Annual Income Oregon and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Report Of Gross Annual Income Oregon, and why is it important?

A Report Of Gross Annual Income Oregon is a critical document used to summarize an individual's total income within a given year. This report is essential for tax purposes, loan applications, and financial assessments, allowing both individuals and organizations to evaluate financial health. Understanding its importance can help you manage your finances and communicate your income accurately.

-

How can airSlate SignNow assist me in creating a Report Of Gross Annual Income Oregon?

airSlate SignNow provides a user-friendly platform for creating and eSigning important documents, including the Report Of Gross Annual Income Oregon. You can easily upload your income data, add necessary signatures, and securely share the report with stakeholders. The process is streamlined and efficient, ensuring that you can generate the report you need without hassle.

-

Is there a cost associated with using airSlate SignNow for a Report Of Gross Annual Income Oregon?

Yes, there are various pricing plans available for airSlate SignNow that cater to different business needs. These plans vary based on features and the number of users, but they often include the ability to create documents like the Report Of Gross Annual Income Oregon at a reasonable cost. Investing in this solution can greatly enhance your document management system.

-

What features does airSlate SignNow offer for document management related to the Report Of Gross Annual Income Oregon?

airSlate SignNow includes features such as customizable templates, advanced security measures, and integration options that facilitate the creation and management of the Report Of Gross Annual Income Oregon. With these tools, you can streamline the document creation process, ensure data safety, and enhance collaboration among team members. It’s an all-in-one solution that simplifies issues around income reporting.

-

Can I integrate airSlate SignNow with other tools for managing my Report Of Gross Annual Income Oregon?

Absolutely! airSlate SignNow offers integration capabilities with various business applications, allowing you to connect your financial software with the Report Of Gross Annual Income Oregon documentation. This feature enables automated data transfers and improves overall efficiency in managing your documents, ensuring that your income reporting is accurate and timely.

-

What are the benefits of using airSlate SignNow for my Report Of Gross Annual Income Oregon?

Using airSlate SignNow for your Report Of Gross Annual Income Oregon offers several benefits, including time-saving automation, improved accuracy, and enhanced security for your sensitive financial information. The platform’s ease of use means that you do not need extensive technical skills to create or manage your documents. Additionally, you can track the signing process, providing you with peace of mind.

-

Is airSlate SignNow compliant with regulations for creating a Report Of Gross Annual Income Oregon?

Yes, airSlate SignNow adheres to industry standards and regulations, ensuring that the creation of the Report Of Gross Annual Income Oregon complies with relevant laws. This compliance guarantees that your documents hold legal validity and authenticity, making them acceptable for taxation and financial institutions. Always ensure you stay updated with any regulatory changes to maintain compliance.

Get more for Report Of Gross Annual Income Oregon

- Pa campaign form

- Pennsylvania right to know form

- Other deductions form pennsylvania housing finance agency phfa

- Employerampamp39s job description for disability application psers psers state pa form

- Application for pennsylvania boat registration renewal pfbc 733 fish state pa form

- Self sufficiency descriptions and matrix pennsylvania department dsf health state pa form

- Online application for plcb appointment of manager form

- Application for wine auction permit pennsylvania liquor control form

Find out other Report Of Gross Annual Income Oregon

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement