Expense Statement Form

What is the Expense Statement

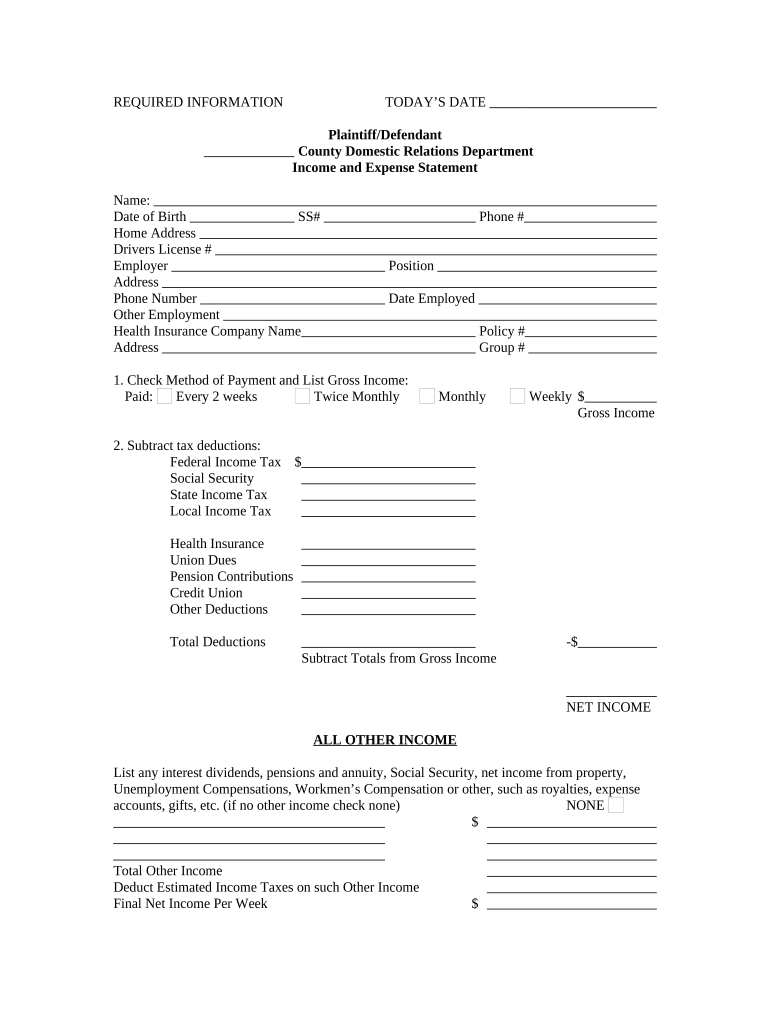

The Pennsylvania income expense statement is a financial document used to report income and expenses for individuals or businesses in Pennsylvania. This form is essential for accurately tracking financial performance and is often required for tax purposes. It provides a detailed overview of income sources, such as wages, business profits, and any other earnings, alongside corresponding expenses, including operational costs, deductions, and other financial outflows. Understanding this document is crucial for maintaining compliance with state regulations and for effective financial management.

How to Use the Expense Statement

Using the Pennsylvania income expense statement involves several key steps. First, gather all relevant financial documents, including receipts, invoices, and bank statements. Next, categorize your income and expenses accurately, ensuring that each entry reflects the correct amounts and corresponding categories. After filling out the expense statement, review it for accuracy and completeness. This document may be submitted to state authorities or used for personal financial tracking, depending on your needs.

Steps to Complete the Expense Statement

Completing the Pennsylvania income expense statement requires careful attention to detail. Follow these steps for an effective process:

- Collect all necessary financial records, including income sources and expense receipts.

- Organize your information by category, such as personal, business, or investment income.

- Fill in the expense statement template, ensuring that all figures are accurate and up-to-date.

- Double-check for any errors or omissions before finalizing the document.

- Save a copy for your records and submit it as required.

Legal Use of the Expense Statement

The Pennsylvania income expense statement holds legal significance, particularly for tax compliance. To be considered valid, the document must be filled out accurately and submitted within the designated time frames. It is essential to maintain records that support the entries made on the statement, as these may be required for audits or verification by tax authorities. Utilizing a reliable digital platform for completing and signing this document can enhance its legal standing and ensure compliance with state laws.

Key Elements of the Expense Statement

Understanding the key elements of the Pennsylvania income expense statement is vital for accurate completion. Important components include:

- Income Section: Details all sources of income, including wages, business revenue, and investment earnings.

- Expense Section: Lists all deductible expenses, such as operational costs, travel expenses, and other necessary expenditures.

- Total Income and Expenses: Summarizes the total figures to provide a clear financial picture.

- Signatures: Requires the signature of the individual or authorized representative, affirming the accuracy of the information provided.

Examples of Using the Expense Statement

The Pennsylvania income expense statement can be utilized in various scenarios. For instance, self-employed individuals may use it to report their business income and expenses during tax season. Similarly, landlords can document rental income and related expenses for tax deductions. Additionally, businesses may use this form to prepare financial statements for investors or lenders, showcasing their financial health and operational efficiency.

Quick guide on how to complete expense statement

Complete Expense Statement seamlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can access the needed form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents rapidly without holdups. Handle Expense Statement on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to adjust and electronically sign Expense Statement effortlessly

- Locate Expense Statement and then click Get Form to proceed.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent parts of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or missing documents, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Expense Statement and ensure outstanding communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a PA income expense statement and why is it important?

A PA income expense statement is a financial document that summarizes an individual's or business's income and expenses over a specific period. It's essential for tracking financial health, preparing for tax obligations, and making informed business decisions. Accurate preparation of this statement can lead to better financial planning.

-

How can airSlate SignNow help with my PA income expense statement preparation?

airSlate SignNow simplifies the process of creating and signing your PA income expense statement by allowing you to fill out forms electronically. With customizable templates and e-signature capabilities, you can ensure your documents are professionally prepared and legally binding. This efficiency saves time and reduces the risk of errors.

-

What features does airSlate SignNow offer for managing PA income expense statements?

airSlate SignNow provides features such as templates for PA income expense statements, easy filing options, and secure e-signature capabilities. Additionally, it includes tracking and audit trails for all modifications and signatures. These features enhance the reliability and transparency of your financial documentation.

-

Is airSlate SignNow cost-effective for creating PA income expense statements?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, making it a cost-effective solution for preparing PA income expense statements. With various subscription tiers, you can select a plan that fits your budget and needs. The potential savings from time and resources make it an economical choice.

-

Can I integrate airSlate SignNow with other tools I use for financial management?

Absolutely! airSlate SignNow offers seamless integrations with popular financial and accounting software that can help streamline the process of managing your PA income expense statements. This allows you to synchronize data easily and improve your workflow efficiency, ultimately saving you time.

-

How secure is my information when using airSlate SignNow for PA income expense statements?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance with industry standards to protect your sensitive information when creating and sharing PA income expense statements. You can confidently manage your documents knowing that they are secure and confidential.

-

Can I access my PA income expense statements from different devices using airSlate SignNow?

Yes, airSlate SignNow is accessible from various devices, including desktops, tablets, and smartphones. This remote accessibility allows you to manage your PA income expense statements and send documents for e-signature on-the-go, providing flexibility and convenience in your financial management.

Get more for Expense Statement

Find out other Expense Statement

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast