Living Trust for Husband and Wife with No Children Pennsylvania Form

What is the Living Trust For Husband And Wife With No Children Pennsylvania

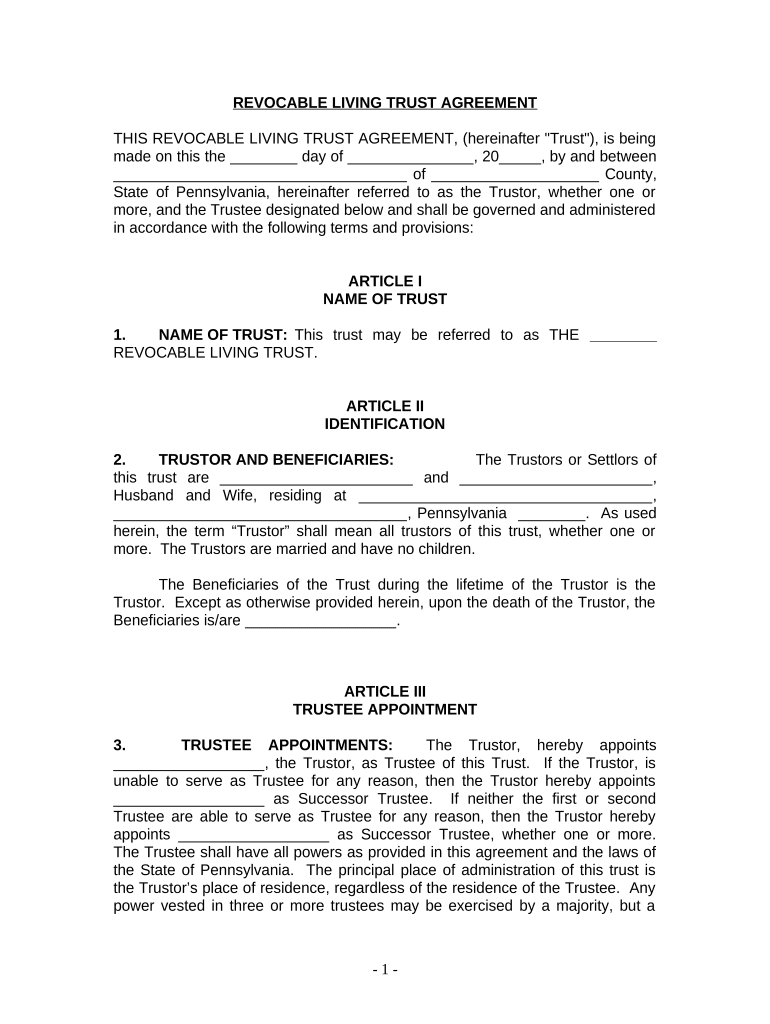

A living trust for husband and wife with no children in Pennsylvania is a legal arrangement that allows a couple to manage their assets during their lifetime and specify how those assets should be distributed after their passing. This type of trust is particularly useful for couples without children, as it simplifies the estate planning process and can help avoid probate. The trust allows both spouses to act as trustees, providing flexibility in managing the trust assets. Additionally, it can include provisions for the surviving spouse, ensuring that their needs are met after the other spouse's death.

Key Elements of the Living Trust For Husband And Wife With No Children Pennsylvania

Several key elements define a living trust for husband and wife with no children in Pennsylvania:

- Trustees: Typically, both spouses serve as trustees, allowing them to manage the trust assets together.

- Beneficiaries: The couple can designate themselves as the primary beneficiaries, with provisions for other family members or friends if desired.

- Asset Management: The trust outlines how assets, such as real estate and bank accounts, are managed and distributed.

- Revocability: Most living trusts are revocable, meaning the couple can modify or dissolve the trust as their circumstances change.

- Successor Trustees: The trust should name successor trustees to manage the trust after both spouses have passed away.

Steps to Complete the Living Trust For Husband And Wife With No Children Pennsylvania

Completing a living trust for husband and wife with no children in Pennsylvania involves several important steps:

- Gather Information: Collect details about all assets, including property, bank accounts, and investments.

- Consult an Attorney: While templates are available, consulting with an estate planning attorney can ensure that the trust complies with Pennsylvania laws.

- Draft the Trust Document: Create a trust document that outlines the terms, including trustees, beneficiaries, and asset management provisions.

- Sign the Document: Both spouses must sign the trust document in the presence of a notary public to make it legally binding.

- Fund the Trust: Transfer ownership of assets into the trust to ensure they are managed according to the trust's terms.

Legal Use of the Living Trust For Husband And Wife With No Children Pennsylvania

The legal use of a living trust for husband and wife with no children in Pennsylvania is primarily to manage and distribute assets without the need for probate. This type of trust is recognized under Pennsylvania law and can provide several benefits, including:

- Privacy: Unlike wills, which become public records, trusts remain private.

- Efficient Asset Management: The trust can provide clear guidelines for managing assets during the couple's lifetime and after their death.

- Avoiding Probate: Assets held in the trust do not go through the probate process, saving time and costs.

State-Specific Rules for the Living Trust For Husband And Wife With No Children Pennsylvania

In Pennsylvania, there are specific rules governing living trusts that couples should be aware of:

- Legal Requirements: The trust must be in writing and signed by the grantors (the couple) in front of a notary.

- Asset Transfer: To be effective, assets must be formally transferred into the trust, which may require retitling property and accounts.

- Tax Considerations: Couples should consider how the trust impacts their taxes, as income generated by trust assets may be taxable.

How to Obtain the Living Trust For Husband And Wife With No Children Pennsylvania

Obtaining a living trust for husband and wife with no children in Pennsylvania can be done through the following methods:

- Online Resources: Many websites offer templates and guides for creating a living trust.

- Estate Planning Attorneys: Hiring an attorney can ensure that the trust is tailored to the couple's specific needs and complies with state laws.

- Legal Document Services: Some companies provide services to prepare legal documents, including living trusts, at a lower cost than hiring an attorney.

Quick guide on how to complete living trust for husband and wife with no children pennsylvania

Effortlessly Prepare Living Trust For Husband And Wife With No Children Pennsylvania on Any Device

Digital document management has become increasingly common among businesses and individuals. It offers an ideal green alternative to traditional printed and signed documents, as you can easily find the necessary template and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Manage Living Trust For Husband And Wife With No Children Pennsylvania on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The Easiest Way to Modify and eSign Living Trust For Husband And Wife With No Children Pennsylvania with Ease

- Find Living Trust For Husband And Wife With No Children Pennsylvania and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to confirm your changes.

- Choose how you wish to send your form: via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate the frustration of lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Living Trust For Husband And Wife With No Children Pennsylvania and ensure optimal communication at every step of your document preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With No Children in Pennsylvania?

A Living Trust For Husband And Wife With No Children in Pennsylvania is a legal arrangement that allows couples to manage their assets during their lifetime and specify how those assets will be distributed upon their death. This type of trust helps avoid probate, ensuring a smoother transition of assets without court involvement.

-

How does a Living Trust For Husband And Wife With No Children in Pennsylvania benefit us?

The main benefit of a Living Trust For Husband And Wife With No Children in Pennsylvania is the ability to maintain control over your assets during your lifetime while simplifying the estate planning process. Additionally, it can minimize estate taxes and provide privacy since it does not go through probate.

-

What are the costs associated with creating a Living Trust For Husband And Wife With No Children in Pennsylvania?

The costs for establishing a Living Trust For Husband And Wife With No Children in Pennsylvania can vary based on the complexity of your estate and whether you choose to use legal assistance or online services. Generally, you can expect one-time legal fees ranging from $1,000 to $3,000, making it a worthwhile investment for peace of mind.

-

Can we manage a Living Trust For Husband And Wife With No Children in Pennsylvania on our own?

Yes, couples can manage a Living Trust For Husband And Wife With No Children in Pennsylvania independently, provided they understand the legal requirements and properly fund the trust. However, consulting with an estate planning attorney can ensure that the trust is set up correctly and serves its intended purpose.

-

What documents do we need for a Living Trust For Husband And Wife With No Children in Pennsylvania?

To create a Living Trust For Husband And Wife With No Children in Pennsylvania, you will need documents including your property deeds, bank statements, stock certificates, and insurance policies. Additionally, a comprehensive list of your assets and liabilities will help in the effective setup of the trust.

-

How does a Living Trust For Husband And Wife With No Children in Pennsylvania compare to a will?

Unlike a will, which goes through probate and becomes public record, a Living Trust For Husband And Wife With No Children in Pennsylvania allows assets to be transferred directly to beneficiaries without court intervention. This can save time and costs associated with the probate process, making trusts an attractive option for many couples.

-

Are there tax implications for setting up a Living Trust For Husband And Wife With No Children in Pennsylvania?

A Living Trust For Husband And Wife With No Children in Pennsylvania typically does not incur immediate tax implications since it is revocable. However, it is essential to consult with a tax professional to understand how your trust may affect estate taxes or other tax obligations.

Get more for Living Trust For Husband And Wife With No Children Pennsylvania

- Sss loan application form

- Hoa generic proxy vote form

- Application for adoption farfels friends rescue form

- 85a first quarter diesel form kansas department of revenue ksrevenue

- Affidavit fact writ form

- Kansas cdl medical form

- Relprevv observation form cpnp

- This is a sample form created by legal services of greater miami inc

Find out other Living Trust For Husband And Wife With No Children Pennsylvania

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document