Assignment to Living Trust Pennsylvania Form

What is the Assignment To Living Trust Pennsylvania

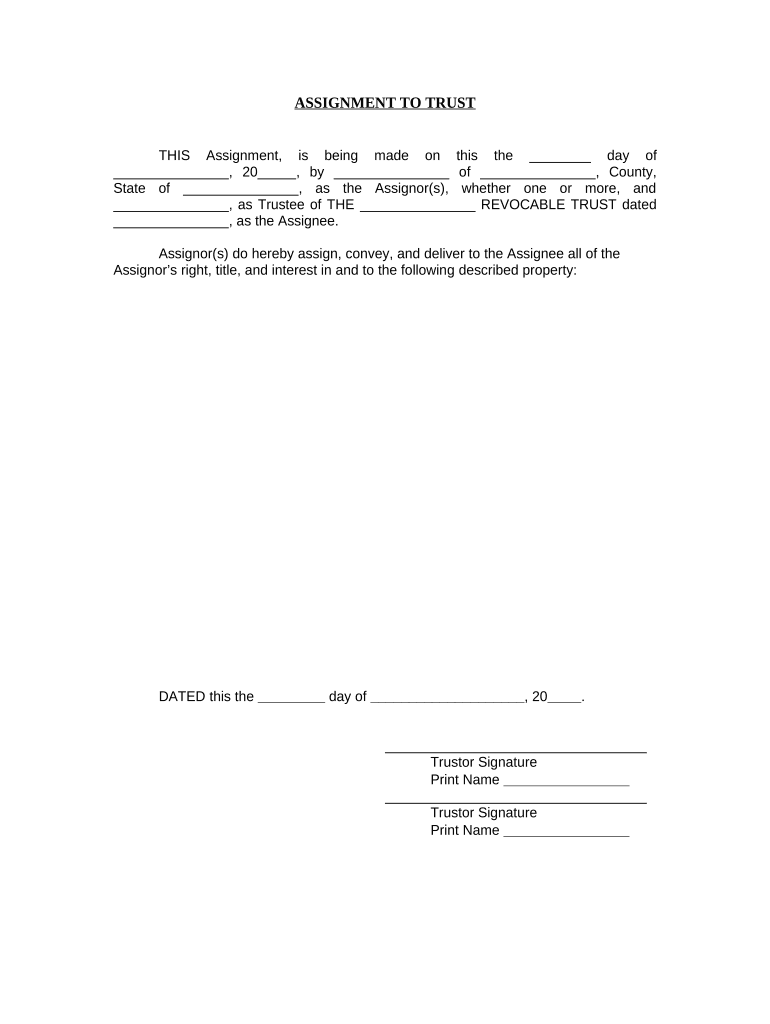

The Assignment To Living Trust Pennsylvania is a legal document used to transfer ownership of an asset into a living trust. This process allows individuals to manage their assets during their lifetime and ensure a smooth transition to beneficiaries upon death. The assignment serves as a formal declaration that the asset is now held in trust, which can help avoid probate and simplify estate management.

How to use the Assignment To Living Trust Pennsylvania

To use the Assignment To Living Trust Pennsylvania, individuals must first create a living trust document, which outlines the terms and conditions for managing the trust. Once the trust is established, the assignment form can be filled out to officially transfer specific assets into the trust. This includes providing details about the asset, such as its description and value, and the name of the trust. After completion, the form should be signed and dated to ensure its legal validity.

Steps to complete the Assignment To Living Trust Pennsylvania

Completing the Assignment To Living Trust Pennsylvania involves several key steps:

- Review the living trust document to ensure it is up to date.

- Identify the assets you wish to transfer into the trust.

- Fill out the assignment form with accurate information regarding the asset and the trust.

- Sign the document in the presence of a notary public, if required.

- Keep a copy of the completed form for your records.

Legal use of the Assignment To Living Trust Pennsylvania

The legal use of the Assignment To Living Trust Pennsylvania is crucial for ensuring that the transfer of assets is recognized by courts and financial institutions. It must comply with state laws governing trusts and estates. Proper execution of the assignment, including signatures and notarization when necessary, is essential for its enforceability. This document helps establish clear ownership and management of assets within the trust framework.

Key elements of the Assignment To Living Trust Pennsylvania

Key elements of the Assignment To Living Trust Pennsylvania include:

- The name of the individual creating the trust (grantor).

- The name of the trust and its date of creation.

- A detailed description of the asset being transferred.

- The signature of the grantor and any witnesses, if required.

- Notarization, if applicable, to validate the document.

State-specific rules for the Assignment To Living Trust Pennsylvania

State-specific rules for the Assignment To Living Trust Pennsylvania dictate how the assignment must be executed to be legally binding. These rules may include requirements for notarization, specific language that must be included in the document, and any filing obligations with state authorities. Understanding these regulations ensures that the assignment is compliant with Pennsylvania law and can withstand legal scrutiny.

Quick guide on how to complete assignment to living trust pennsylvania

Complete Assignment To Living Trust Pennsylvania effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the right format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Assignment To Living Trust Pennsylvania on any platform using airSlate SignNow Android or iOS applications and streamline any document-centric task today.

How to edit and eSign Assignment To Living Trust Pennsylvania with ease

- Locate Assignment To Living Trust Pennsylvania and click on Get Form to start.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your adjustments.

- Select how you wish to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Assignment To Living Trust Pennsylvania and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for completing an Assignment To Living Trust Pennsylvania using airSlate SignNow?

To complete an Assignment To Living Trust Pennsylvania with airSlate SignNow, you simply need to upload your trust documents, specify the necessary parties, and include details of the assets involved. The platform enables you to add e-signatures and manage the document flow efficiently. This streamlined process ensures that your assignment is legally binding and properly executed.

-

What are the costs associated with using airSlate SignNow for an Assignment To Living Trust Pennsylvania?

airSlate SignNow offers flexible pricing plans tailored to different user needs, starting from a basic package that provides essential features for completing an Assignment To Living Trust Pennsylvania. You can choose from monthly or annual subscriptions, making it a cost-effective solution. Additionally, the platform often offers promotions that further reduce costs.

-

What features does airSlate SignNow offer for managing an Assignment To Living Trust Pennsylvania?

airSlate SignNow includes a variety of features specifically designed for managing an Assignment To Living Trust Pennsylvania, such as customizable templates, real-time tracking of document status, and secure cloud storage. These features enhance the overall user experience, ensuring that you can focus on what matters most—your trust assets.

-

How does airSlate SignNow ensure the security of my Assignment To Living Trust Pennsylvania documents?

The security of your Assignment To Living Trust Pennsylvania documents is a top priority for airSlate SignNow. The platform uses advanced encryption protocols, multi-factor authentication, and compliance with industry standards to safeguard your sensitive information. This means you can confidently execute your documents without worrying about unauthorized access.

-

Can I integrate airSlate SignNow with other applications for my Assignment To Living Trust Pennsylvania?

Yes, airSlate SignNow offers integration capabilities with various applications, allowing for a seamless workflow when handling your Assignment To Living Trust Pennsylvania. Whether you need to connect to Google Drive, Dropbox, or CRM systems, airSlate SignNow makes it easy to streamline your document management and e-signature processes.

-

What benefits can I expect when using airSlate SignNow for my Assignment To Living Trust Pennsylvania?

Using airSlate SignNow for your Assignment To Living Trust Pennsylvania brings numerous benefits, including increased efficiency, reduced turnaround times for document signing, and improved accuracy through automated workflows. Additionally, its user-friendly interface ensures that clients of all tech levels can navigate the process with ease.

-

Is airSlate SignNow suitable for individuals as well as businesses for Assignment To Living Trust Pennsylvania?

Absolutely! airSlate SignNow is an excellent choice for both individuals and businesses dealing with an Assignment To Living Trust Pennsylvania. The platform's versatility caters to various user needs, whether you're managing personal estate planning or handling complex business assets.

Get more for Assignment To Living Trust Pennsylvania

Find out other Assignment To Living Trust Pennsylvania

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template