Pennsylvania Installments Fixed Rate Promissory Note Secured by Residential Real Estate Pennsylvania Form

What is the Pennsylvania Installments Fixed Rate Promissory Note Secured By Residential Real Estate Pennsylvania

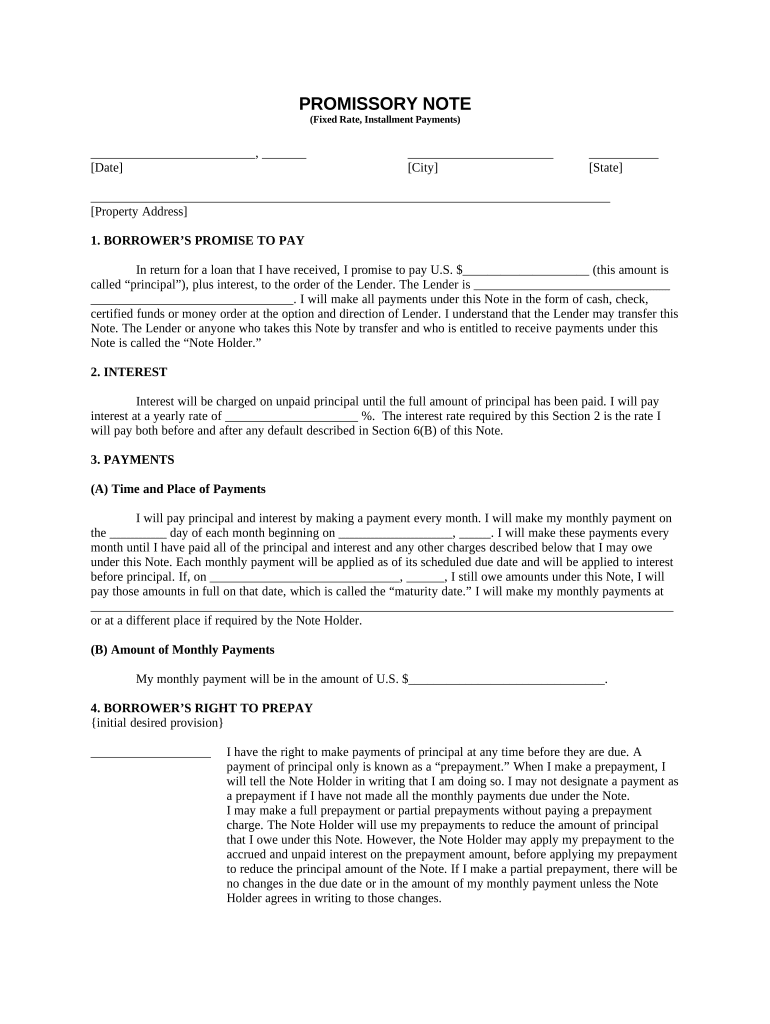

The Pennsylvania Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines the terms of a loan secured by residential property in Pennsylvania. This type of promissory note specifies the repayment schedule, interest rate, and other essential details regarding the loan agreement. By securing the loan against real estate, lenders have a form of collateral that can be claimed in case of default, providing an added layer of security for both parties involved.

Key Elements of the Pennsylvania Installments Fixed Rate Promissory Note Secured By Residential Real Estate Pennsylvania

Several key elements are crucial in crafting a Pennsylvania Installments Fixed Rate Promissory Note. These include:

- Principal Amount: The total sum of money being borrowed.

- Interest Rate: The fixed rate at which interest will accrue on the principal amount.

- Payment Schedule: The timeline for repayments, typically outlined in monthly installments.

- Default Provisions: Conditions under which the lender may take action if the borrower fails to meet payment obligations.

- Property Description: A detailed description of the residential real estate securing the loan.

Steps to Complete the Pennsylvania Installments Fixed Rate Promissory Note Secured By Residential Real Estate Pennsylvania

Completing the Pennsylvania Installments Fixed Rate Promissory Note involves several important steps:

- Gather necessary information about the borrower and lender, including names and contact details.

- Determine the loan amount, interest rate, and repayment terms.

- Clearly describe the residential property that will serve as collateral.

- Draft the note, ensuring all key elements are included and clearly articulated.

- Review the document for accuracy and completeness before signing.

- Both parties should sign the document, ideally in the presence of a notary public to enhance its legal validity.

Legal Use of the Pennsylvania Installments Fixed Rate Promissory Note Secured By Residential Real Estate Pennsylvania

The legal use of this promissory note is significant in establishing a formal loan agreement between parties. It serves as a binding contract that can be enforced in a court of law. To ensure its legal standing, the document must comply with Pennsylvania state laws regarding promissory notes and secured transactions. This includes adhering to regulations set forth by the Uniform Commercial Code (UCC) as applicable in Pennsylvania.

How to Obtain the Pennsylvania Installments Fixed Rate Promissory Note Secured By Residential Real Estate Pennsylvania

Obtaining a Pennsylvania Installments Fixed Rate Promissory Note can be done through various means. Many legal templates are available online that can be customized to meet specific needs. It is also advisable to consult with a legal professional to ensure that the document meets all legal requirements and accurately reflects the intentions of both parties. Additionally, local real estate offices or financial institutions may provide their own versions of this note, which can be used as a reference.

State-Specific Rules for the Pennsylvania Installments Fixed Rate Promissory Note Secured By Residential Real Estate Pennsylvania

In Pennsylvania, specific rules govern the creation and enforcement of promissory notes. These include requirements for written agreements, the necessity of clear terms, and compliance with state laws regarding secured transactions. It is important to understand that Pennsylvania law may have unique stipulations regarding interest rates, default procedures, and the rights of both lenders and borrowers. Consulting a legal expert familiar with Pennsylvania real estate law can help ensure compliance and protect the interests of both parties.

Quick guide on how to complete pennsylvania installments fixed rate promissory note secured by residential real estate pennsylvania

Complete Pennsylvania Installments Fixed Rate Promissory Note Secured By Residential Real Estate Pennsylvania effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct document and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your papers swiftly and without holdups. Handle Pennsylvania Installments Fixed Rate Promissory Note Secured By Residential Real Estate Pennsylvania on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to modify and electronically sign Pennsylvania Installments Fixed Rate Promissory Note Secured By Residential Real Estate Pennsylvania with ease

- Find Pennsylvania Installments Fixed Rate Promissory Note Secured By Residential Real Estate Pennsylvania and click on Get Form to begin.

- Utilize the tools we offer to finish your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Pennsylvania Installments Fixed Rate Promissory Note Secured By Residential Real Estate Pennsylvania to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Pennsylvania Installments Fixed Rate Promissory Note Secured By Residential Real Estate Pennsylvania?

A Pennsylvania Installments Fixed Rate Promissory Note Secured By Residential Real Estate Pennsylvania is a legally binding document that outlines payment terms for a loan secured by real estate. This note specifies a fixed interest rate and sets a structured payment schedule, ensuring predictable payments for both lenders and borrowers.

-

How does the Pennsylvania Installments Fixed Rate Promissory Note differ from other loan types?

The Pennsylvania Installments Fixed Rate Promissory Note is specifically secured by residential real estate, offering safety for lenders compared to unsecured loans. Unlike variable-rate loans, this note features a fixed interest rate, which helps borrowers maintain consistent monthly payments throughout the loan term.

-

What are the benefits of using a Pennsylvania Installments Fixed Rate Promissory Note?

Utilizing a Pennsylvania Installments Fixed Rate Promissory Note provides borrowers with financial predictability due to fixed payments, as well as the potential for lower interest rates due to the collateralization with residential real estate. It is an effective way to secure financing for home renovations, investments, or major purchases.

-

Are there any fees associated with a Pennsylvania Installments Fixed Rate Promissory Note?

Fees can vary based on the lender and specific terms of the Pennsylvania Installments Fixed Rate Promissory Note. Common fees may include application fees, closing costs, and possibly early repayment penalties. Always review all terms before signing to ensure you understand the costs involved.

-

Can I modify the payment terms of a Pennsylvania Installments Fixed Rate Promissory Note?

Modifying the payment terms of a Pennsylvania Installments Fixed Rate Promissory Note typically requires mutual agreement between the borrower and lender. It's essential to discuss any desired changes early on, and amendments to the note should be documented in writing to avoid misunderstandings.

-

What documentation do I need to provide for a Pennsylvania Installments Fixed Rate Promissory Note?

To complete a Pennsylvania Installments Fixed Rate Promissory Note, borrowers generally need to provide proof of income, credit history, and information about the residential real estate being used as collateral. Additional documentation may include tax returns and other relevant financial statements to establish credibility.

-

How long is the term for a Pennsylvania Installments Fixed Rate Promissory Note?

The term length for a Pennsylvania Installments Fixed Rate Promissory Note varies based on lender policies and borrower needs but typically ranges from 5 to 30 years. Choosing the right length is crucial for aligning payments with your financial situation and long-term goals.

Get more for Pennsylvania Installments Fixed Rate Promissory Note Secured By Residential Real Estate Pennsylvania

- Patient medical history form bw farese physical therapy

- New patient medical history questionnaire comprehensive pain form

- 2012 mortgage credit certificate program broward county broward form

- California id fee waiver how to reduce fee form

- Bidder form

- Do it yourself divorce rosen law firm form

- Bossier application form

- What is form approved omb no0960 0292

Find out other Pennsylvania Installments Fixed Rate Promissory Note Secured By Residential Real Estate Pennsylvania

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple