Rhode Island Single Divorced Form

What is the Rhode Island Trust?

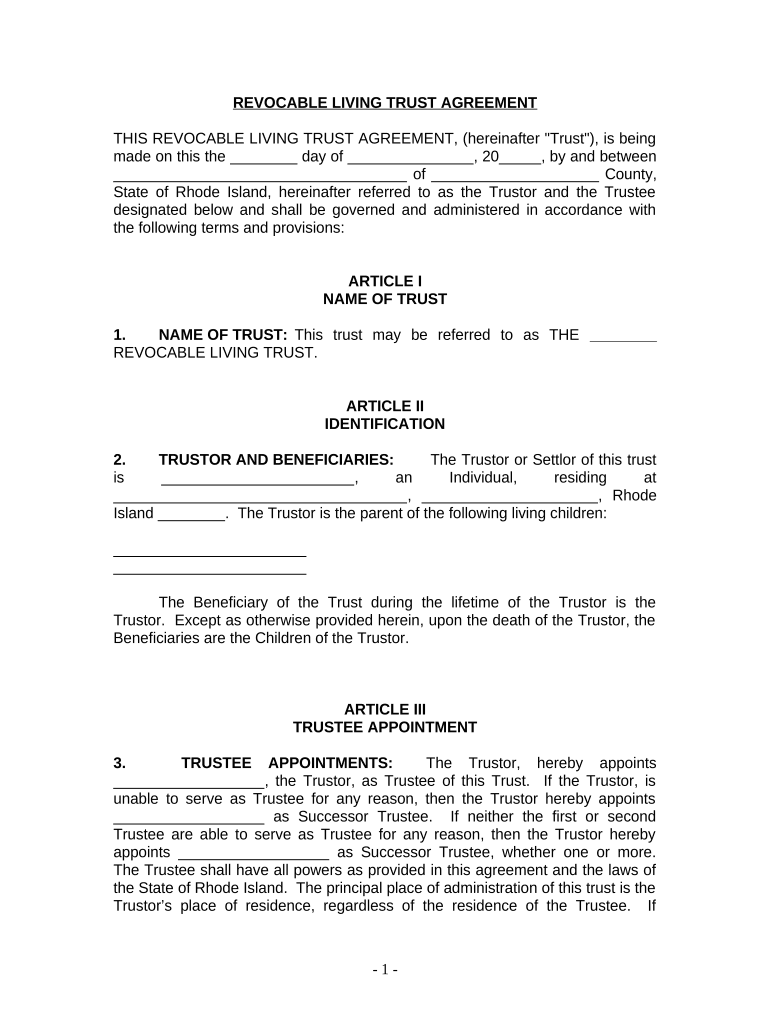

The Rhode Island trust is a legal arrangement that allows a person, known as the grantor, to transfer assets to a trustee. The trustee manages these assets for the benefit of designated beneficiaries. Trusts can serve various purposes, including estate planning, asset protection, and tax minimization. Understanding the specific types of trusts available in Rhode Island, such as revocable and irrevocable trusts, is essential for effective estate management.

How to Use the Rhode Island Trust

Using a Rhode Island trust involves several key steps. First, the grantor must decide on the type of trust that best suits their needs. Next, the grantor will draft the trust document, which outlines the terms and conditions of the trust, including the roles of the trustee and beneficiaries. Once the document is finalized, the grantor transfers assets into the trust. It is advisable to consult with a legal professional to ensure compliance with state laws and to address any specific requirements.

Key Elements of the Rhode Island Trust

Several key elements define a Rhode Island trust. These include:

- Grantor: The individual who creates the trust.

- Trustee: The person or entity responsible for managing the trust assets.

- Beneficiaries: Individuals or entities that benefit from the trust.

- Trust Document: The legal document that outlines the rules and terms of the trust.

- Assets: Property or financial resources placed into the trust.

Legal Use of the Rhode Island Trust

The legal use of a Rhode Island trust is governed by state laws, which dictate how trusts must be created and administered. Trusts can be used for various legal purposes, including avoiding probate, managing assets for minors, and providing for individuals with disabilities. To ensure that a trust is legally enforceable, it must comply with Rhode Island's trust laws and regulations, including proper documentation and asset transfer procedures.

Steps to Complete the Rhode Island Trust

Completing a Rhode Island trust involves a systematic approach:

- Determine the purpose of the trust.

- Select a suitable trustee.

- Draft the trust document, detailing the terms and conditions.

- Transfer assets into the trust, ensuring proper title changes.

- Review and update the trust as necessary to reflect changes in circumstances.

State-Specific Rules for the Rhode Island Trust

Rhode Island has specific rules governing the creation and administration of trusts. These rules include requirements for the trust document, the qualifications of trustees, and the rights of beneficiaries. It is important for grantors to familiarize themselves with these regulations to ensure that their trust is valid and enforceable. Consulting with an attorney who specializes in estate planning can provide valuable guidance in navigating these state-specific rules.

Quick guide on how to complete rhode island single divorced

Complete Rhode Island Single Divorced effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Rhode Island Single Divorced on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Rhode Island Single Divorced with ease

- Acquire Rhode Island Single Divorced and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Decide how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Rhode Island Single Divorced and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Rhode Island trust and how does it work?

A Rhode Island trust is a legal entity that allows you to manage and protect your assets. It works by placing your assets in the trust, which is then managed by a trustee on behalf of the beneficiaries. This can help with estate planning and ensure that your assets are distributed according to your wishes.

-

How does airSlate SignNow support the creation of a Rhode Island trust?

airSlate SignNow provides an efficient platform for drafting and signing the documents necessary to establish a Rhode Island trust. Our easy-to-use interface allows you to securely create, customize, and sign trust agreements digitally, ensuring compliance and ease of access.

-

What are the benefits of using a Rhode Island trust?

Using a Rhode Island trust offers several advantages, such as asset protection, tax benefits, and avoiding probate. It ensures that your assets are managed according to your wishes, which can be particularly beneficial for estate planning and providing for your loved ones.

-

What types of Rhode Island trusts are available?

There are various types of Rhode Island trusts, including revocable trusts, irrevocable trusts, and special needs trusts. Each type serves a unique purpose and can be tailored to fit specific financial and personal goals, providing flexibility in estate planning.

-

What is the cost of setting up a Rhode Island trust?

The cost of setting up a Rhode Island trust can vary based on the attorney’s fees and complexity of the trust. Utilizing airSlate SignNow can reduce these costs signNowly by providing a cost-effective solution for drafting and signing necessary documents, helping you create your trust without the high expenses often associated with legal services.

-

How can I integrate airSlate SignNow with my existing workflow for managing a Rhode Island trust?

airSlate SignNow offers various integrations that can seamlessly fit into your existing workflow. You can easily link it with popular CRMs and document management tools, allowing you to manage your Rhode Island trust documents efficiently and keep everything organized.

-

Is airSlate SignNow secure for handling Rhode Island trust documents?

Yes, airSlate SignNow is designed with robust security measures to protect your sensitive Rhode Island trust documents. We implement industry-standard encryption, secure access controls, and compliance with regulations to ensure your information remains confidential and safe.

Get more for Rhode Island Single Divorced

Find out other Rhode Island Single Divorced

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF