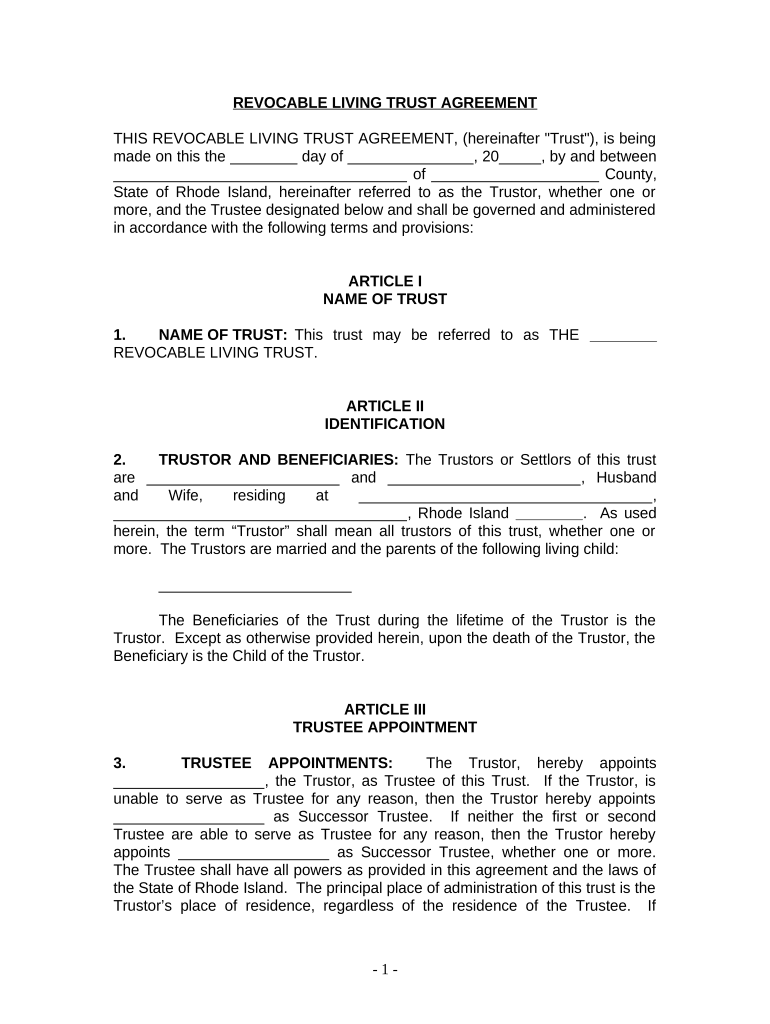

Living Trust for Husband and Wife with One Child Rhode Island Form

What is the Living Trust For Husband And Wife With One Child Rhode Island

A living trust for husband and wife with one child in Rhode Island is a legal arrangement that allows couples to manage their assets during their lifetime and specify how those assets should be distributed after their death. This type of trust can help avoid probate, streamline the transfer of assets, and provide clear instructions for the care of the child. It typically includes provisions for both spouses and outlines the management of the trust in the event of one spouse's incapacity or death.

Key elements of the Living Trust For Husband And Wife With One Child Rhode Island

Several key elements define a living trust for husband and wife with one child in Rhode Island:

- Grantors: Both spouses act as grantors, contributing assets to the trust.

- Trustee: The couple can serve as trustees, allowing them to manage the trust assets during their lifetime.

- Beneficiaries: The couple's child is typically named as the primary beneficiary, ensuring assets are transferred to them upon the death of both parents.

- Distribution Instructions: The trust document outlines how and when the assets will be distributed to the child, including any conditions or age requirements.

Steps to complete the Living Trust For Husband And Wife With One Child Rhode Island

Completing a living trust for husband and wife with one child in Rhode Island involves several steps:

- Identify Assets: Determine which assets will be included in the trust, such as real estate, bank accounts, and investments.

- Draft the Trust Document: Create a legal document that outlines the terms of the trust, including the roles of grantors, trustees, and beneficiaries.

- Sign the Document: Both spouses must sign the trust document in the presence of a notary public to ensure its validity.

- Transfer Assets: Officially transfer ownership of the identified assets into the trust, which may require updating titles or account information.

How to use the Living Trust For Husband And Wife With One Child Rhode Island

Utilizing a living trust for husband and wife with one child in Rhode Island involves managing the trust assets and ensuring compliance with its terms. The couple can continue to use the assets in the trust as they see fit, including selling or purchasing new assets. Upon the death of one spouse, the surviving spouse retains control, and upon the death of both, the trust assets are distributed according to the established instructions. Regular reviews of the trust may be necessary to ensure it reflects current wishes and circumstances.

Legal use of the Living Trust For Husband And Wife With One Child Rhode Island

The legal use of a living trust for husband and wife with one child in Rhode Island is governed by state laws regarding trusts and estates. To be legally valid, the trust must be properly executed, which includes being signed by both spouses and notarized. Additionally, the trust must comply with Rhode Island's specific regulations regarding asset management and distribution. It is advisable to consult with a legal professional to ensure that the trust meets all legal requirements and effectively addresses the couple's estate planning needs.

State-specific rules for the Living Trust For Husband And Wife With One Child Rhode Island

Rhode Island has specific rules that govern living trusts, including requirements for execution and asset transfer. The trust document must clearly state the intentions of the grantors and follow the state's guidelines for notarization and witnessing. Additionally, Rhode Island law allows for revocable trusts, meaning the couple can modify or revoke the trust during their lifetime. Understanding these state-specific rules is crucial to ensure the trust functions as intended and provides the desired legal protections.

Quick guide on how to complete living trust for husband and wife with one child rhode island

Effortlessly Prepare Living Trust For Husband And Wife With One Child Rhode Island on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, since you can easily locate the right form and securely keep it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly without delays. Manage Living Trust For Husband And Wife With One Child Rhode Island on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Living Trust For Husband And Wife With One Child Rhode Island with Ease

- Obtain Living Trust For Husband And Wife With One Child Rhode Island and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to confirm your changes.

- Choose your preferred method to send your form: via email, SMS, or an invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Living Trust For Husband And Wife With One Child Rhode Island and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for Husband and Wife with One Child in Rhode Island?

A Living Trust for Husband and Wife with One Child in Rhode Island is a legal arrangement that allows couples to manage their assets during their lifetime and specify how their assets will be distributed to their child after their passing. This type of trust helps avoid probate, providing a straightforward and efficient way to transfer property. Additionally, it can offer flexibility in managing family assets.

-

How does a Living Trust for Husband and Wife with One Child in Rhode Island benefit our family?

Establishing a Living Trust for Husband and Wife with One Child in Rhode Island provides signNow benefits, such as avoiding the lengthy probate process and ensuring that your child receives their inheritance without complications. It also allows for controlled distribution of assets, offering peace of mind knowing that your wishes will be honored. Additionally, it can provide tax benefits and protect assets against creditors.

-

What are the costs associated with creating a Living Trust for Husband and Wife with One Child in Rhode Island?

The costs associated with creating a Living Trust for Husband and Wife with One Child in Rhode Island vary based on factors such as the complexity of the trust and the legal assistance required. Typically, you may expect to pay for professional attorney fees, which can range from a few hundred to several thousand dollars. However, investing in a Living Trust can ultimately save on probate costs down the line.

-

Can we update or change our Living Trust for Husband and Wife with One Child in Rhode Island?

Yes, one of the key advantages of a Living Trust for Husband and Wife with One Child in Rhode Island is its flexibility. You can update and modify the trust as your circumstances change, such as the birth of additional children or changes in financial situations. Regularly reviewing and updating your trust ensures it remains aligned with your family's needs and wishes.

-

What assets can be included in a Living Trust for Husband and Wife with One Child in Rhode Island?

A Living Trust for Husband and Wife with One Child in Rhode Island can hold various assets, including real estate, bank accounts, investments, and personal property. Almost any asset you own can typically be placed into the trust, allowing for easier management and distribution. It's advisable to work with a legal professional to ensure all desired assets are properly incorporated into your trust.

-

Who can be the trustee of a Living Trust for Husband and Wife with One Child in Rhode Island?

In a Living Trust for Husband and Wife with One Child in Rhode Island, you typically serve as your own trustee while you're alive, allowing you to maintain control over the trust assets. You can also designate successor trustees who will manage the trust after your passing or incapacity. Choosing a reliable and trustworthy individual or institution as a successor trustee is essential for ensuring your child’s financial future.

-

How does airSlate SignNow facilitate the creation and management of a Living Trust for Husband and Wife with One Child in Rhode Island?

airSlate SignNow provides an easy-to-use platform for creating and managing legal documents, including a Living Trust for Husband and Wife with One Child in Rhode Island. Our service allows you to draft, send, and eSign your trust documents securely and efficiently, saving you time and hassle. With cost-effective solutions and digital accessibility, SignNow makes the process more convenient for families.

Get more for Living Trust For Husband And Wife With One Child Rhode Island

Find out other Living Trust For Husband And Wife With One Child Rhode Island

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document