Sc Corporation Form

What is the SC Corporation?

The SC Corporation, or South Carolina Corporation, is a legal business entity formed under the laws of South Carolina. This type of corporation provides limited liability protection to its owners, meaning personal assets are generally protected from business debts and liabilities. The SC Corporation can be used for various business activities, making it a popular choice among entrepreneurs in the state. Additionally, it allows for easier access to capital, as corporations can issue stock to raise funds.

How to Obtain the SC Corporation

To obtain an SC Corporation, you must follow several steps:

- Choose a name: The name must be unique and not already in use by another business in South Carolina.

- Designate a registered agent: This individual or business must be located in South Carolina and will receive legal documents on behalf of the corporation.

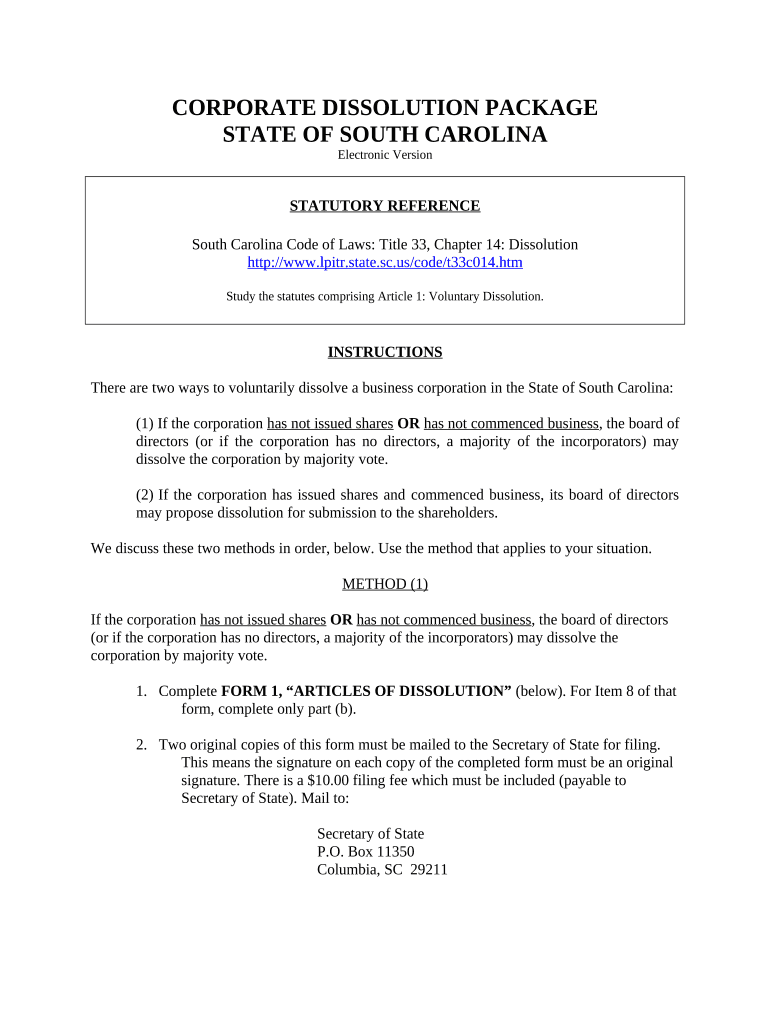

- File Articles of Incorporation: Submit the necessary paperwork to the South Carolina Secretary of State, including the Articles of Incorporation, which outline the corporation's purpose and structure.

- Pay the filing fee: There is a fee associated with filing the Articles of Incorporation, which varies based on the type of corporation.

- Obtain an Employer Identification Number (EIN): This number is required for tax purposes and can be obtained from the IRS.

Steps to Complete the SC Corporation

Completing the SC Corporation involves several critical steps:

- Draft corporate bylaws: These internal rules govern the management of the corporation.

- Hold an organizational meeting: This initial meeting of the board of directors is essential for adopting bylaws and appointing officers.

- Issue stock certificates: If applicable, stock must be issued to the initial shareholders, documenting their ownership in the corporation.

- Maintain compliance: Ensure ongoing compliance with state and federal regulations, including filing annual reports and paying necessary taxes.

Legal Use of the SC Corporation

The SC Corporation is legally recognized and can engage in various business activities, provided they comply with state laws. This includes entering contracts, suing and being sued, and holding property in the corporation's name. It is essential for owners to understand the legal obligations associated with maintaining the corporation's status, including proper record-keeping and adherence to corporate formalities.

Required Documents

To establish an SC Corporation, several documents are necessary:

- Articles of Incorporation: This foundational document outlines the corporation's purpose, structure, and basic operational guidelines.

- Bylaws: Internal rules that govern the corporation's operations and management.

- Initial resolutions: Documents that outline decisions made by the board of directors during the organizational meeting.

- Employer Identification Number (EIN): Required for tax identification purposes.

Filing Deadlines / Important Dates

When forming an SC Corporation, it is crucial to be aware of specific deadlines:

- Articles of Incorporation: Must be filed with the South Carolina Secretary of State before conducting business.

- Annual report: Corporations must file an annual report by the anniversary date of their incorporation.

- Tax filings: Ensure compliance with federal and state tax filing deadlines to avoid penalties.

Quick guide on how to complete sc corporation 497325807

Effortlessly Prepare Sc Corporation on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly and without delays. Manage Sc Corporation on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Modify and Electronically Sign Sc Corporation Effortlessly

- Locate Sc Corporation and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information using tools provided by airSlate SignNow designed specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

No more concerns about lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Sc Corporation to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an SC Corporation and how can airSlate SignNow benefit it?

An SC Corporation, or S Corporation, is a specific type of corporation that meets certain Internal Revenue Code requirements. AirSlate SignNow offers SC Corporations a user-friendly platform to efficiently send and eSign important documents, ensuring compliance and expediting business processes.

-

What features does airSlate SignNow offer for SC Corporations?

AirSlate SignNow provides features tailored for SC Corporations, such as customizable templates, secure storage, and robust eSignature capabilities. These tools help streamline document management while maintaining legal compliance and enhancing collaboration among team members.

-

How does pricing work for SC Corporations using airSlate SignNow?

AirSlate SignNow offers flexible pricing plans suited for SC Corporations, enabling businesses to select the package that best fits their needs. With a cost-effective solution, SC Corporations can take advantage of unlimited document signing and additional features without overstretching their budget.

-

Can airSlate SignNow integrate with other tools used by SC Corporations?

Yes, airSlate SignNow seamlessly integrates with a variety of business applications commonly used by SC Corporations, such as CRM systems, cloud storage services, and productivity tools. This ensures a smooth workflow and enhances the overall efficiency of document handling and management.

-

What are the benefits of using airSlate SignNow for SC Corporations?

The primary benefits of using airSlate SignNow for SC Corporations include improved efficiency, reduced paper usage, and enhanced security for sensitive documents. By digitizing the eSignature process, SC Corporations can speed up transactions and focus more on growing their business.

-

Is airSlate SignNow compliant with regulations for SC Corporations?

Absolutely, airSlate SignNow is designed to comply with industry regulations and legal standards pertinent to SC Corporations. This includes adherence to the ESIGN Act and UETA, providing peace of mind that electronic signatures hold the same legal weight as traditional signatures.

-

How can airSlate SignNow help with tax documentation for SC Corporations?

AirSlate SignNow assists SC Corporations in efficiently managing tax documentation by allowing them to prepare, send, and eSign forms securely. This streamlined process minimizes the risk of errors and ensures timely submission of necessary documents to maintain compliance with tax regulations.

Get more for Sc Corporation

Find out other Sc Corporation

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy