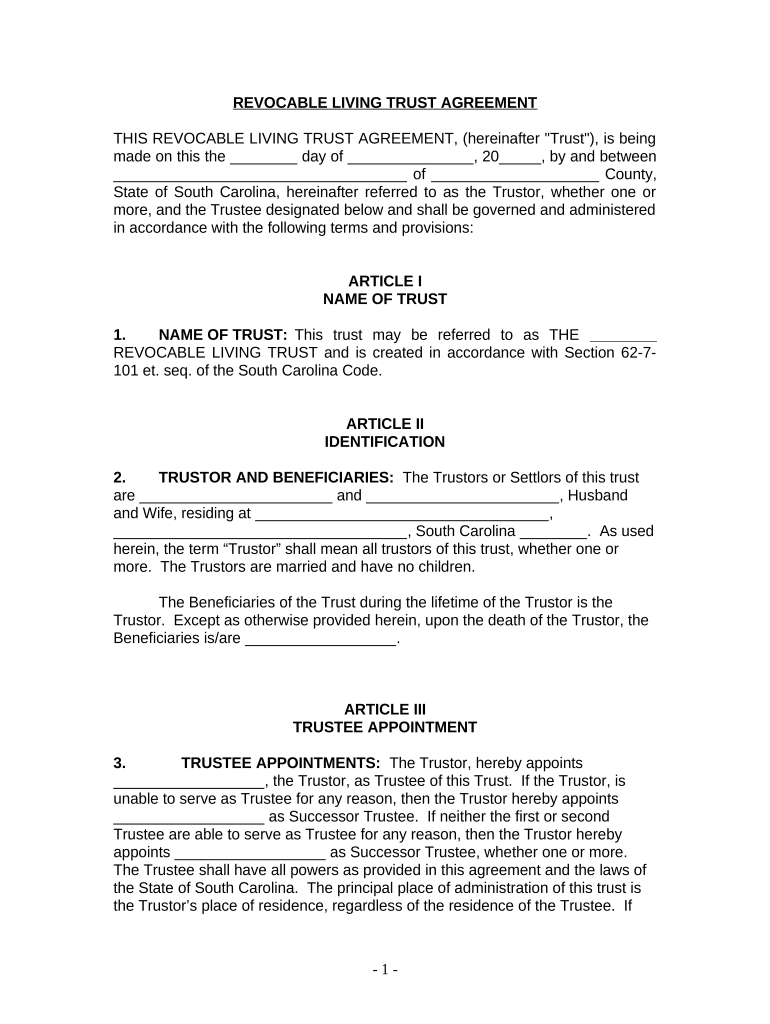

Sc Living Trust Form

What is the SC Living Trust

The SC living trust is a legal arrangement that allows individuals to manage their assets during their lifetime and dictate how those assets should be distributed after their death. This type of trust is particularly beneficial for estate planning, as it helps avoid the lengthy and often costly probate process. By placing assets into a living trust, the grantor retains control over those assets while alive, and the trust becomes irrevocable upon their passing, ensuring a smooth transition of wealth to beneficiaries.

How to Use the SC Living Trust

Using an SC living trust involves several steps to ensure it meets legal requirements and effectively serves its purpose. First, individuals must identify the assets they wish to include in the trust, such as real estate, bank accounts, and investments. Next, they must create the trust document, which outlines the terms and conditions of the trust, including the trustee's powers and the beneficiaries' rights. Once established, the grantor must transfer ownership of the identified assets into the trust. This process is crucial for the trust to function as intended and provide the desired benefits.

Steps to Complete the SC Living Trust

Completing an SC living trust involves a series of methodical steps:

- Identify and list all assets to be included in the trust.

- Choose a reliable trustee, who may be the grantor or another trusted individual.

- Draft the trust document, ensuring it complies with South Carolina laws.

- Sign the document in front of a notary public to validate it.

- Transfer ownership of the assets into the trust by changing titles and account names as necessary.

- Review and update the trust periodically to reflect any changes in assets or personal circumstances.

Legal Use of the SC Living Trust

The legal use of an SC living trust is governed by state laws that dictate how trusts must be created and administered. In South Carolina, the trust must be established in writing and signed by the grantor. It is essential that the trust document clearly outlines the distribution of assets and the responsibilities of the trustee. Additionally, the trust should comply with relevant tax laws to ensure that it does not incur unnecessary tax liabilities. Proper legal guidance can help ensure that the trust is valid and enforceable.

Key Elements of the SC Living Trust

Several key elements define the SC living trust, making it an effective estate planning tool:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust and its assets.

- Beneficiaries: Individuals or entities designated to receive the trust's assets upon the grantor's death.

- Trust Document: The legal document that outlines the terms, conditions, and structure of the trust.

- Asset Transfer: The process of moving ownership of assets into the trust to ensure they are managed according to the grantor's wishes.

State-Specific Rules for the SC Living Trust

South Carolina has specific rules regarding the establishment and administration of living trusts. These include requirements for the trust document to be in writing and signed by the grantor. Additionally, the state allows for revocable living trusts, which can be modified or revoked by the grantor at any time during their lifetime. It is important to consult with a legal professional who is familiar with South Carolina trust laws to ensure compliance and to address any unique circumstances that may arise.

Quick guide on how to complete sc living trust

Prepare Sc Living Trust effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It offers a superb eco-friendly substitute to conventional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides all the tools you require to generate, alter, and eSign your documents swiftly without delays. Handle Sc Living Trust on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to alter and eSign Sc Living Trust with ease

- Locate Sc Living Trust and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize signNow sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tiresome form searches, or errors that require printing new document copies. airSlate SignNow manages all your needs in document administration in just a few clicks from any device you prefer. Edit and eSign Sc Living Trust and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an SC living trust?

An SC living trust is a legal entity that holds your assets during your lifetime and specifies how they should be distributed after your death. This type of trust can help avoid probate, ensuring a smoother and quicker transfer of assets. With airSlate SignNow, you can easily create and manage your SC living trust documents online.

-

How does the pricing for SC living trust services work?

Pricing for creating an SC living trust varies based on the complexity of your assets and the services required. airSlate SignNow offers a cost-effective solution for eSigning and managing your documents, making it affordable to set up your SC living trust without hidden fees. You can choose from various subscription plans that cater to individual needs.

-

What are the key benefits of establishing an SC living trust?

Establishing an SC living trust provides numerous benefits, such as avoiding probate, maintaining privacy, and allowing for flexible asset management. Additionally, it can save your beneficiaries time and money in the long run. airSlate SignNow simplifies the process, enabling you to seamlessly create and manage your living trust documents.

-

Can I integrate airSlate SignNow with my existing document management system for my SC living trust?

Yes, airSlate SignNow offers integration capabilities with various document management systems, allowing you to streamline your SC living trust processes. This integration ensures that all your documents are easily accessible and can be eSigned quickly. Our user-friendly platform enhances productivity while managing your living trust.

-

Is it difficult to modify an SC living trust once it’s set up?

Modifying an SC living trust is straightforward and can be done through amendments or revocation. With airSlate SignNow, making changes to your living trust documents is user-friendly and efficient, ensuring your trust remains current as your circumstances change. This flexibility is crucial for maintaining control over your asset distribution.

-

What types of assets can be included in an SC living trust?

An SC living trust can hold a variety of assets, including real estate, bank accounts, investments, and personal property. By including these assets in your trust, you can manage them effectively and dictate how they will be distributed upon your death. airSlate SignNow assists you in creating the necessary documents for your SC living trust with ease.

-

Do I need a lawyer to create my SC living trust with airSlate SignNow?

While it’s beneficial to consult a lawyer when creating an SC living trust, airSlate SignNow provides the tools necessary for you to create your trust documents independently. Our platform offers templates and guidance to help you navigate the process. This empowers you to take control of your estate planning while saving on legal fees.

Get more for Sc Living Trust

- 2013 financial disclosure form office of the new mexico

- El paso county clerk and recorder form

- Fictitious business name statement santa cruz form

- Mcalisters application form

- Pd100h state of oregon form

- Department of athletics redcoat and usher employment application form

- Facebook template for character form

- Fidelity retirement plan account application for inheritors trading form

Find out other Sc Living Trust

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile