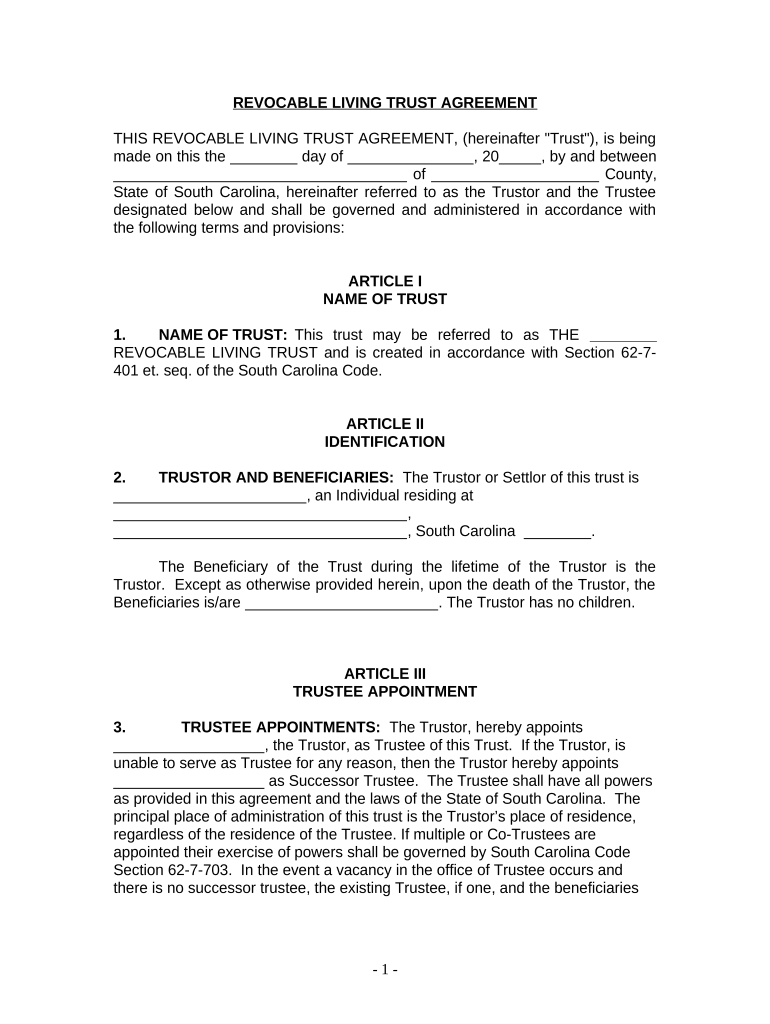

Living Trust Individual Form

What is the Living Trust Individual

A living trust individual is a legal document that allows a person to place their assets into a trust during their lifetime. This type of trust is designed to manage and distribute the individual's assets according to their wishes while avoiding probate after death. The individual, often referred to as the grantor or settlor, retains control over the assets and can modify the trust as needed. This flexibility makes living trusts a popular choice for estate planning in the United States.

How to use the Living Trust Individual

Using a living trust individual involves several key steps. First, the grantor must identify the assets they wish to place in the trust, which may include real estate, bank accounts, and investments. Next, the grantor should create the trust document, specifying the terms and beneficiaries. Once the trust is established, the grantor must transfer ownership of the assets to the trust. This process ensures that the assets are managed according to the grantor's wishes and can be distributed to beneficiaries without going through probate.

Steps to complete the Living Trust Individual

Completing a living trust individual requires careful attention to detail. The following steps outline the process:

- Determine the assets to include in the trust.

- Draft the trust document, detailing the terms and conditions.

- Sign the trust document in the presence of a notary public.

- Transfer ownership of the identified assets to the trust.

- Review and update the trust as necessary to reflect changes in circumstances.

Legal use of the Living Trust Individual

The legal use of a living trust individual is governed by state laws, which can vary significantly across the United States. Generally, a living trust is recognized as a valid legal entity, provided it meets specific requirements, such as being in writing and signed by the grantor. It is essential to ensure compliance with state regulations to maintain the trust's validity and effectiveness in managing assets and distributing them upon the grantor's death.

Key elements of the Living Trust Individual

Several key elements define a living trust individual. These include:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust assets, which can be the grantor or a designated third party.

- Beneficiaries: Individuals or organizations designated to receive the trust assets upon the grantor's death.

- Trust document: The legal document that outlines the terms and conditions of the trust.

State-specific rules for the Living Trust Individual

State-specific rules for living trusts can impact their formation and execution. Each state has its own laws regarding the creation, management, and taxation of trusts. It is crucial for individuals to consult with a legal professional familiar with their state's regulations to ensure compliance and to understand any potential tax implications or requirements for funding the trust.

Quick guide on how to complete living trust individual 497325810

Complete Living Trust Individual effortlessly on any gadget

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, enabling you to access the proper form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage Living Trust Individual on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Living Trust Individual without stress

- Obtain Living Trust Individual and click on Get Form to begin.

- Utilize the features we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Modify and electronically sign Living Trust Individual and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a living trust individual and why do I need one?

A living trust individual is a legal document that allows you to manage your assets during your lifetime and specifies how they will be distributed after your death. Establishing a living trust can help avoid probate court, provide privacy, and ensure your assets are handled according to your wishes, making it an essential estate planning tool.

-

How does airSlate SignNow streamline the process of creating a living trust individual?

airSlate SignNow offers a user-friendly platform that simplifies the process of drafting and signing a living trust individual. With our eSign capabilities, you can easily create, customize, and securely sign your trust documents online, saving time and reducing the hassle of paper-based processes.

-

What features does airSlate SignNow provide for managing a living trust individual?

airSlate SignNow includes features such as customizable templates, secure document storage, and tracking options for all actions performed on your living trust individual. These tools help ensure that you can easily manage your trust documents and keep them organized.

-

Is airSlate SignNow pricing affordable for individuals looking to create a living trust?

Yes, airSlate SignNow offers competitive pricing plans that cater to individuals seeking to create a living trust individual without breaking the bank. Our pricing models are designed to ensure that anyone can access essential features for document management and eSigning at a cost-effective rate.

-

Can I integrate airSlate SignNow with other tools for managing my living trust individual?

Absolutely! airSlate SignNow integrates seamlessly with various applications and platforms, allowing you to manage your living trust individual alongside other tools you may already be using. This flexibility helps streamline your workflow and enhances your document management experience.

-

What are the benefits of using airSlate SignNow for a living trust individual?

Using airSlate SignNow for a living trust individual provides numerous benefits including time efficiency, ease of use, and enhanced security for your sensitive documents. Our platform allows you to create, sign, and store your trust documents securely, ensuring they are accessible whenever needed.

-

How secure is my information when using airSlate SignNow for a living trust individual?

Your information is highly secure with airSlate SignNow, as we prioritize data protection with advanced encryption and security measures. When creating a living trust individual on our platform, you can have peace of mind knowing that your documents are safeguarded against unauthorized access.

Get more for Living Trust Individual

- Dea form 224a

- Imm5644epfd form

- Kansas referee workbook form

- Cook county economic disclosure statement and form

- Abp 1676 4 grmh department of public social services form

- Form hud 9539 portal hud

- A47 025 2014 corporation tax returnvsd government of barbados form

- I noticed my cell phone bill was higher than usual and found a apps fcc form

Find out other Living Trust Individual

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form