Living Trust for Husband and Wife with Minor and or Adult Children South Carolina Form

What is the Living Trust For Husband And Wife With Minor And Or Adult Children South Carolina

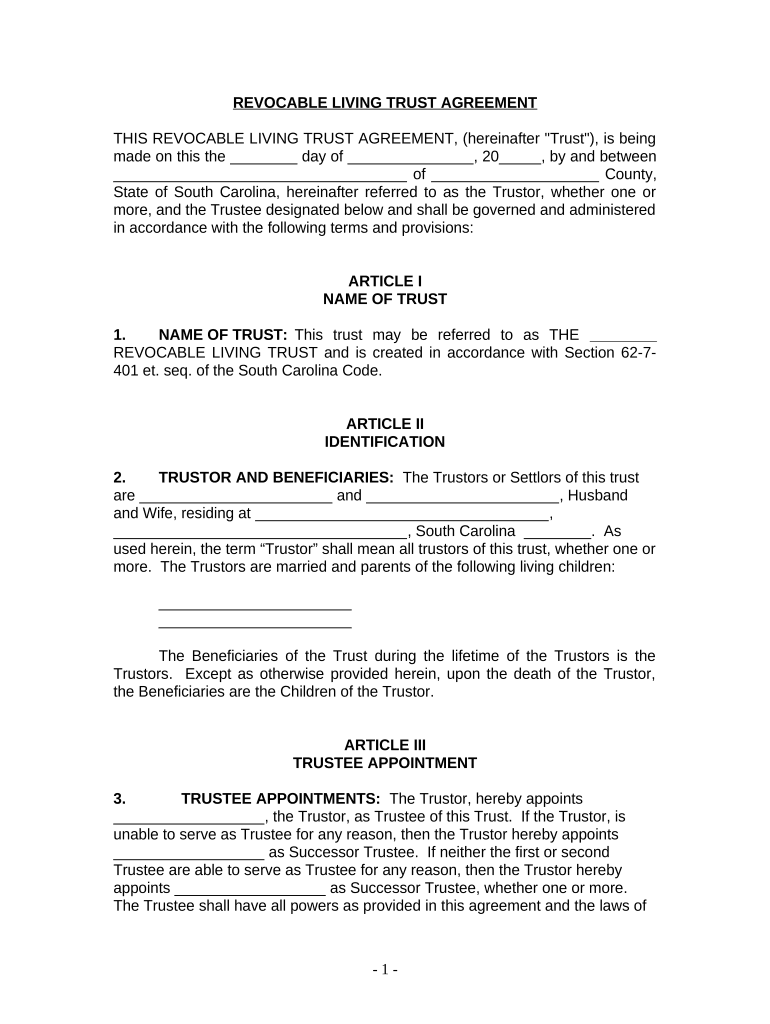

A living trust for husband and wife with minor and/or adult children in South Carolina is a legal arrangement that allows couples to manage their assets during their lifetime and specify how these assets should be distributed upon their death. This type of trust can help avoid probate, ensuring a smoother transition of assets to beneficiaries. It is particularly beneficial for families with minor children, as it allows parents to designate guardians and manage funds for their children's benefit until they reach adulthood.

Key Elements of the Living Trust For Husband And Wife With Minor And Or Adult Children South Carolina

Several key elements define a living trust for couples in South Carolina:

- Trustees: Typically, both spouses serve as trustees, managing the trust assets. They can appoint successor trustees to take over if they become unable to manage the trust.

- Beneficiaries: The couple can name their children, both minor and adult, as beneficiaries, specifying how and when they will receive their inheritance.

- Asset Management: The trust outlines how assets are to be managed and distributed, providing flexibility and control over family wealth.

- Guardianship Provisions: For minor children, the trust can include provisions for guardianship, ensuring that children are cared for by trusted individuals.

Steps to Complete the Living Trust For Husband And Wife With Minor And Or Adult Children South Carolina

Completing a living trust involves several important steps:

- Identify Assets: List all assets to be included in the trust, such as real estate, bank accounts, and investments.

- Choose Trustees: Decide who will manage the trust, typically both spouses, and identify successor trustees.

- Draft the Trust Document: Create the trust document, outlining the terms, beneficiaries, and management of assets.

- Sign the Document: Both spouses must sign the trust document in the presence of a notary public to ensure its legality.

- Fund the Trust: Transfer ownership of the identified assets into the trust, which may require additional paperwork for real estate and financial accounts.

Legal Use of the Living Trust For Husband And Wife With Minor And Or Adult Children South Carolina

The legal use of a living trust in South Carolina provides several advantages, including:

- Avoiding Probate: Assets held in a living trust do not go through probate, allowing for quicker distribution to beneficiaries.

- Privacy: Unlike wills, which become public records, living trusts remain private, keeping family matters confidential.

- Control Over Distribution: The trust allows for specific instructions on how and when assets are distributed, especially for minor children.

State-Specific Rules for the Living Trust For Husband And Wife With Minor And Or Adult Children South Carolina

In South Carolina, specific rules govern living trusts, including:

- Notarization: Trust documents must be signed in the presence of a notary public to be legally binding.

- Asset Transfer Requirements: Certain assets, such as real estate, require formal transfer to the trust, which may involve additional documentation.

- Tax Implications: Living trusts are generally not subject to income tax, but it is essential to consult with a tax advisor regarding specific situations.

Quick guide on how to complete living trust for husband and wife with minor and or adult children south carolina

Complete Living Trust For Husband And Wife With Minor And Or Adult Children South Carolina effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Living Trust For Husband And Wife With Minor And Or Adult Children South Carolina on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and eSign Living Trust For Husband And Wife With Minor And Or Adult Children South Carolina without hassle

- Obtain Living Trust For Husband And Wife With Minor And Or Adult Children South Carolina and click Get Form to begin.

- Utilize the provided tools to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Living Trust For Husband And Wife With Minor And Or Adult Children South Carolina and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for Husband and Wife with Minor and or Adult Children in South Carolina?

A Living Trust for Husband and Wife with Minor and or Adult Children in South Carolina is a legal document that allows you to manage and distribute your assets during your lifetime and after your death. It is particularly designed for couples with children, ensuring that your assets are protected and transferred according to your wishes without going through probate.

-

What are the benefits of creating a Living Trust for Husband and Wife with Minor and or Adult Children in South Carolina?

The primary benefits include avoiding probate, maintaining privacy, and ensuring a smoother transition of assets to your children. This type of trust can also provide financial management for minor children and can be tailored to meet specific family needs, making it an ideal solution for families in South Carolina.

-

How much does a Living Trust for Husband and Wife with Minor and or Adult Children in South Carolina cost?

The cost of creating a Living Trust for Husband and Wife with Minor and or Adult Children in South Carolina varies depending on factors such as complexity and legal fees. Typically, you might expect to pay between $1,000 and $3,000 for the setup, but online services like airSlate SignNow can offer more cost-effective solutions for document creation and eSigning.

-

Can a Living Trust be modified after it is created in South Carolina?

Yes, a Living Trust for Husband and Wife with Minor and or Adult Children in South Carolina can be modified, as long as it is a revocable trust. This flexibility allows you to change beneficiaries, assets, or terms of the trust as your family's needs change.

-

Are there tax implications for setting up a Living Trust for Husband and Wife with Minor and or Adult Children in South Carolina?

Generally, a Living Trust does not have tax implications because assets held in the trust are still considered part of your estate. However, it is advisable to consult a tax professional to understand any specific implications related to your individual circumstances when establishing a Living Trust for Husband and Wife with Minor and or Adult Children in South Carolina.

-

What documents do I need to create a Living Trust for Husband and Wife with Minor and or Adult Children in South Carolina?

To create a Living Trust for Husband and Wife with Minor and or Adult Children in South Carolina, you will typically need a list of your assets, titles, and other ownership documents. Legal assistance from a professional can help ensure all necessary documentation is completed correctly for the trust establishment.

-

How does airSlate SignNow facilitate the creation of a Living Trust for Husband and Wife with Minor and or Adult Children in South Carolina?

airSlate SignNow offers an easy-to-use platform that lets users create, customize, and eSign documents, including Living Trusts for Husband and Wife with Minor and or Adult Children in South Carolina. With its cost-effective solutions, you can manage your estate planning documents without the complexities often associated with traditional legal services.

Get more for Living Trust For Husband And Wife With Minor And Or Adult Children South Carolina

- Chapter 3 ancient mesopotamia crossword puzzle answer key form

- Alarm permit garland form

- Affidavit in lieu of originals form

- Ins5210 form 100874660

- Ia affidavit financial form

- Exalted 3rd ed 2 page interactive sheet mrgoneamp39s character sheets form

- 2015 2016 minnesota board of dentistry self assessment mn form

- Medical malpractice intake form matthew d kaplan llc

Find out other Living Trust For Husband And Wife With Minor And Or Adult Children South Carolina

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online