Financial Account Transfer to Living Trust South Carolina Form

What is the Financial Account Transfer To Living Trust South Carolina

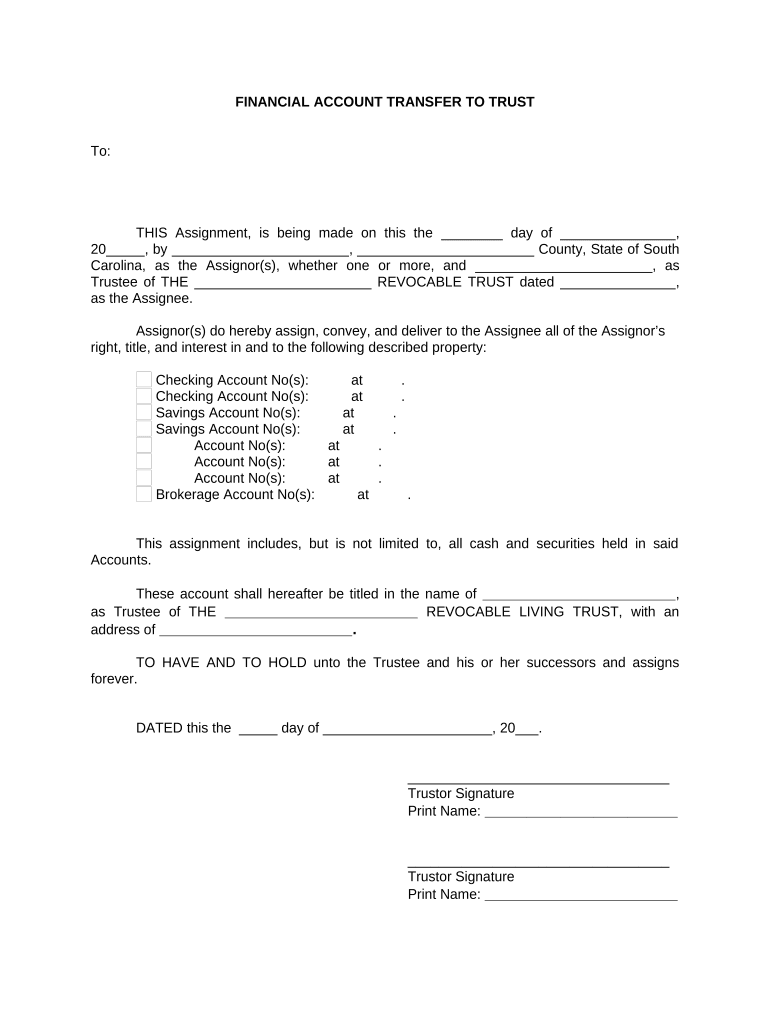

The Financial Account Transfer To Living Trust South Carolina is a legal document designed to facilitate the transfer of financial assets into a living trust. This process allows individuals to manage their assets during their lifetime and ensure a smoother transition of these assets upon death. By placing financial accounts into a living trust, the assets can avoid probate, which can save time and costs for beneficiaries. This document typically includes details about the trust, the financial accounts being transferred, and the individuals involved in the transfer.

Steps to complete the Financial Account Transfer To Living Trust South Carolina

Completing the Financial Account Transfer To Living Trust South Carolina involves several key steps to ensure the process is executed properly:

- Gather necessary documents, including the trust agreement and account statements.

- Complete the transfer form, specifying the accounts to be transferred into the trust.

- Provide identification and any required signatures from the trustee and beneficiaries.

- Submit the completed form to the financial institution holding the accounts.

- Confirm the transfer with the institution to ensure that the accounts are now under the trust's name.

Legal use of the Financial Account Transfer To Living Trust South Carolina

The legal use of the Financial Account Transfer To Living Trust South Carolina is to ensure that assets are properly managed and distributed according to the terms of the trust. This document must comply with South Carolina laws regarding trusts and estate planning. It is essential that the transfer is executed correctly to avoid any legal complications or disputes among beneficiaries. Ensuring that the trust is properly funded with financial accounts is a critical step in effective estate planning.

State-specific rules for the Financial Account Transfer To Living Trust South Carolina

In South Carolina, specific rules govern the creation and management of living trusts, including the Financial Account Transfer To Living Trust. These rules may dictate how the trust is established, the requirements for trustees, and the necessary documentation for asset transfers. It is important to consult with a legal professional familiar with South Carolina estate law to ensure compliance with all state regulations and to understand any unique provisions that may affect the trust.

Required Documents

To complete the Financial Account Transfer To Living Trust South Carolina, several documents are typically required:

- The trust agreement, which outlines the terms and conditions of the trust.

- Account statements for the financial accounts being transferred.

- Identification documents for the trustee and beneficiaries.

- Any additional forms required by the financial institution.

How to use the Financial Account Transfer To Living Trust South Carolina

Using the Financial Account Transfer To Living Trust South Carolina effectively involves understanding the purpose of the document and the steps needed for completion. Individuals should ensure that they have all necessary documents ready and understand the implications of transferring their financial accounts into a living trust. Proper execution of the transfer form is crucial for ensuring that the assets are legally recognized as part of the trust, which can help in estate management and distribution.

Quick guide on how to complete financial account transfer to living trust south carolina

Prepare Financial Account Transfer To Living Trust South Carolina effortlessly on any device

Web-based document management has become widely adopted by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Financial Account Transfer To Living Trust South Carolina on any platform through airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The simplest way to modify and eSign Financial Account Transfer To Living Trust South Carolina with ease

- Locate Financial Account Transfer To Living Trust South Carolina and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Financial Account Transfer To Living Trust South Carolina and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for Financial Account Transfer To Living Trust South Carolina?

The Financial Account Transfer To Living Trust South Carolina involves several steps, including collecting all financial documents, completing the necessary forms, and submitting them to your financial institutions. It's essential to ensure that your living trust meets state requirements. Professional assistance can streamline this process and ensure compliance.

-

What are the benefits of transferring financial accounts to a living trust in South Carolina?

Transferring financial accounts to a living trust in South Carolina can help avoid probate, ensure privacy, and provide clear instructions on asset distribution. It also allows for the management of your assets should you become incapacitated. Ultimately, this can lead to a smoother transition of your estate after your passing.

-

How much does it cost to transfer financial accounts to a living trust in South Carolina?

The cost for Financial Account Transfer To Living Trust South Carolina can vary depending on the complexity of your estate and whether you hire professional services. Basic transfer costs may include fees for attorney consultations, document preparation, and filing fees with financial institutions. Generally, it's best to budget for anywhere between a few hundred to a couple thousand dollars.

-

Can I transfer my financial accounts to a living trust without legal assistance in South Carolina?

Yes, you can transfer your financial accounts to a living trust without legal assistance in South Carolina, but it is recommended to consult a professional. Understanding the legal requirements and ensuring all documents are correctly completed is crucial. Mistakes can lead to delays or complications, so careful preparation is essential.

-

What types of financial accounts can I transfer to a living trust in South Carolina?

In South Carolina, you can transfer various financial accounts to a living trust, including bank accounts, investment accounts, and retirement accounts. Each type may have specific requirements for naming the trust as the beneficiary or account holder. It's important to follow the correct procedures for each account type to ensure a smooth transfer.

-

Are there any tax implications when transferring financial accounts to a living trust in South Carolina?

Generally, transferring financial accounts to a living trust in South Carolina does not trigger tax consequences, as the assets remain in your control. However, certain tax implications could arise if the trust generates income or if you transfer irrevocable assets. Consult a tax professional to understand any potential impacts specific to your situation.

-

How can airSlate SignNow assist with the Financial Account Transfer To Living Trust South Carolina?

airSlate SignNow offers an easy-to-use, cost-effective solution for managing documents related to Financial Account Transfer To Living Trust South Carolina. With features like eSigning and document storage, you can efficiently handle all your trust documents. This can signNowly simplify the process of transferring financial accounts and ensure timely execution.

Get more for Financial Account Transfer To Living Trust South Carolina

- Fringe benefit identification prime contractor and all subcontractors form

- Tdlr complaint sign form

- Download a fax cover sheet great lakes mygreatlakes form

- Consent to release information needed for vehicle buyback

- Patient report form

- Beneficiary recontact report instructions for reginfogov reginfo form

- Cc 1355 rule to show cause page 1 using this form 1

- Wework membership agreement form

Find out other Financial Account Transfer To Living Trust South Carolina

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice