Notice of Nonliability by Corporation or LLC South Dakota Form

What is the Notice Of Nonliability By Corporation Or LLC South Dakota

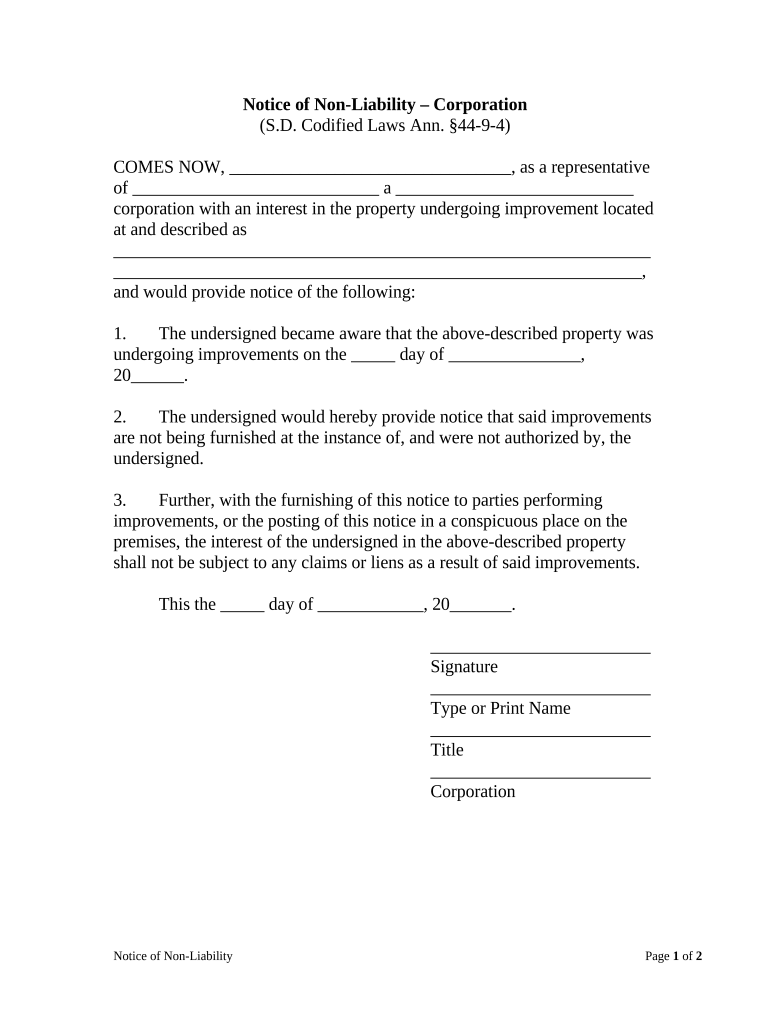

The Notice of Nonliability by Corporation or LLC in South Dakota serves as a legal document that protects a corporation or limited liability company from being held liable for certain obligations. This form is particularly important for businesses that want to clarify the limits of their liability in specific situations, such as contracts or debts incurred by individuals acting on behalf of the corporation or LLC. By filing this notice, the entity asserts that it does not assume responsibility for any obligations that exceed its established boundaries, thus safeguarding its assets and interests.

Key Elements of the Notice Of Nonliability By Corporation Or LLC South Dakota

Several key elements must be included in the Notice of Nonliability to ensure its effectiveness and legal standing. These include:

- Name of the Corporation or LLC: Clearly state the legal name of the entity.

- Address: Provide the principal office address of the corporation or LLC.

- Statement of Nonliability: Include a clear declaration that the corporation or LLC is not liable for specific debts or obligations.

- Effective Date: Specify the date when the notice takes effect.

- Signature: The document must be signed by an authorized representative of the corporation or LLC.

Steps to Complete the Notice Of Nonliability By Corporation Or LLC South Dakota

Completing the Notice of Nonliability involves several straightforward steps:

- Gather necessary information about the corporation or LLC, including its legal name and address.

- Draft the notice, ensuring all key elements are included as outlined above.

- Review the document for accuracy and completeness.

- Obtain the signature of an authorized representative.

- File the completed notice with the appropriate state office, typically the Secretary of State.

How to Use the Notice Of Nonliability By Corporation Or LLC South Dakota

The Notice of Nonliability can be utilized in various scenarios to protect the interests of a corporation or LLC. It is commonly used when entering into contracts, loan agreements, or any situation where liability could arise. By providing this notice, the entity informs third parties that they cannot hold the corporation or LLC liable for certain obligations, thus clarifying the extent of liability upfront. This proactive measure can help prevent legal disputes and misunderstandings regarding financial responsibilities.

State-Specific Rules for the Notice Of Nonliability By Corporation Or LLC South Dakota

In South Dakota, specific rules govern the use and filing of the Notice of Nonliability. These may include:

- The requirement to file the notice with the Secretary of State.

- Adherence to state laws regarding the content and format of the notice.

- Timelines for filing to ensure the notice is effective when needed.

It is important to consult state regulations or legal counsel to ensure compliance with all applicable laws.

Legal Use of the Notice Of Nonliability By Corporation Or LLC South Dakota

The legal use of the Notice of Nonliability is crucial for maintaining the integrity of a corporation or LLC. By formally declaring nonliability, the entity can protect its assets from claims that exceed its legal obligations. This document can be particularly useful in disputes where the liability of the business is questioned. Courts typically recognize the validity of such notices when they are properly executed and filed, making them an essential tool for risk management in business operations.

Quick guide on how to complete notice of nonliability by corporation or llc south dakota

Complete Notice Of Nonliability By Corporation Or LLC South Dakota effortlessly on any device

Managing documents online has become increasingly popular among corporations and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Notice Of Nonliability By Corporation Or LLC South Dakota on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Notice Of Nonliability By Corporation Or LLC South Dakota with ease

- Locate Notice Of Nonliability By Corporation Or LLC South Dakota and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to apply your changes.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Notice Of Nonliability By Corporation Or LLC South Dakota to ensure excellent communication at every step of your form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Notice Of Nonliability By Corporation Or LLC South Dakota?

A Notice Of Nonliability By Corporation Or LLC South Dakota is a legal document that notifies third parties that a corporation or LLC is not liable for certain debts or obligations incurred by its individual members or managers. This notice helps protect the business's assets while keeping stakeholders informed about financial liability.

-

How can airSlate SignNow help with creating a Notice Of Nonliability By Corporation Or LLC South Dakota?

With airSlate SignNow, you can easily create and customize a Notice Of Nonliability By Corporation Or LLC South Dakota through our intuitive document editor. Our platform allows you to add your company details and signatures quickly, making the process seamless and efficient.

-

Is there a cost associated with using airSlate SignNow for creating legal documents?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan includes features like document creation, eSigning, and secure storage, ensuring that your Notice Of Nonliability By Corporation Or LLC South Dakota is professionally handled at a competitive price.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides robust features for document management, including unlimited eSigning, customizable templates, and cloud storage solutions. These features make it ideal for handling legal documents like the Notice Of Nonliability By Corporation Or LLC South Dakota efficiently.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integration capabilities with various applications such as Google Drive, Salesforce, and more. This allows you to streamline your workflow and easily access documents, including the Notice Of Nonliability By Corporation Or LLC South Dakota from your preferred software.

-

What are the benefits of using airSlate SignNow for legal document creation?

Using airSlate SignNow for your legal document needs, including the Notice Of Nonliability By Corporation Or LLC South Dakota, provides numerous benefits. These include fast turnaround times, digital signatures that are legally binding, and enhanced security features to protect your sensitive information.

-

Is airSlate SignNow legally compliant for creating legal documents?

Yes, airSlate SignNow complies with all necessary regulations and eSignature laws, ensuring that documents like the Notice Of Nonliability By Corporation Or LLC South Dakota are legally binding. You can trust our platform for compliant document creation and signing.

Get more for Notice Of Nonliability By Corporation Or LLC South Dakota

- Clubhouse reservation request towne lake hills hoa form

- Lutheran housing services inc form

- Formato de solicitud de transferencia de semanas imss

- Computer networking a top down approach 7th edition pdf download form

- Of new hampshire limited liability company sos nh form

- Ct 1040x 2016 form

- Rotary club ridgefield park new jersey 07660 rpps form

- Revised form 22d nccourts

Find out other Notice Of Nonliability By Corporation Or LLC South Dakota

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document