South Dakota Lien Form

What is the South Dakota Lien Form

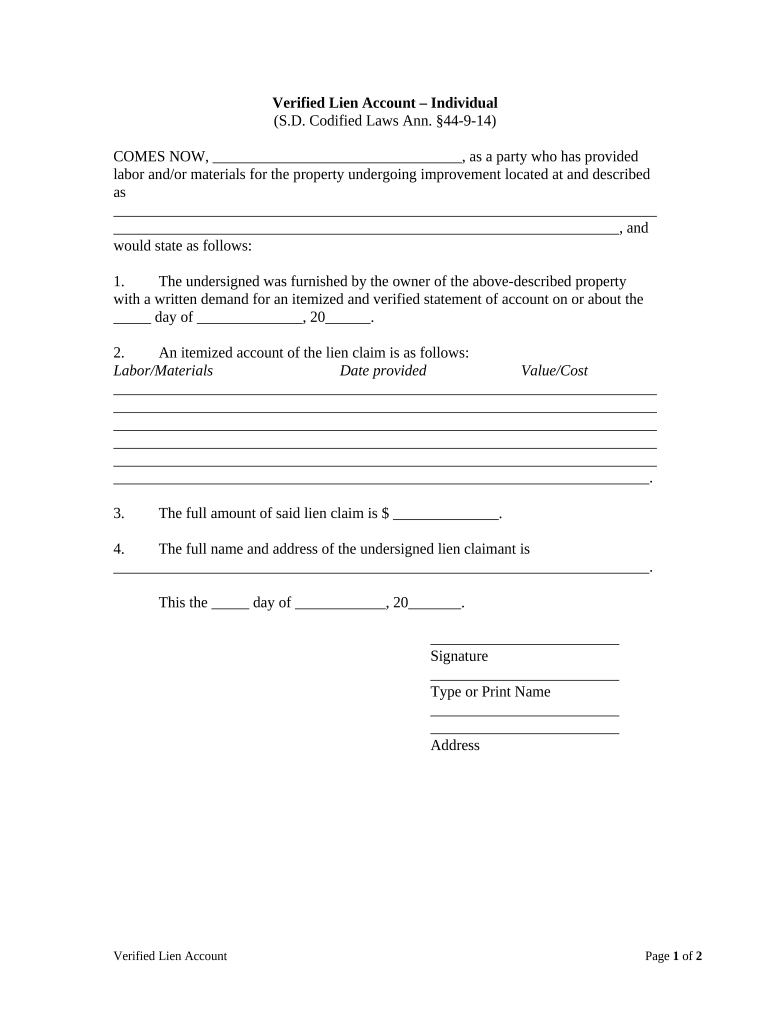

The South Dakota lien form is a legal document used to establish a claim against a property for unpaid debts or obligations. This form is essential for creditors seeking to secure their interests in a debtor's property. It provides a formal mechanism for asserting a lien, which can affect the property owner's ability to sell or refinance the property until the debt is settled. Understanding the purpose and implications of this form is crucial for both creditors and debtors in South Dakota.

How to use the South Dakota Lien Form

Using the South Dakota lien form involves several key steps. First, ensure that you have the correct version of the form, as there may be updates or changes over time. Next, fill out the form with accurate details, including the names of the parties involved, the nature of the debt, and a description of the property subject to the lien. After completing the form, it must be signed and dated by the appropriate parties. Finally, the completed form should be filed with the appropriate county office to make the lien official.

Steps to complete the South Dakota Lien Form

Completing the South Dakota lien form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the South Dakota lien form from a reliable source.

- Enter the names and addresses of the creditor and debtor accurately.

- Provide a detailed description of the debt, including the amount owed and the due date.

- Include a clear description of the property that is subject to the lien.

- Sign and date the form in the designated areas.

- Submit the completed form to the appropriate county office for recording.

Legal use of the South Dakota Lien Form

The legal use of the South Dakota lien form is governed by state laws that outline the requirements for establishing a lien. To be valid, the form must be properly completed, signed, and filed within the specified timeframes. It is important to comply with all legal stipulations to ensure that the lien is enforceable. Failure to adhere to these requirements can result in the lien being deemed invalid, which may jeopardize the creditor's ability to recover the owed amount.

Key elements of the South Dakota Lien Form

The South Dakota lien form contains several key elements that must be included for it to be valid. These elements typically include:

- The full names and addresses of the creditor and debtor.

- A detailed description of the debt, including the amount and nature of the obligation.

- A clear description of the property subject to the lien.

- The signatures of the involved parties, along with the date of signing.

Ensuring that all these elements are present and accurately filled out is essential for the form's legal effectiveness.

State-specific rules for the South Dakota Lien Form

Each state has its own regulations regarding lien forms, and South Dakota is no exception. It is important to be aware of the specific rules that govern the use of the lien form in this state. These rules may include filing fees, deadlines for submission, and any additional documentation that may be required. Familiarizing yourself with these state-specific regulations can help ensure that the lien is properly established and enforceable.

Quick guide on how to complete south dakota lien form

Effortlessly prepare South Dakota Lien Form on any device

Digital document management has gained popularity among businesses and individuals alike. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage South Dakota Lien Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to edit and eSign South Dakota Lien Form with ease

- Obtain South Dakota Lien Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or conceal sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information, then click on the Done button to save your changes.

- Choose how you prefer to send your form, whether by email, SMS, invite link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign South Dakota Lien Form to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a South Dakota lien form?

A South Dakota lien form is a legal document used to indicate that a creditor has a legal right to someone's property until a debt is paid. This form is crucial for protecting creditors' interests in South Dakota. It outlines the specifics of the debt and the property that serves as collateral.

-

How can airSlate SignNow help with South Dakota lien forms?

airSlate SignNow simplifies the process of creating and eSigning South Dakota lien forms. With its user-friendly interface, you can quickly fill out, send, and sign these forms electronically, streamlining your paperwork and ensuring compliance with South Dakota laws.

-

Are there any fees associated with using airSlate SignNow for South Dakota lien forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan based on the frequency of usage and features required for handling South Dakota lien forms. Each plan provides a cost-effective solution for your document management.

-

Is airSlate SignNow secure for signing South Dakota lien forms?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure servers, to protect your South Dakota lien forms. Your data and documents are safe, giving you peace of mind while you eSign and manage your legal documentation.

-

Can I integrate airSlate SignNow with other tools for managing South Dakota lien forms?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, enhancing your workflow for South Dakota lien forms. Integrate with platforms you already use to create a more efficient document management process.

-

What are the benefits of using airSlate SignNow for South Dakota lien forms?

Using airSlate SignNow for South Dakota lien forms provides numerous benefits, including time savings, reduced paperwork, and improved accuracy. The platform ensures that your documents are completed correctly and can be accessed anywhere, making your processes more efficient.

-

How do I get started with airSlate SignNow for South Dakota lien forms?

Getting started with airSlate SignNow is easy! Simply sign up on our website, choose the plan that suits your needs, and begin creating your South Dakota lien forms. Within minutes, you can start sending and signing documents effortlessly.

Get more for South Dakota Lien Form

Find out other South Dakota Lien Form

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed