Utah Letters Administration Form

What is the Utah Letters Administration

The Utah Letters Administration refers to legal documents that facilitate the management and distribution of a deceased person's estate. This process is essential for ensuring that the assets are handled according to the deceased's wishes and state laws. The letters serve as official authorization for an executor or administrator to act on behalf of the estate, allowing them to collect assets, pay debts, and distribute property to beneficiaries.

How to obtain the Utah Letters Administration

To obtain the Utah Letters Administration, an interested party must file a petition with the appropriate probate court. This process typically involves submitting the deceased's will, if available, along with necessary forms that outline the petitioner's relationship to the deceased. The court will review the application, and if approved, will issue the letters, granting the petitioner the authority to manage the estate.

Steps to complete the Utah Letters Administration

Completing the Utah Letters Administration involves several key steps:

- Gather necessary documents, including the death certificate and any existing wills.

- File a petition for probate with the local court, including required forms and fees.

- Attend the court hearing, where the judge will review the petition and any objections.

- If approved, receive the letters of administration, which empower the administrator to act on behalf of the estate.

- Notify beneficiaries and creditors about the probate proceedings.

Legal use of the Utah Letters Administration

The Utah Letters Administration are legally binding documents that authorize the appointed administrator to manage estate affairs. This includes collecting assets, paying debts, and distributing property according to the will or state laws if no will exists. It is crucial for the administrator to act in good faith and adhere to legal obligations to avoid potential disputes or legal repercussions.

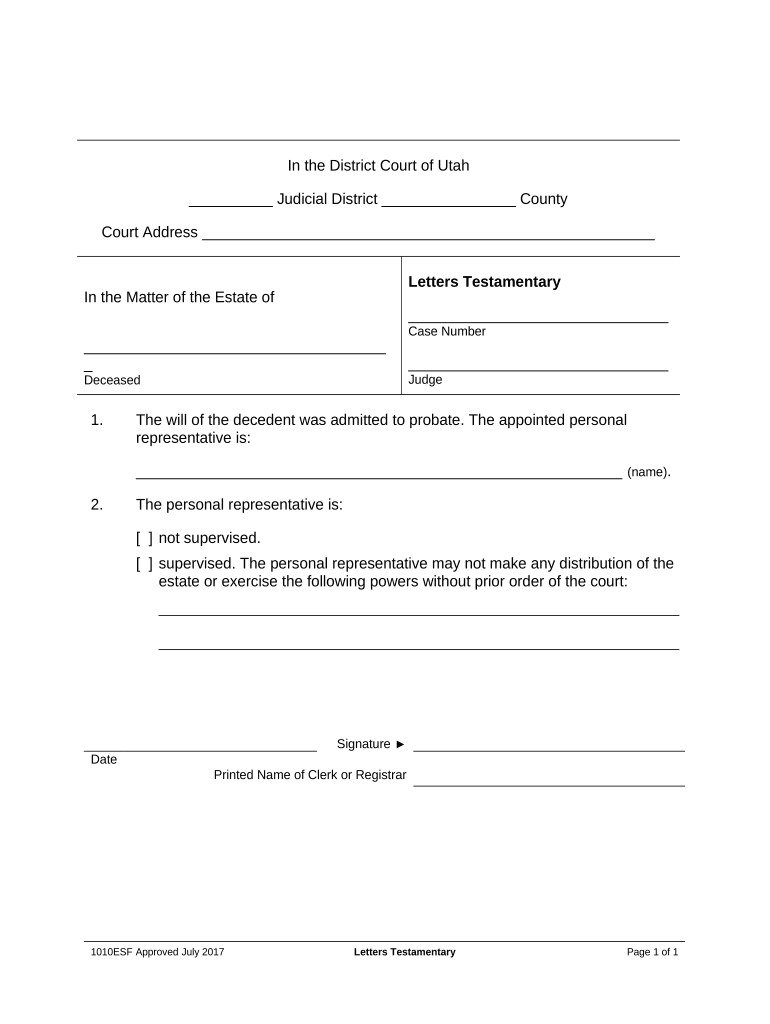

Key elements of the Utah Letters Administration

Key elements of the Utah Letters Administration include:

- The name of the deceased and the date of death.

- The name of the appointed administrator and their relationship to the deceased.

- Specific powers granted to the administrator, such as the authority to sell property or settle debts.

- The court's jurisdiction and case number for reference.

State-specific rules for the Utah Letters Administration

Utah has specific rules governing the Letters Administration process, including timelines for filing, requirements for notifying heirs, and guidelines for asset management. It is important for administrators to familiarize themselves with Utah probate laws to ensure compliance and avoid delays in the administration process. Legal counsel may be beneficial to navigate these regulations effectively.

Quick guide on how to complete utah letters administration

Complete Utah Letters Administration easily on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the right form and securely keep it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Utah Letters Administration on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to edit and eSign Utah Letters Administration effortlessly

- Locate Utah Letters Administration and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Amend and eSign Utah Letters Administration and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Utah letters administration?

Utah letters administration are legal documents issued by the court that grant authority to an executor or administrator to manage the estate of a deceased person. These letters are crucial for handling any estate's affairs, including settling debts and distributing assets in accordance with the deceased's wishes.

-

How does airSlate SignNow assist with Utah letters administration?

airSlate SignNow simplifies the process of managing Utah letters administration by providing an easy-to-use platform for document preparation and eSigning. With customizable templates, you can quickly create and send necessary documents for estate management, ensuring compliance with legal requirements.

-

What features does airSlate SignNow offer for managing Utah letters administration?

airSlate SignNow offers features such as customizable templates, secure eSigning, real-time collaboration, and powerful integrations with other applications. These features streamline the process of preparing and executing necessary documents related to Utah letters administration, making it efficient and effective.

-

Is airSlate SignNow affordable for small businesses dealing with Utah letters administration?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing Utah letters administration. With various pricing plans available, users can select the option that best fits their budget while still accessing essential features to handle estate management efficiently.

-

Can airSlate SignNow integrate with other software for Utah letters administration tasks?

Absolutely! airSlate SignNow integrates seamlessly with many popular software applications, enhancing your workflow for Utah letters administration. Whether it's CRM systems or document management tools, these integrations ensure a smoother process for managing documents and eSigning.

-

How secure is airSlate SignNow for handling Utah letters administration documents?

Security is a top priority for airSlate SignNow. The platform employs robust encryption and compliance with various regulations to protect the sensitive documents associated with Utah letters administration, offering peace of mind as you manage your estate-related paperwork.

-

What benefits do users gain from using airSlate SignNow for Utah letters administration?

Using airSlate SignNow for Utah letters administration provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration among stakeholders. The platform helps users save time and ensures that important documents are handled correctly and legally.

Get more for Utah Letters Administration

- Medical history somerhill dental practice somerhilldental co form

- Program title mgma annual conference healthcare innovation pavilion form

- Peff pdf form

- East coast dyes lacrosse gear dicks sporting goods form

- Prescription claim reimbursement form for claim re

- What is the mrn on discharge report form

- Pre op screening patient form pdf le bonheur children s hospital lebonheur

- Medicare part a redetermination and clerical error reopening request form

Find out other Utah Letters Administration

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free