South Dakota Release Lien Form

What is the South Dakota Release Lien

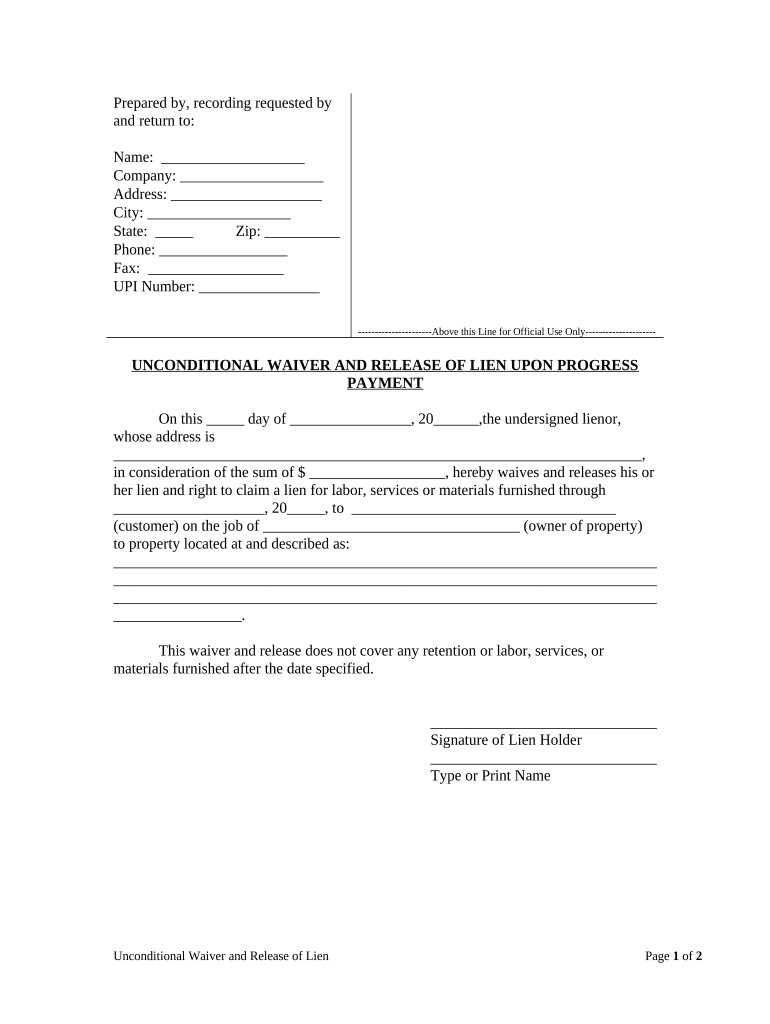

The South Dakota lien release form is a legal document that signifies the removal of a lien from a property or asset. A lien is a legal right or interest that a lender has in the borrower's property, granted until the debt obligation is satisfied. The release form serves as proof that the debt has been paid or settled, allowing the property owner to regain full ownership rights without encumbrances. This document is essential for ensuring clear title when selling or transferring property, as it confirms that no outstanding claims exist against the asset.

How to use the South Dakota Release Lien

Using the South Dakota lien release form involves several steps to ensure it is completed correctly. First, the property owner or debtor must obtain the form from a reliable source. Next, the individual must fill out the required details, including the names of the parties involved, the description of the property, and the specifics of the lien being released. After completing the form, it should be signed by the lienholder, confirming that the debt has been satisfied. Finally, the completed form must be filed with the appropriate county office to officially record the release.

Steps to complete the South Dakota Release Lien

Completing the South Dakota lien release form requires careful attention to detail. Here are the key steps:

- Obtain the South Dakota lien release form from an official source.

- Fill in the necessary information, including the names of the debtor and lienholder, the property description, and the lien details.

- Ensure the lienholder signs the form to validate the release.

- Submit the completed form to the appropriate county office for recording.

- Keep a copy of the filed document for your records.

Key elements of the South Dakota Release Lien

The South Dakota lien release form must include several critical elements to be considered valid. These elements typically include:

- The names and addresses of both the lienholder and the property owner.

- A detailed description of the property affected by the lien.

- The date the lien was originally placed and the date of release.

- The signature of the lienholder, confirming the debt has been satisfied.

Legal use of the South Dakota Release Lien

The legal use of the South Dakota lien release form is crucial for protecting the rights of property owners. Once the form is properly completed and filed, it legally removes the lien from the property records. This action is essential for ensuring that the property can be sold or refinanced without any claims from creditors. It is important for all parties involved to understand that improper use of the lien release form can lead to legal complications, including disputes over property ownership.

State-specific rules for the South Dakota Release Lien

Each state has its own regulations regarding lien releases. In South Dakota, specific rules govern how the lien release form must be completed and filed. It is important to adhere to these state-specific guidelines to ensure the document is legally binding. For example, the form must be signed by the lienholder, and the filing must occur within a certain timeframe after the debt is settled. Additionally, the form must be submitted to the correct county office to be officially recognized.

Quick guide on how to complete south dakota release lien

Manage South Dakota Release Lien effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle South Dakota Release Lien on any platform using airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

How to edit and electronically sign South Dakota Release Lien with ease

- Locate South Dakota Release Lien and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal authority as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign South Dakota Release Lien and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a South Dakota lien release form?

A South Dakota lien release form is a legal document used to officially release a lien on a property. This form is necessary when a debt secured by the lien has been paid in full. Utilizing airSlate SignNow streamlines the process of generating and eSigning this document, making it easy to handle your legal paperwork.

-

How can I create a South Dakota lien release form using airSlate SignNow?

Creating a South Dakota lien release form with airSlate SignNow is simple. You can either use a pre-made template or create a customized form from scratch. Our user-friendly interface guides you through the necessary fields and ensures that your document meets all legal requirements.

-

Is there a cost associated with using airSlate SignNow for a South Dakota lien release form?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution. Various pricing plans are available to cater to different needs, ensuring that you can efficiently manage your South Dakota lien release form without breaking the bank.

-

What features does airSlate SignNow offer for handling South Dakota lien release forms?

airSlate SignNow offers several features for managing South Dakota lien release forms, including eSigning, document templates, and real-time tracking. Users can also collaborate with others in a secure environment, ensuring your lien release process is both efficient and compliant.

-

How does eSigning a South Dakota lien release form work with airSlate SignNow?

With airSlate SignNow, eSigning a South Dakota lien release form is straightforward. After creating your document, simply send it to the parties involved. Recipients can sign electronically, and once completed, you’ll receive a copy of the signed form for your records.

-

Can I integrate airSlate SignNow with other tools for managing South Dakota lien release forms?

Absolutely! airSlate SignNow seamlessly integrates with various platforms, such as Google Drive and Dropbox, to ensure your South Dakota lien release forms are easily accessible. This integration helps maintain an organized workflow and saves time managing documents.

-

What are the benefits of using airSlate SignNow for South Dakota lien release forms?

Using airSlate SignNow for South Dakota lien release forms provides numerous benefits, including improved efficiency, cost savings, and enhanced security. The platform simplifies the document management process, allowing you to focus on your core business activities while ensuring compliance.

Get more for South Dakota Release Lien

- Constitutional blood test requisition form genetics medicine iu

- Fa002 form 2014

- Affidavit support consent form

- Sss pohrocom form

- Fill in the blanks test in swimming form

- Revised recommendations on the safe transport of dangerous form

- Family wish list form adopt a family

- Application for police verification certificate for job purpose form

Find out other South Dakota Release Lien

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple