Living Trust for Husband and Wife with No Children South Dakota Form

What is the Living Trust For Husband And Wife With No Children South Dakota

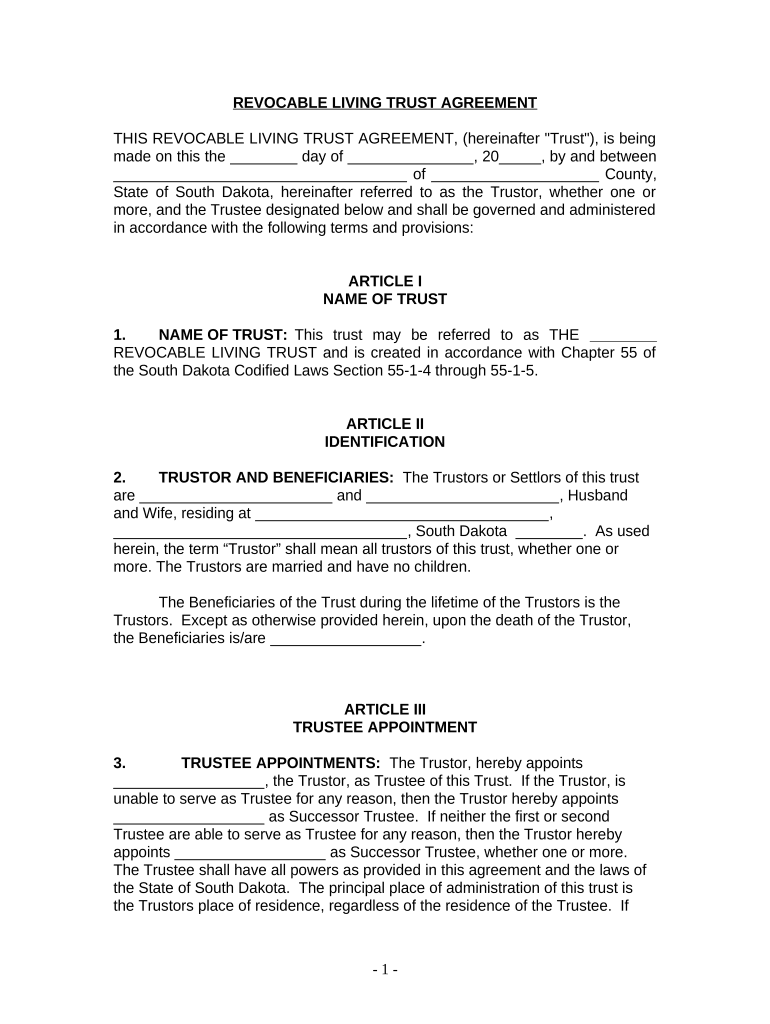

A living trust for husband and wife with no children in South Dakota is a legal arrangement that allows a couple to manage their assets during their lifetime and dictate how those assets will be distributed upon their passing. This type of trust is particularly beneficial for couples without children, as it provides a straightforward way to ensure that their estate is handled according to their wishes. The trust can help avoid probate, streamline the transfer of assets, and offer privacy regarding the couple's financial affairs.

Steps to Complete the Living Trust For Husband And Wife With No Children South Dakota

Completing a living trust involves several key steps:

- Identify assets: List all assets you wish to include in the trust, such as real estate, bank accounts, and investments.

- Choose a trustee: Decide who will manage the trust. This can be one or both spouses, or a trusted third party.

- Draft the trust document: Create a legal document that outlines the terms of the trust, including how assets will be managed and distributed.

- Sign the document: Both spouses must sign the trust document in the presence of a notary public to ensure its legality.

- Transfer assets: Change the titles of the assets to the name of the trust to ensure they are included in the trust.

Legal Use of the Living Trust For Husband And Wife With No Children South Dakota

This living trust is legally recognized in South Dakota, provided it meets specific state requirements. The trust must be properly executed, which includes being signed by both spouses and notarized. It is essential to ensure that the trust document complies with South Dakota laws to avoid any legal challenges in the future. Additionally, a living trust allows couples to maintain control over their assets while providing clear instructions for asset distribution.

State-Specific Rules for the Living Trust For Husband And Wife With No Children South Dakota

In South Dakota, specific rules govern the creation and management of living trusts. These include:

- The trust must be in writing and signed by the grantors.

- It must outline the management of assets and the distribution process.

- Trusts can be revocable, allowing the couple to modify or dissolve the trust during their lifetime.

- Assets transferred into the trust must be clearly identified and legally titled in the name of the trust.

Key Elements of the Living Trust For Husband And Wife With No Children South Dakota

Several key elements are crucial for establishing a living trust:

- Grantors: The individuals creating the trust, typically the husband and wife.

- Trustee: The person or entity responsible for managing the trust assets.

- Beneficiaries: Individuals or entities designated to receive the trust assets upon the grantors' passing.

- Trust terms: Specific instructions on how the assets should be managed and distributed.

How to Obtain the Living Trust For Husband And Wife With No Children South Dakota

To obtain a living trust, couples can either create one using online legal services or consult with an estate planning attorney. Online platforms often provide templates and guidance for drafting a trust document. However, consulting with an attorney can ensure that the trust is tailored to the couple's specific needs and complies with South Dakota laws. Once the trust document is prepared, it must be signed and notarized to become legally binding.

Quick guide on how to complete living trust for husband and wife with no children south dakota

Effortlessly Prepare Living Trust For Husband And Wife With No Children South Dakota on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Living Trust For Husband And Wife With No Children South Dakota on any device with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

Steps to Modify and eSign Living Trust For Husband And Wife With No Children South Dakota with Ease

- Find Living Trust For Husband And Wife With No Children South Dakota and select Get Form to initiate the process.

- Use the tools we provide to complete your form.

- Emphasize critical sections of your documents or obscure confidential details using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, through email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Living Trust For Husband And Wife With No Children South Dakota while ensuring superior communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With No Children in South Dakota?

A Living Trust For Husband And Wife With No Children in South Dakota is a legal document that allows spouses to manage and control their assets during their lifetime, and to determine how those assets will be distributed after their passing. This type of trust can simplify the estate settlement process and avoid probate.

-

Why should I create a Living Trust For Husband And Wife With No Children in South Dakota?

Creating a Living Trust For Husband And Wife With No Children in South Dakota can provide peace of mind, ensuring that your assets are handled according to your wishes. It also helps avoid the lengthy and public probate process, potentially saving your loved ones time and money.

-

How much does a Living Trust For Husband And Wife With No Children in South Dakota cost?

The cost of setting up a Living Trust For Husband And Wife With No Children in South Dakota varies, but typically ranges from a few hundred to a couple of thousand dollars, depending on the complexity of your estate. It's essential to weigh the long-term benefits against the initial costs for your financial planning.

-

What are the key features of a Living Trust For Husband And Wife With No Children in South Dakota?

Key features of a Living Trust For Husband And Wife With No Children in South Dakota include asset management during your lifetime, flexibility in changing the trust terms, and clear instructions for distribution upon death. This type of trust also protects your privacy as it does not go through probate.

-

Are there any tax benefits to creating a Living Trust For Husband And Wife With No Children in South Dakota?

While a Living Trust For Husband And Wife With No Children in South Dakota does not provide direct tax benefits, it can help streamline your estate's tax process. It allows for smoother asset transfer, which may help in estate tax planning.

-

Can I modify a Living Trust For Husband And Wife With No Children in South Dakota?

Yes, a Living Trust For Husband And Wife With No Children in South Dakota can be modified or revoked as long as both spouses are alive and competent. This flexibility allows you to adapt the trust to changing circumstances.

-

How does airSlate SignNow assist with the creation of a Living Trust For Husband And Wife With No Children in South Dakota?

airSlate SignNow provides an easy-to-use platform for preparing and eSigning your Living Trust For Husband And Wife With No Children in South Dakota documents. With our cost-effective solution, you can ensure that all necessary paperwork is completed accurately.

Get more for Living Trust For Husband And Wife With No Children South Dakota

- Rabobank australia limited account closuredischarge form

- Alcpt form 1 to 100

- 6347 lottery report rapport de loterie b2006b05 alcohol and bb agco on form

- Form 8 yakima valley community college yvcc

- Small group census harvard pilgrim form

- Competing pathways for target behavior form

- Dch 1315 healthy michigan assessment final plan copy 4 28 14docx form

- Reporting bprobationb travel brequest formb pdf sterling heights sterling heights

Find out other Living Trust For Husband And Wife With No Children South Dakota

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile