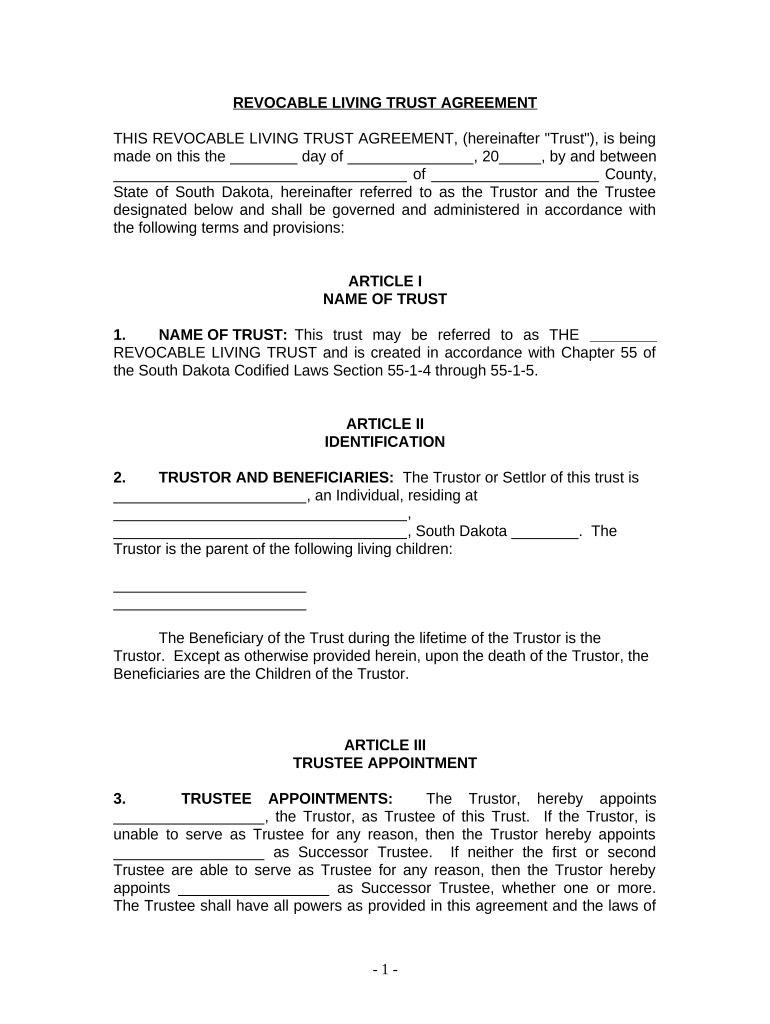

Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children South Dakota Form

What is the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children South Dakota

A living trust is a legal document that allows an individual, such as someone who is single, divorced, or a widow or widower with children, to manage their assets during their lifetime and specify how those assets should be distributed after their death. In South Dakota, this type of trust can help avoid probate, ensuring a smoother transition of assets to beneficiaries. The trust becomes effective immediately upon creation, allowing the grantor to maintain control over their assets while providing for their children.

Steps to Complete the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children South Dakota

Completing a living trust involves several key steps:

- Determine your assets: List all assets you wish to include in the trust, such as real estate, bank accounts, and personal property.

- Choose a trustee: Select an individual or institution to manage the trust. This person will be responsible for distributing assets according to your wishes.

- Draft the trust document: Create the trust document, specifying the terms, beneficiaries, and trustee responsibilities. It is advisable to consult with a legal professional to ensure compliance with South Dakota laws.

- Fund the trust: Transfer ownership of your assets into the trust. This may involve changing titles or account names to reflect the trust as the owner.

- Review and update: Regularly review the trust to ensure it meets your current needs and make updates as necessary, especially after major life events.

Key Elements of the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children South Dakota

Several key elements define a living trust in South Dakota:

- Grantor: The individual creating the trust, who retains control over the assets.

- Trustee: The person or entity responsible for managing the trust assets and ensuring the terms are followed.

- Beneficiaries: Individuals or entities designated to receive the assets after the grantor's death.

- Trust document: The written agreement that outlines the terms of the trust, including asset management and distribution instructions.

Legal Use of the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children South Dakota

The legal use of a living trust in South Dakota provides several benefits, including:

- Avoiding probate: Assets held in a living trust typically bypass the probate process, allowing for quicker distribution to beneficiaries.

- Privacy: Unlike wills, which become public records, living trusts remain private, protecting the details of asset distribution.

- Control: The grantor can specify terms for asset management and distribution, ensuring their wishes are followed.

- Flexibility: The grantor can amend or revoke the trust at any time during their lifetime, adapting to changing circumstances.

State-Specific Rules for the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children South Dakota

In South Dakota, specific rules govern the creation and management of living trusts:

- Age and capacity: The grantor must be at least eighteen years old and have the mental capacity to create a trust.

- Written document: The trust must be documented in writing and signed by the grantor to be legally binding.

- Witnesses and notarization: While not always required, having the trust document witnessed and notarized can strengthen its validity.

- Asset transfer: Properly transferring assets into the trust is essential to ensure they are protected under the trust's terms.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children south dakota

Effortlessly Prepare Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children South Dakota on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the tools required to swiftly create, modify, and electronically sign your documents without delays. Manage Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children South Dakota on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

Steps to Edit and eSign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children South Dakota with Ease

- Locate Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children South Dakota and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all details and click the Done button to save your modifications.

- Choose how you wish to share your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tiresome document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Alter and eSign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children South Dakota and ensure exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for Individual Who Is Single, Divorced Or Widow Or Widower With Children in South Dakota?

A Living Trust for Individual Who Is Single, Divorced Or Widow Or Widower With Children in South Dakota is a legal document that allows you to manage your assets during your lifetime and specify how they should be distributed after your death. This type of trust can provide peace of mind by ensuring your children's financial security according to your wishes.

-

How does a Living Trust benefit someone who is single, divorced, or widowed in South Dakota?

A Living Trust benefits someone who is single, divorced, or widowed in South Dakota by allowing them to maintain control over their assets and avoid probate. This can streamline the transfer of assets to your children and protect their inheritance from lengthy court processes.

-

What are the costs associated with creating a Living Trust in South Dakota?

The costs of creating a Living Trust for Individual Who Is Single, Divorced Or Widow Or Widower With Children in South Dakota can vary based on the complexity of your estate and the legal assistance you choose. Typically, you may incur attorney fees, filing fees, and costs related to asset transfer, but the long-term savings on probate fees can outweigh these initial costs.

-

Can I update or revoke my Living Trust created in South Dakota?

Yes, you can update or revoke your Living Trust for Individual Who Is Single, Divorced Or Widow Or Widower With Children in South Dakota at any time, provided it is revocable. This flexibility allows you to adjust your wishes as your circumstances change, such as remarriage or the birth of additional children.

-

How do I fund my Living Trust in South Dakota?

Funding your Living Trust for Individual Who Is Single, Divorced Or Widow Or Widower With Children in South Dakota involves transferring ownership of your assets into the trust. This includes bank accounts, real estate, and investment accounts, ensuring that these assets will be managed according to your trust's terms.

-

Will my Living Trust help avoid estate taxes in South Dakota?

A Living Trust itself does not directly reduce estate taxes for Individuals Who Are Single, Divorced Or Widowed With Children in South Dakota. However, effective asset management within the trust can help minimize taxable assets and ensure your children receive more of your estate's value.

-

What happens to my Living Trust if I move out of South Dakota?

If you move out of South Dakota, your Living Trust for Individual Who Is Single, Divorced Or Widow Or Widower With Children may still be valid, but it might require modifications to comply with the new state laws. It's advisable to consult with an estate planning attorney in your new location to address any legal adjustments.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children South Dakota

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children South Dakota

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding