Contract for Deed Seller's Annual Accounting Statement Tennessee Form

What is the Contract For Deed Seller's Annual Accounting Statement Tennessee

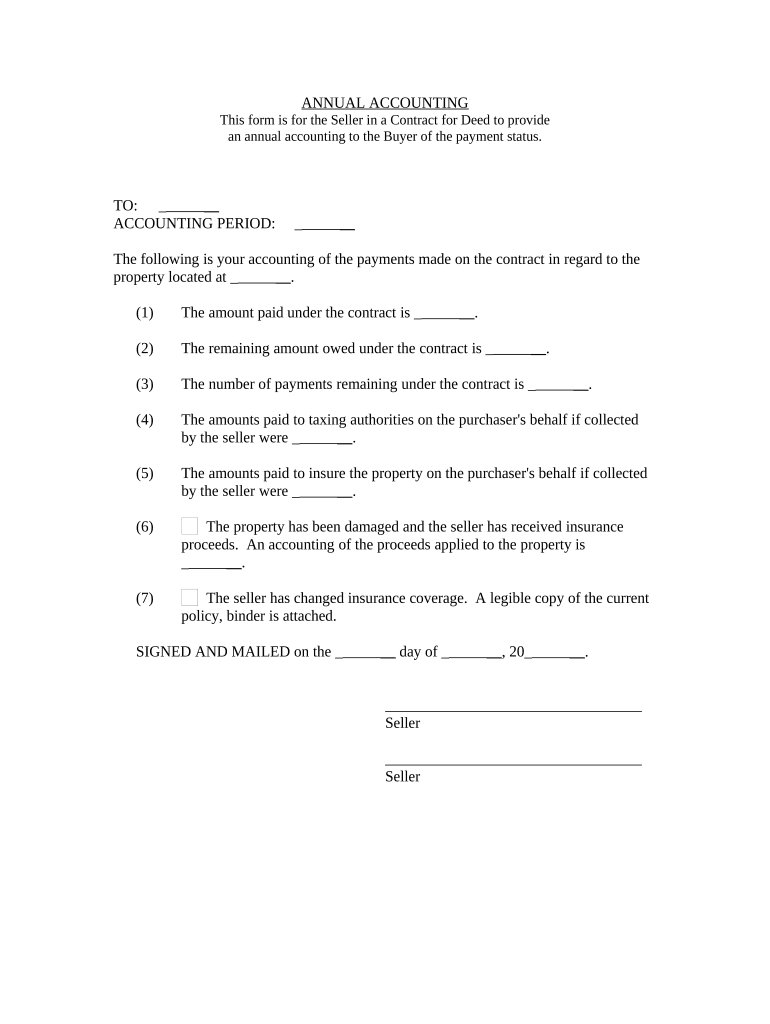

The Contract For Deed Seller's Annual Accounting Statement in Tennessee is a crucial document for sellers involved in a contract for deed arrangement. This statement provides a detailed account of the financial transactions between the seller and the buyer over the course of the year. It typically includes information such as the total payments received, any outstanding balances, and an itemized list of expenses related to the property. This transparency helps both parties maintain clarity regarding their financial obligations and rights under the contract.

How to use the Contract For Deed Seller's Annual Accounting Statement Tennessee

Using the Contract For Deed Seller's Annual Accounting Statement involves several steps. First, sellers need to gather all relevant financial records, including payment receipts and any expenses related to the property. Next, they should accurately fill out the statement, ensuring all figures are correct and clearly presented. Once completed, the statement should be provided to the buyer, offering them a comprehensive view of their financial standing. This document can also serve as a reference for tax purposes and potential legal matters.

Steps to complete the Contract For Deed Seller's Annual Accounting Statement Tennessee

Completing the Contract For Deed Seller's Annual Accounting Statement involves the following steps:

- Collect all payment records and financial documents related to the property.

- Detail the total amount received from the buyer throughout the year.

- List any expenses incurred, such as maintenance or property taxes.

- Calculate the outstanding balance, if applicable.

- Review the statement for accuracy and completeness.

- Provide a copy to the buyer and retain one for your records.

Legal use of the Contract For Deed Seller's Annual Accounting Statement Tennessee

The legal use of the Contract For Deed Seller's Annual Accounting Statement in Tennessee is essential for both parties involved in the transaction. This document serves as a formal record of the financial dealings and can be used in legal proceedings if disputes arise. It is important that the statement is completed accurately and in compliance with state laws to ensure its validity. Proper documentation can protect the seller's rights and provide the buyer with necessary information regarding their obligations.

Key elements of the Contract For Deed Seller's Annual Accounting Statement Tennessee

Several key elements should be included in the Contract For Deed Seller's Annual Accounting Statement to ensure its effectiveness:

- Payment History: A detailed account of all payments made by the buyer.

- Outstanding Balance: The remaining amount due under the contract.

- Expenses: Any costs incurred by the seller related to the property.

- Dates: Important dates for payments and any deadlines.

- Signatures: Signatures from both the seller and buyer to acknowledge the statement.

State-specific rules for the Contract For Deed Seller's Annual Accounting Statement Tennessee

Tennessee has specific regulations governing the use of the Contract For Deed Seller's Annual Accounting Statement. Sellers must adhere to these rules to ensure compliance. This includes providing accurate financial records, maintaining transparency with buyers, and ensuring that all documentation is properly signed and dated. Familiarity with state laws regarding contracts for deed is crucial for both sellers and buyers to avoid legal complications.

Quick guide on how to complete contract for deed sellers annual accounting statement tennessee

Complete Contract For Deed Seller's Annual Accounting Statement Tennessee effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can find the necessary form and securely store it in the cloud. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Handle Contract For Deed Seller's Annual Accounting Statement Tennessee on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven operation today.

The easiest way to edit and electronically sign Contract For Deed Seller's Annual Accounting Statement Tennessee without breaking a sweat

- Locate Contract For Deed Seller's Annual Accounting Statement Tennessee and then click Get Form to get started.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Craft your electronic signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to share your form, through email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Contract For Deed Seller's Annual Accounting Statement Tennessee to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Contract For Deed Seller's Annual Accounting Statement in Tennessee?

A Contract For Deed Seller's Annual Accounting Statement in Tennessee provides a clear financial record for sellers involved in a contract for deed arrangement. It outlines the payments received, outstanding balances, and any other relevant transaction details. This document is crucial for sellers to track financial progress and comply with state regulations.

-

How can airSlate SignNow help with the Contract For Deed Seller's Annual Accounting Statement in Tennessee?

airSlate SignNow offers an easy-to-use platform that enables sellers to create, send, and eSign the Contract For Deed Seller's Annual Accounting Statement in Tennessee efficiently. With our solution, you can automate the paperwork process and maintain accurate records effortlessly, reducing the administrative burden on sellers.

-

What are the costs associated with generating a Contract For Deed Seller's Annual Accounting Statement in Tennessee?

The pricing for using airSlate SignNow to create a Contract For Deed Seller's Annual Accounting Statement in Tennessee is competitive and tailored to different business needs. With various subscription plans available, you can choose an option that suits your requirements and budget. Sign up for a free trial to explore our features and pricing before committing.

-

What features does airSlate SignNow offer for creating accounting statements?

airSlate SignNow provides a range of features for creating a Contract For Deed Seller's Annual Accounting Statement in Tennessee, including customizable templates, automatic calculations, and secure eSigning options. These features streamline the documentation process, ensuring your statements are accurate and easy to generate.

-

Is it easy to integrate airSlate SignNow with other accounting software?

Yes, airSlate SignNow can be easily integrated with various accounting software options to better manage your Contract For Deed Seller's Annual Accounting Statement in Tennessee. This integration helps centralize your data, allowing for seamless workflow and accurate financial reporting.

-

What benefits can I expect from using airSlate SignNow for my accounting statements?

By using airSlate SignNow for your Contract For Deed Seller's Annual Accounting Statement in Tennessee, you can expect enhanced efficiency, reduced paperwork, and improved compliance. Our platform ensures that all documents are securely stored and easily retrievable, aiding in better organization and tracking.

-

Can I customize my Contract For Deed Seller's Annual Accounting Statement?

Absolutely! airSlate SignNow allows you to fully customize your Contract For Deed Seller's Annual Accounting Statement in Tennessee to meet specific needs. With our user-friendly interface, you can add fields, modify templates, and tailor the document to fit your business requirements perfectly.

Get more for Contract For Deed Seller's Annual Accounting Statement Tennessee

- Dl 90b 2015 2019 form

- Colposcopy report form

- Consent to disclose utility customer data xcel energy form

- Form ad 1048 2015 2019

- M ind bo dy hea rt wholesoldier counseling form tradoc news

- Recital dvd order form recital t shirt order form miss jenniferamp39s

- Notice of commencement bonita springs form

- The nef application form r250 000 r75 million

Find out other Contract For Deed Seller's Annual Accounting Statement Tennessee

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT