Individual Credit Application Tennessee Form

What is the Individual Credit Application Tennessee

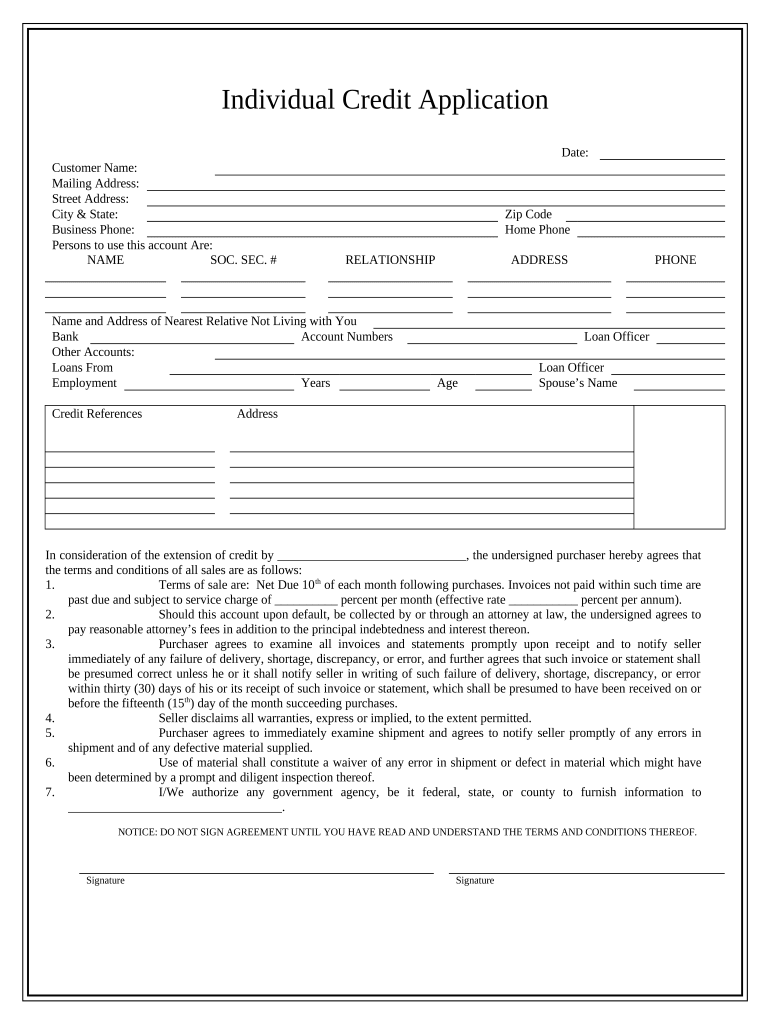

The Individual Credit Application Tennessee is a formal document used by individuals seeking credit from financial institutions. This application collects essential personal and financial information to assess the applicant's creditworthiness. It typically includes details such as the applicant's name, address, social security number, employment information, income, and existing debts. Understanding this form is crucial for anyone looking to secure loans, credit cards, or other financial products in Tennessee.

How to use the Individual Credit Application Tennessee

Using the Individual Credit Application Tennessee involves several straightforward steps. First, gather all necessary personal and financial information, ensuring accuracy to avoid delays in processing. Next, fill out the application form either digitally or in print, depending on the institution's requirements. After completing the form, review it for completeness and accuracy before submitting it to the lender. This application can often be submitted online, by mail, or in person, depending on the lender's preferences.

Steps to complete the Individual Credit Application Tennessee

Completing the Individual Credit Application Tennessee involves a systematic approach:

- Step 1: Gather personal information, including your full name, address, and social security number.

- Step 2: Compile financial details such as your income, employment history, and any existing debts.

- Step 3: Access the application form through your chosen lender's website or obtain a physical copy.

- Step 4: Fill out the application carefully, ensuring all information is accurate and complete.

- Step 5: Review the application for any errors or missing information before submission.

- Step 6: Submit the application according to the lender's specified method.

Legal use of the Individual Credit Application Tennessee

The Individual Credit Application Tennessee has legal significance, as it serves as a binding document between the applicant and the lender. By submitting this application, the applicant authorizes the lender to conduct a credit check and verify the provided information. It is essential to ensure that all information is truthful and complete, as inaccuracies can lead to denial of credit or legal repercussions. Compliance with federal and state regulations regarding privacy and data protection is also critical when handling this sensitive information.

Key elements of the Individual Credit Application Tennessee

Several key elements are essential when filling out the Individual Credit Application Tennessee:

- Personal Information: This includes your name, address, date of birth, and social security number.

- Employment Details: Information about your current employer, job title, and length of employment.

- Financial Information: Your income, expenses, and any existing loans or credit obligations.

- Consent for Credit Check: A statement allowing the lender to access your credit report.

Eligibility Criteria

To successfully complete the Individual Credit Application Tennessee, applicants must meet specific eligibility criteria. Generally, applicants should be at least eighteen years old and possess a valid social security number. Lenders may also require proof of income and employment, as well as a satisfactory credit history. Each financial institution may have additional requirements based on their lending policies, so it is advisable to check with the lender for specific eligibility guidelines.

Quick guide on how to complete individual credit application tennessee

Complete Individual Credit Application Tennessee seamlessly on any device

Online document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, adjust, and eSign your documents quickly without any hold-ups. Manage Individual Credit Application Tennessee on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Individual Credit Application Tennessee easily

- Find Individual Credit Application Tennessee and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Adjust and eSign Individual Credit Application Tennessee and ensure outstanding communication at any stage of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Individual Credit Application in Tennessee?

An Individual Credit Application in Tennessee is a formal request submitted by an individual seeking credit or financing from a lender. This application typically requires personal information, employment history, and financial details. Completing an Individual Credit Application in Tennessee accurately is crucial for obtaining the desired credit amount.

-

How do I complete an Individual Credit Application in Tennessee using airSlate SignNow?

To complete an Individual Credit Application in Tennessee using airSlate SignNow, simply create your document within our platform, fill in the required fields, and send it for eSignature. Our user-friendly interface guides you through the process efficiently. Once all parties sign, you'll receive a finalized PDF for your records.

-

What are the benefits of using airSlate SignNow for my Individual Credit Application in Tennessee?

Using airSlate SignNow for your Individual Credit Application in Tennessee streamlines the process, allowing you to sign documents electronically and quickly. This digital approach reduces paperwork, saves time, and minimizes errors. Additionally, our secure platform ensures your personal and financial data is protected.

-

Are there any costs associated with using airSlate SignNow for an Individual Credit Application in Tennessee?

airSlate SignNow offers various pricing plans, making it a cost-effective solution for managing your Individual Credit Application in Tennessee. Depending on the features you need, you can choose a plan that fits your budget. We also provide a free trial, allowing you to explore our services before committing.

-

Can I integrate airSlate SignNow with other software for my Individual Credit Application in Tennessee?

Yes, airSlate SignNow easily integrates with various popular software solutions, enhancing your workflow for the Individual Credit Application in Tennessee. Integration with CRM systems, cloud storage, and other tools allows for seamless document management and tracking. This versatility makes it easier to manage your credit applications across different platforms.

-

What features does airSlate SignNow offer for managing Individual Credit Applications in Tennessee?

airSlate SignNow provides features tailored for managing Individual Credit Applications in Tennessee, including eSignature capabilities, document templates, and collaboration tools. Our platform allows multiple users to collaborate on the same application, ensuring all necessary information is included and signed. Additionally, you can track the status of your application in real-time.

-

Is it safe to use airSlate SignNow for my Individual Credit Application in Tennessee?

Absolutely! airSlate SignNow prioritizes the security of your information and complies with industry regulations. Our platform uses advanced encryption and authentication methods to protect your Individual Credit Application in Tennessee from unauthorized access. You can trust that your sensitive data is secure with us.

Get more for Individual Credit Application Tennessee

Find out other Individual Credit Application Tennessee

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later