Ptax 342 R 2018-2026

What is the PTAX 342 R?

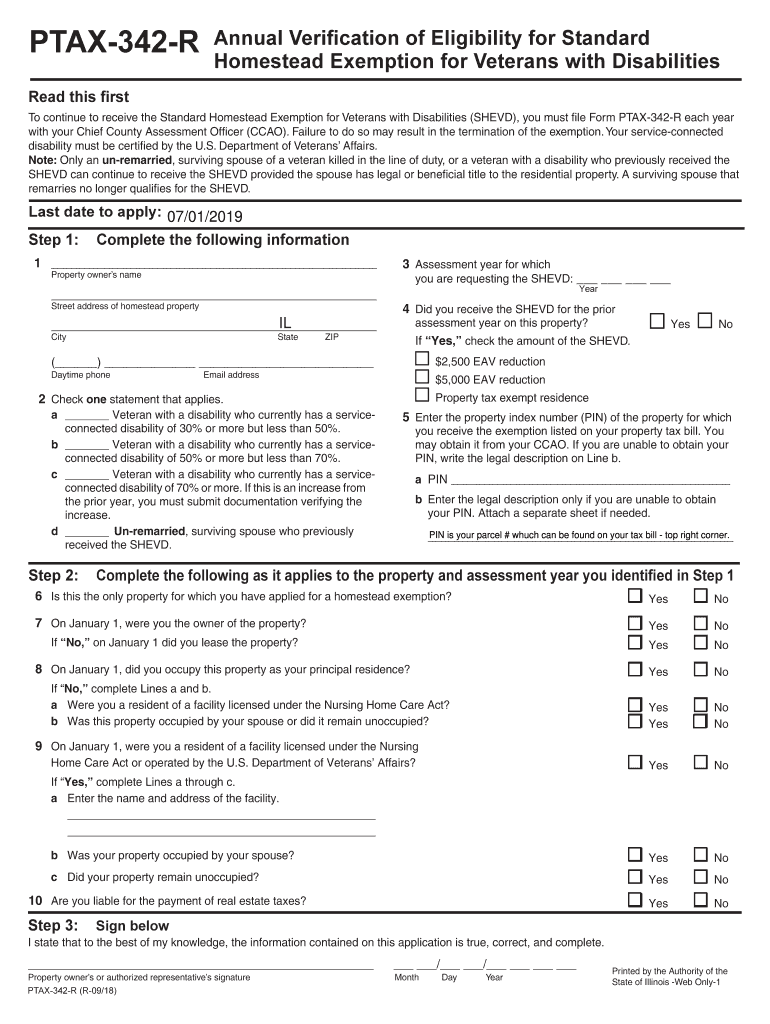

The PTAX 342 R is a form utilized in Illinois to facilitate the annual verification of eligibility for the disabled veterans standard homestead exemption. This exemption offers significant property tax relief to qualifying veterans and their surviving spouses. The form collects necessary information to confirm continued eligibility, ensuring that those who have served in the military receive the benefits they deserve. Understanding this form is crucial for veterans seeking to maintain their exemption status.

How to Obtain the PTAX 342 R

Veterans can obtain the PTAX 342 R form through various channels. The form is available online via the Illinois Department of Revenue's website, where it can be downloaded and printed. Additionally, local county assessor's offices may provide physical copies of the form. It is essential for veterans to ensure they have the most current version of the PTAX 342 R to avoid any issues with their exemption status.

Steps to Complete the PTAX 342 R

Completing the PTAX 342 R involves several key steps:

- Download or request the PTAX 342 R form.

- Fill in personal information, including name, address, and service details.

- Provide documentation that verifies eligibility, such as proof of military service.

- Sign and date the form to certify the accuracy of the information provided.

- Submit the completed form to the appropriate local assessor's office by the specified deadline.

Following these steps carefully helps ensure that the verification process goes smoothly and that veterans retain their exemptions.

Eligibility Criteria for the PTAX 342 R

To qualify for the disabled veterans standard homestead exemption, applicants must meet specific eligibility criteria. These include:

- Being a veteran with a service-related disability.

- Owning and occupying the property for which the exemption is claimed.

- Providing proof of disability through documentation from the Department of Veterans Affairs.

Meeting these criteria is essential for successful verification and continued exemption from property taxes.

Required Documents for the PTAX 342 R

When completing the PTAX 342 R, veterans must include certain documents to support their application. These typically include:

- Proof of military service, such as a DD-214 form.

- Documentation of the service-related disability from the Department of Veterans Affairs.

- Any previous correspondence regarding the exemption status.

Providing these documents helps streamline the verification process and confirms eligibility for the exemption.

Form Submission Methods for the PTAX 342 R

The PTAX 342 R can be submitted through various methods to ensure convenience for veterans. These methods include:

- Mailing the completed form to the local assessor's office.

- Submitting the form in person at the local assessor's office.

- Some counties may offer online submission options, allowing for a quicker process.

Choosing the appropriate submission method can help ensure timely processing of the verification.

Quick guide on how to complete ptax 342 r 2018 2019 form

Your assistance manual on how to prepare your Ptax 342 R

If you're interested in understanding how to complete and submit your Ptax 342 R, here are a few brief instructions to simplify the tax filing process.

To start, you merely need to create your airSlate SignNow account to revolutionize your online document management. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, draft, and finalize your income tax documents with ease. With its editor, you can alternate between text, checkboxes, and eSignatures and revert to amend responses when necessary. Optimize your tax handling with advanced PDF editing, eSigning, and straightforward sharing.

Follow the steps below to complete your Ptax 342 R in just a few minutes:

- Establish your account and start working on PDFs within moments.

- Utilize our directory to find any IRS tax form; navigate through various versions and schedules.

- Click Obtain form to open your Ptax 342 R in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and correct any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Make use of this guide to file your taxes electronically with airSlate SignNow. Please be aware that submitting in paper form can increase return errors and postpone refunds. It goes without saying, before electronically filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ptax 342 r 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

Which ITR form should an NRI fill out for AY 2018–2019 if there are two rental incomes in India other than that from interests?

Choosing Correct Income Tax form is the important aspect of filling Income tax return.Lets us discuss it one by one.ITR -1 —— Mainly used for salary income , other source income, one house property income ( upto Rs. 50 Lakhs ) for Individual Resident Assessees only.ITR-2 —- For Salary Income , Other source income ( exceeding Rs. 50 lakhs) house property income from more than one house and Capital Gains / Loss Income for Individual Resident or Non- Resident Assessees and HUF Assessees only.ITR 3— Income from Business or profession Together with any other income such as Salary Income, Other sources, Capital Gains , House property ( Business/ Profession income is must for filling this form) . For individual and HUF Assessees OnlySo in case NRI Assessees having rental income from two house property , then ITR need to be filed in Form ITR 2.For Detail understanding please refer to my video link.

Create this form in 5 minutes!

How to create an eSignature for the ptax 342 r 2018 2019 form

How to make an electronic signature for the Ptax 342 R 2018 2019 Form in the online mode

How to make an eSignature for the Ptax 342 R 2018 2019 Form in Chrome

How to make an electronic signature for putting it on the Ptax 342 R 2018 2019 Form in Gmail

How to create an eSignature for the Ptax 342 R 2018 2019 Form from your smart phone

How to make an electronic signature for the Ptax 342 R 2018 2019 Form on iOS

How to generate an electronic signature for the Ptax 342 R 2018 2019 Form on Android

People also ask

-

What is the process for annual verification veterans using airSlate SignNow?

The process for annual verification veterans with airSlate SignNow is straightforward. Users can upload required documents, set eSignature fields, and send them to the relevant parties for approval. All actions are tracked, ensuring compliance and easy access to verification records.

-

How does airSlate SignNow ensure the security of annual verification veterans documents?

airSlate SignNow employs state-of-the-art security protocols to safeguard annual verification veterans documents. With features like encryption, secure cloud storage, and two-factor authentication, users can trust that their sensitive information remains protected throughout the verification process.

-

Are there any fees associated with annual verification veterans tasks on airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to different business needs, including those focusing on annual verification veterans. Users can select a plan that fits their budget, and all features related to eSigning and document management are included without hidden fees.

-

What features does airSlate SignNow offer for handling annual verification veterans?

airSlate SignNow provides essential features for managing annual verification veterans, such as customizable templates, automated reminders, and eSignature capabilities. These tools simplify document workflow, increase efficiency, and ensure timely completion of verification tasks.

-

Can I integrate airSlate SignNow with other software for annual verification veterans?

Yes, airSlate SignNow offers seamless integrations with various platforms to streamline annual verification veterans tasks. Whether it’s CRM systems, cloud storage services, or accounting software, these integrations facilitate a smooth workflow and enhance productivity.

-

How does using airSlate SignNow benefit businesses managing annual verification veterans?

Using airSlate SignNow signNowly benefits businesses by reducing the time and resources spent on annual verification veterans processes. The platform automates document handling and increases accessibility, leading to improved efficiency and faster turnaround times.

-

Is there a mobile application for managing annual verification veterans with airSlate SignNow?

Yes, airSlate SignNow offers a mobile application that allows users to manage annual verification veterans on the go. With the app, you can securely sign documents, track their statuses, and receive notifications, making it convenient for busy professionals.

Get more for Ptax 342 R

- Home health care re authorization request form

- Pymrs form

- Addendum to offer to purchase and contract form

- Tpn referral form

- A document solution checklist meniko form

- Tauhara geothermal charitable trust project application form organisation details organisationroopu name contact person

- Iht411 listed stocks and shares schedule iht411 form

- Formulir penghentian layanan business channel bank ekonomi bankekonomi co

Find out other Ptax 342 R

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast