Lp157 2009-2026

What is the Lp157

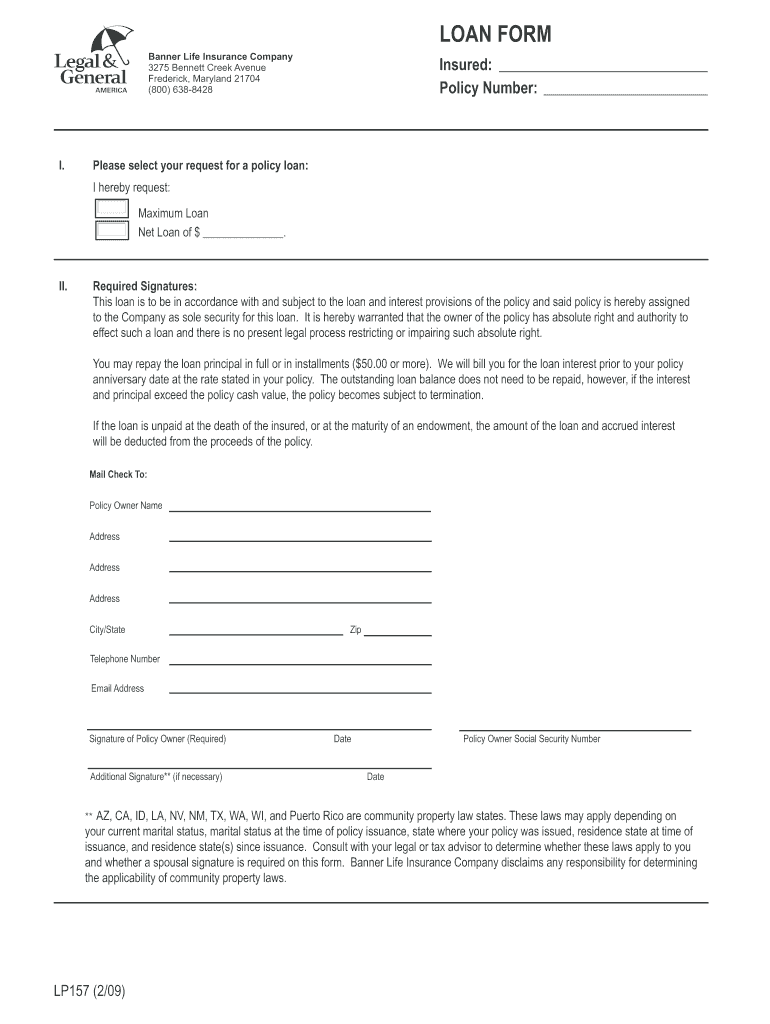

The Lp157 form is a specific document used by individuals seeking to apply for or manage loans through a banner loan company. This form is essential for documenting the necessary information related to the loan application process, including personal details, loan amounts, and repayment terms. Understanding the Lp157 is crucial for ensuring that all information is accurately reported and processed, facilitating a smoother transaction with the loan company.

How to use the Lp157

Using the Lp157 involves several steps that ensure the form is completed correctly. Start by gathering all required personal information, including your social security number, employment details, and financial history. Once you have this information, carefully fill out the form, ensuring that all fields are completed accurately. Review the form for any errors before submitting it to the banner loan company, as inaccuracies can delay the loan approval process.

Steps to complete the Lp157

Completing the Lp157 requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary personal and financial information.

- Fill out the form accurately, ensuring all fields are completed.

- Double-check for any errors or omissions.

- Submit the completed form to the banner loan company through the designated method.

By following these steps, you can ensure that your application is processed efficiently.

Legal use of the Lp157

The Lp157 must be used in accordance with applicable laws and regulations governing loan applications. It is important to ensure that all information provided is truthful and complete, as any discrepancies can lead to legal consequences. Additionally, the banner loan company may have specific guidelines that must be adhered to when submitting this form, so it is advisable to review these requirements carefully.

Required Documents

When completing the Lp157, certain documents may be required to support your application. These documents typically include:

- Proof of identity, such as a driver's license or passport.

- Income verification, such as pay stubs or tax returns.

- Bank statements to demonstrate financial stability.

Having these documents ready can streamline the application process and improve the chances of approval.

Form Submission Methods

The Lp157 can typically be submitted through various methods, depending on the banner loan company's policies. Common submission methods include:

- Online submission through the company's secure portal.

- Mailing the completed form to the designated address.

- In-person submission at a local branch or office.

Choosing the right method for submission can affect the speed and efficiency of your loan application process.

Quick guide on how to complete loan form banner life insurance company

The optimal method to locate and endorse Lp157

On the scale of a whole enterprise, ineffective workflows surrounding paper approval can consume considerable working time. Endorsing documents like Lp157 is a fundamental aspect of operations across any sector, which is why the effectiveness of each agreement's lifecycle signNowly impacts the overall performance of the organization. With airSlate SignNow, endorsing your Lp157 is as straightforward and rapid as it can be. You will find on this platform the latest version of virtually any form. Even better, you can sign it right away without needing to install external applications on your computer or printing anything as physical copies.

Steps to obtain and endorse your Lp157

- Browse our collection by category or utilize the search bar to locate the form you require.

- View the form preview by clicking Learn more to confirm it’s the correct one.

- Click Get form to begin editing immediately.

- Complete your form and incorporate any essential information using the toolbar.

- When finished, click the Sign tool to endorse your Lp157.

- Select the signature method that is most convenient for you: Draw, Generate initials, or upload a photo of your handwritten signature.

- Click Done to finalize editing and proceed to document-sharing options as necessary.

With airSlate SignNow, you possess everything required to handle your documents effectively. You can find, complete, modify, and even send your Lp157 in a single tab with no inconvenience. Enhance your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How can I apply for an education loan from SBI online?

Step 1: Go to GyanDhan’s website. Check your loan eligibility here.Step 2: Apply for loan with collateral at GyanDhanStep3: Fill the Complete Application form.Done ! You will get a mail from SBI that they have received your application along with a mail from GyanDhan which will contain the details of the branch manger and the documents required.GyanDhan is in partnership with SBI for education loan abroad. GyanDhan team has technically integrated their systems so that customer can fill the GyanDhan’s form and it automatically get applied to SBI. The idea is to make education loan process so simple via GyanDhan that students don’t have to worry finances when they think of higher education abroad.GyanDhan is a marketplace for an education loan abroad and are in partnership with banks like SBI, BOB, Axis and many more.PS: I work at GyanDhan

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

-

How can a life insurance policy be both paid up and outstanding? Also, must an insurance company provide documentation for a loan?

Most likely, at some point, there has been a loan taken out on the cash value of the policy. If this has been repaid then it should not show as outstanding. The insurance company can provide you with copies of the actual policy, any outstanding loans or if there were missing payments at some point. You absolutely want to contact them to make certain that everything is in order with the policy so that if the insured (person on which the policy was written) were to pass away the beneficiary could be paid more quickly. The insurance company can give you any and all details regarding the policy as long as you are the owner of the policy or the person on which the insurance was written.

-

In what cases do you have to fill out an insurance claim form?

Ah well let's see. An insurance claim form is used to make a claim against your insurance for financial, repair or replacement of something depending on your insurance. Not everything will qualify so you actually have to read the small print.

-

What are some reasons that a health insurance company would ask for a pre-authorization form to be filled out by a Dr. before filling a prescription?

One common reason would be that there is a cheaper, therapeutically equivalent drug that they would like you to try first before they approve a claim for the prescribed drug. Another reason is that they want to make sure the prescribed drug is medically necessary.Remember that nothing is stopping you from filling the prescribed drug. It just won't be covered by insurance until the pre-authorization process is complete.

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

Create this form in 5 minutes!

How to create an eSignature for the loan form banner life insurance company

How to generate an eSignature for your Loan Form Banner Life Insurance Company online

How to make an eSignature for the Loan Form Banner Life Insurance Company in Chrome

How to create an electronic signature for putting it on the Loan Form Banner Life Insurance Company in Gmail

How to create an electronic signature for the Loan Form Banner Life Insurance Company straight from your mobile device

How to create an eSignature for the Loan Form Banner Life Insurance Company on iOS

How to make an eSignature for the Loan Form Banner Life Insurance Company on Android devices

People also ask

-

What is a banner loan company?

A banner loan company specializes in providing various types of loans for consumers and businesses. These companies often offer competitive rates and flexible terms to help clients meet their financial needs. With a banner loan company, you can access funds for purchasing, consolidating debt, or investing in your business with ease.

-

What types of loans does a banner loan company offer?

Typically, a banner loan company offers personal loans, business loans, and auto loans. Each type of loan is designed to cater to different needs, whether you’re looking to finance a new car, expand your business, or cover unexpected expenses. Understanding the loan types available can help you choose the right option for your financial goals.

-

How does the application process work with a banner loan company?

The application process at a banner loan company is generally straightforward and user-friendly. Applicants typically need to fill out an online form, providing necessary personal and financial information. After submission, the company will review your application and provide a decision quickly, often within a few hours.

-

What are the benefits of choosing a banner loan company?

Choosing a banner loan company can offer numerous benefits, including competitive interest rates, flexible repayment plans, and quick access to funds. Additionally, many banner loan companies provide excellent customer service and personalized support to help you throughout the loan process. This can make a signNow difference in your overall borrowing experience.

-

Are there any fees associated with a banner loan company?

While many banner loan companies offer loans with no origination fees, it's essential to review the terms and conditions. Common fees may include late payment fees or prepayment penalties. Understanding these fees in advance can help you make an informed decision and choose a loan that fits your budget.

-

How does a banner loan company integrate with airSlate SignNow?

A banner loan company can integrate seamlessly with airSlate SignNow to streamline the document signing process. By utilizing eSignature solutions, businesses can ensure that loan agreements and other necessary documents are signed quickly and securely. This integration can signNowly enhance efficiency, reducing paperwork and expediting loan disbursal.

-

What security measures does a banner loan company implement?

A reputable banner loan company prioritizes client security by implementing robust data protection protocols. This includes encryption, secure servers, and compliance with financial regulations to protect sensitive information. It's vital to choose a company that demonstrates a commitment to safeguarding your financial and personal data.

Get more for Lp157

- Legal last will and testament form for divorced and remarried person with mine yours and ours children illinois

- Legal last will and testament form with all property to trust called a pour over will illinois

- Illinois revocation form 497306616

- Last will and testament for other persons illinois form

- Notice to beneficiaries of being named in will illinois form

- Estate planning questionnaire and worksheets illinois form

- Document locator and personal information package including burial information form illinois

- Illinois copy form

Find out other Lp157

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free