Non Foreign Affidavit under IRC 1445 Tennessee Form

What is the Non Foreign Affidavit Under IRC 1445 Tennessee

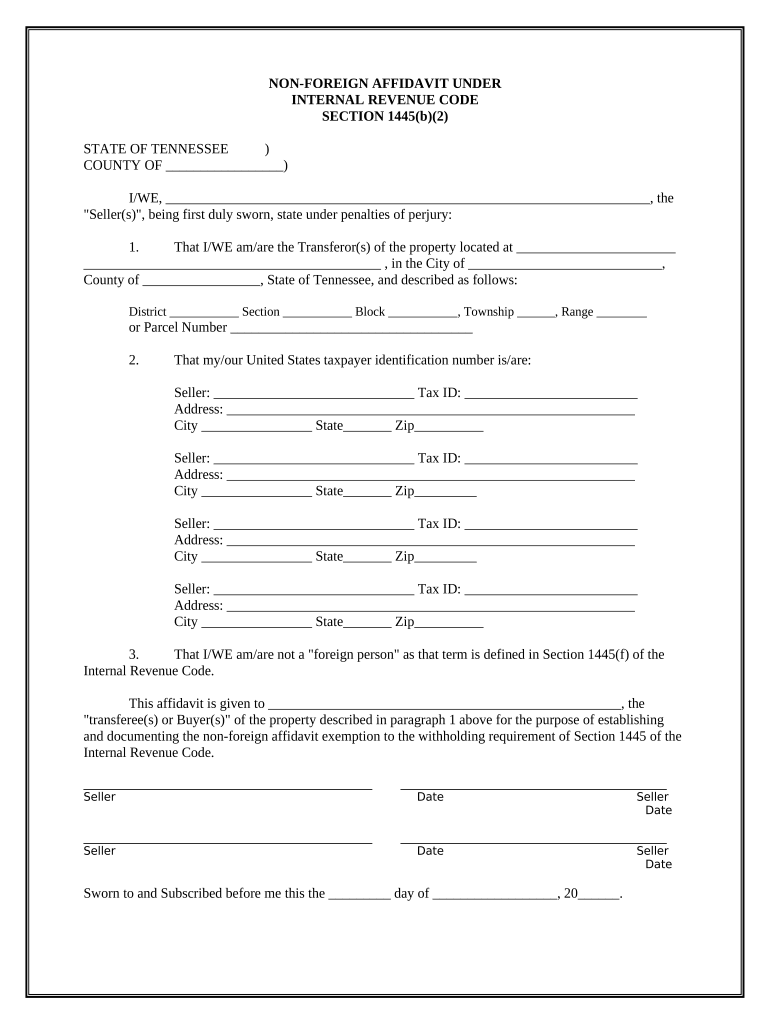

The Non Foreign Affidavit Under IRC 1445 in Tennessee is a legal document used primarily in real estate transactions. It certifies that the seller of a property is not a foreign person, which is essential for compliance with U.S. tax regulations. This affidavit helps ensure that the buyer does not face withholding tax obligations when purchasing property from a non-resident alien or foreign corporation. By providing this affidavit, the seller affirms their status, thereby facilitating a smoother transaction process.

How to use the Non Foreign Affidavit Under IRC 1445 Tennessee

To utilize the Non Foreign Affidavit Under IRC 1445 in Tennessee, the seller must complete the form accurately and provide necessary information, including their name, address, and taxpayer identification number. This document should be presented to the buyer at the time of the sale, ideally during the closing process. It is crucial for both parties to retain a copy of the signed affidavit for their records, as it serves as proof of compliance with IRS regulations.

Steps to complete the Non Foreign Affidavit Under IRC 1445 Tennessee

Completing the Non Foreign Affidavit Under IRC 1445 involves several steps:

- Obtain the affidavit form, which can typically be found through legal resources or real estate professionals.

- Fill in your personal details, including your full name, address, and taxpayer identification number.

- Indicate your status as a non-foreign person by checking the appropriate box or providing a statement.

- Sign and date the affidavit in the presence of a notary public, if required.

- Provide the completed affidavit to the buyer during the closing process.

Key elements of the Non Foreign Affidavit Under IRC 1445 Tennessee

Several key elements must be included in the Non Foreign Affidavit Under IRC 1445 to ensure its validity:

- Seller's Information: Full name, address, and taxpayer identification number.

- Certification Statement: A declaration confirming that the seller is not a foreign person as defined by the IRS.

- Signature: The seller's signature, which must be dated.

- Notary Acknowledgment: In some cases, a notary public may need to witness the signature.

Legal use of the Non Foreign Affidavit Under IRC 1445 Tennessee

The legal use of the Non Foreign Affidavit Under IRC 1445 in Tennessee is crucial for ensuring compliance with federal tax laws. This affidavit protects the buyer from potential withholding taxes that could arise if the seller were a foreign entity. By accurately completing and submitting this affidavit, sellers affirm their tax status, which is necessary for the IRS to process the transaction without imposing additional tax liabilities on the buyer.

Required Documents

When preparing to complete the Non Foreign Affidavit Under IRC 1445 in Tennessee, the following documents may be required:

- Proof of identity, such as a driver's license or passport.

- Taxpayer identification number, which can be a Social Security number or Employer Identification Number.

- Any previous tax documents that may support the seller's non-foreign status.

Quick guide on how to complete non foreign affidavit under irc 1445 tennessee

Effortlessly Prepare Non Foreign Affidavit Under IRC 1445 Tennessee on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and electronically sign your documents without delays. Manage Non Foreign Affidavit Under IRC 1445 Tennessee on any device using the airSlate SignNow apps for Android or iOS and improve any document-related process today.

The Easiest Way to Edit and eSign Non Foreign Affidavit Under IRC 1445 Tennessee Effortlessly

- Obtain Non Foreign Affidavit Under IRC 1445 Tennessee and click on Get Form to begin.

- Employ the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Non Foreign Affidavit Under IRC 1445 Tennessee and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 Tennessee?

A Non Foreign Affidavit Under IRC 1445 Tennessee is a legal document that certifies that a seller of real estate in Tennessee is not a foreign person. This affidavit ensures that the buyer does not incur additional withholding taxes during the sale. It is essential for compliance with tax regulations in real estate transactions.

-

Why do I need a Non Foreign Affidavit Under IRC 1445 Tennessee when selling property?

You need a Non Foreign Affidavit Under IRC 1445 Tennessee to avoid withholding taxes that might be imposed on foreign sellers. By providing this affidavit, you affirm your status as a non-foreign person, thus protecting the buyer from additional tax liabilities. This document helps streamline the closing process in real estate transactions.

-

How can airSlate SignNow help with the Non Foreign Affidavit Under IRC 1445 Tennessee?

airSlate SignNow simplifies the process of drafting and signing a Non Foreign Affidavit Under IRC 1445 Tennessee. With our user-friendly interface, you can easily create, send, and eSign the document online. This cost-effective solution not only saves time but also enhances the overall transaction experience.

-

What features does airSlate SignNow offer for processing the Non Foreign Affidavit Under IRC 1445 Tennessee?

airSlate SignNow offers a range of features for processing the Non Foreign Affidavit Under IRC 1445 Tennessee, including customizable templates, secure eSignature capabilities, and real-time tracking for document status. These features ensure a streamlined signing process while maintaining compliance with legal requirements. Our platform is designed for ease of use, making it accessible to all users.

-

Is there a cost associated with using airSlate SignNow for Non Foreign Affidavit Under IRC 1445 Tennessee?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Depending on the volume of documents and features you require for your Non Foreign Affidavit Under IRC 1445 Tennessee, you can choose a plan that provides maximum value. Our cost-effective solutions make it an ideal choice for businesses working in real estate.

-

Can I integrate airSlate SignNow with other tools for handling the Non Foreign Affidavit Under IRC 1445 Tennessee?

Absolutely! airSlate SignNow offers integrations with popular applications such as Google Drive, Dropbox, and various CRM systems. This makes it easier to manage your documents and streamline workflows related to the Non Foreign Affidavit Under IRC 1445 Tennessee. The integration capabilities enhance productivity and collaboration for your business.

-

What are the benefits of using airSlate SignNow for my Non Foreign Affidavit Under IRC 1445 Tennessee?

Using airSlate SignNow for your Non Foreign Affidavit Under IRC 1445 Tennessee offers several benefits, including ease of use, quick turnaround for document signing, and enhanced security features. The platform ensures compliance with legal standards while making the signing process straightforward. Additionally, you benefit from efficient document management, which is crucial for real estate transactions.

Get more for Non Foreign Affidavit Under IRC 1445 Tennessee

Find out other Non Foreign Affidavit Under IRC 1445 Tennessee

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now