Quitclaim Deed from Corporation to Two Individuals Texas Form

What is the Quitclaim Deed From Corporation To Two Individuals Texas

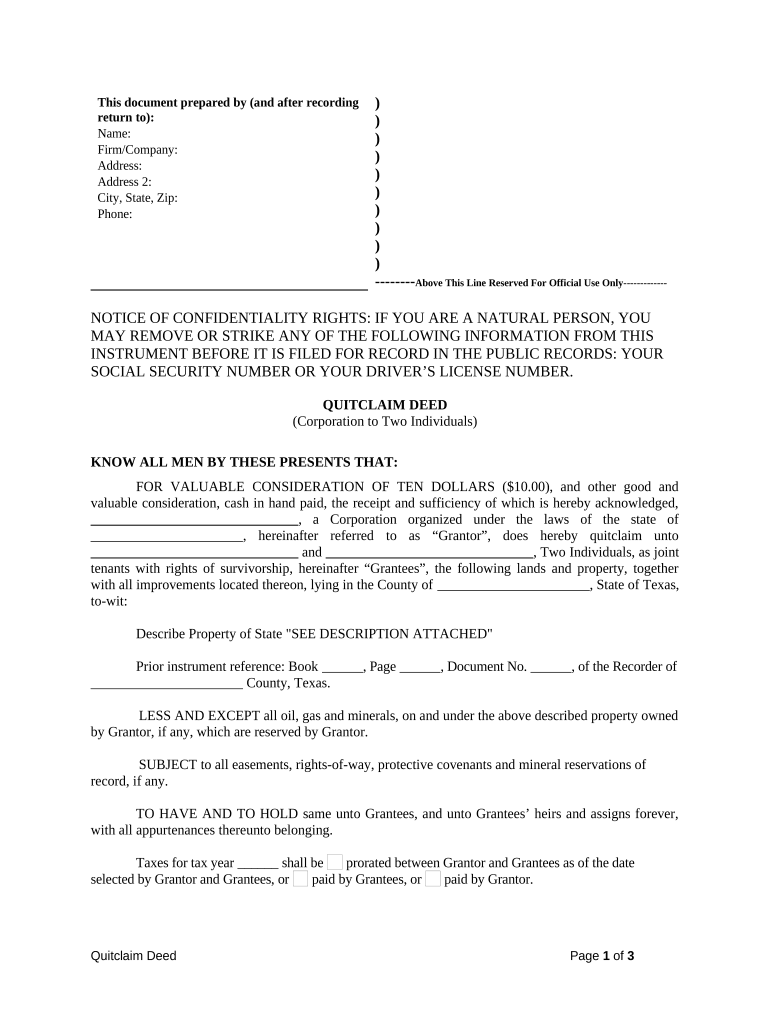

A quitclaim deed from a corporation to two individuals in Texas is a legal document that transfers ownership of property from a corporation to two specified individuals without any warranties. This type of deed is often used in situations where the transferring party does not wish to make any guarantees about the property title. The quitclaim deed effectively allows the corporation to relinquish any claim it has to the property, passing on whatever interest it may hold to the individuals named in the deed.

Key elements of the Quitclaim Deed From Corporation To Two Individuals Texas

Several key elements must be included in a quitclaim deed for it to be valid in Texas:

- Parties Involved: Clearly identify the corporation as the grantor and the two individuals as grantees.

- Property Description: Provide a detailed description of the property being transferred, including its legal description.

- Consideration: State the consideration (if any) for the transfer, which is often nominal in quitclaim transactions.

- Signatures: The deed must be signed by an authorized representative of the corporation.

- Notarization: The signatures should be notarized to ensure the document's authenticity.

Steps to complete the Quitclaim Deed From Corporation To Two Individuals Texas

Completing a quitclaim deed involves several steps:

- Gather necessary information about the property and the parties involved.

- Draft the quitclaim deed, ensuring all key elements are included.

- Have the authorized representative of the corporation sign the document in the presence of a notary.

- File the completed deed with the appropriate county clerk's office to officially record the transfer.

Legal use of the Quitclaim Deed From Corporation To Two Individuals Texas

The quitclaim deed is legally recognized in Texas as a valid means of transferring property ownership. However, it is essential for both parties to understand that a quitclaim deed does not guarantee that the property is free of liens or other encumbrances. Therefore, individuals receiving property through a quitclaim deed should conduct due diligence to ensure they are aware of any potential issues related to the title.

State-specific rules for the Quitclaim Deed From Corporation To Two Individuals Texas

Texas has specific requirements for quitclaim deeds, including:

- The deed must be in writing and signed by the grantor.

- It must include a legal description of the property.

- Notarization is required for the deed to be valid.

- The deed should be filed with the county clerk where the property is located to ensure public record.

How to obtain the Quitclaim Deed From Corporation To Two Individuals Texas

Obtaining a quitclaim deed in Texas can be done through various means:

- Consulting with a real estate attorney for assistance in drafting the document.

- Using online legal services that provide templates for quitclaim deeds.

- Visiting your local county clerk's office for guidance and resources related to property transfers.

Quick guide on how to complete quitclaim deed from corporation to two individuals texas

Finish Quitclaim Deed From Corporation To Two Individuals Texas effortlessly on any gadget

Digital document management has gained traction with businesses and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed papers, allowing you to locate the right form and securely keep it online. airSlate SignNow provides you with all the necessary features to design, modify, and eSign your documents swiftly without any hold-ups. Manage Quitclaim Deed From Corporation To Two Individuals Texas on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

How to alter and eSign Quitclaim Deed From Corporation To Two Individuals Texas with minimal effort

- Obtain Quitclaim Deed From Corporation To Two Individuals Texas and press Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or obscure sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a standard wet ink signature.

- Review the information thoroughly and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form browsing, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Quitclaim Deed From Corporation To Two Individuals Texas and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Corporation To Two Individuals in Texas?

A Quitclaim Deed From Corporation To Two Individuals in Texas is a legal document that allows a corporation to transfer its interest in a property directly to two individuals. This type of deed does not guarantee that the corporation holds clear title, but it effectively relinquishes any claims the corporation may have. It's a simple way to transfer property ownership without extensive legal procedures.

-

Why should I use a Quitclaim Deed From Corporation To Two Individuals in Texas instead of a warranty deed?

Using a Quitclaim Deed From Corporation To Two Individuals in Texas is often quicker and requires less paperwork compared to a warranty deed which offers guarantees about the property title. This type of deed is particularly useful for transfers between family members or close associates where trust is established. However, it’s essential to understand that it doesn’t provide the same level of protection regarding title disputes.

-

What is the process for executing a Quitclaim Deed From Corporation To Two Individuals in Texas?

To execute a Quitclaim Deed From Corporation To Two Individuals in Texas, the corporation must prepare the deed, clearly indicating the property and the parties involved. After the authorized corporate officer signs the deed, it should be signNowd to enhance its legal standing. Finally, the deed must be filed with the county clerk where the property is located.

-

Are there any fees associated with filing a Quitclaim Deed From Corporation To Two Individuals in Texas?

Yes, there are typically fees associated with filing a Quitclaim Deed From Corporation To Two Individuals in Texas. These fees can vary by county and may include recording fees and possibly transfer taxes. It’s advisable to check with the local county clerk's office for specific fee structures.

-

What are the benefits of transferring property using a Quitclaim Deed From Corporation To Two Individuals in Texas?

The benefits of transferring property using a Quitclaim Deed From Corporation To Two Individuals in Texas include a faster process, lower costs, and no need for an extensive title search. This makes it an effective solution for straightforward transactions where both parties trust each other. It’s also an ideal option for gifting property or resolving ownership matters swiftly.

-

Can I create a Quitclaim Deed From Corporation To Two Individuals in Texas online?

Yes, you can create a Quitclaim Deed From Corporation To Two Individuals in Texas online using specific document preparation services. Many platforms offer easy templates that guide you through filling out the required information. Ensure that the platform complies with Texas state laws to ensure the document’s legal validity.

-

What should I include when drafting a Quitclaim Deed From Corporation To Two Individuals in Texas?

When drafting a Quitclaim Deed From Corporation To Two Individuals in Texas, include the full legal names of the corporation and individuals, a detailed description of the property, and the terms of the transfer. Additionally, ensure the deed is signed by an authorized corporate officer and signNowd for legal compliance. It’s frequently recommended to consult with a legal expert during this process.

Get more for Quitclaim Deed From Corporation To Two Individuals Texas

- Bond of qualifying individual exemption request bond exemption form

- Driver statement of applicant cpuc ca form

- Xvifeid 2016 2019 form

- Sler 0950 survey requirements sler 0950 survey requirements form

- Kcc license application 2014 2019 form

- Electrical permit application livingston county building form

- Kcmo codes information bulletin no 110 part a 2013 2019

- Application for gaming funds north dakota 2017 2019 form

Find out other Quitclaim Deed From Corporation To Two Individuals Texas

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word