Texas Liens Form

What is the Texas Liens

The Texas liens refer to legal claims against a property or asset that secure the payment of a debt or obligation. These liens can arise from various situations, including unpaid taxes, loans, or contractor payments. Understanding the nature of these liens is crucial for property owners and businesses, as they can affect ownership rights and the ability to sell or refinance property. In Texas, specific laws govern how liens are created, enforced, and released, making it essential to be aware of the legal framework surrounding them.

How to Use the Texas Liens

Utilizing Texas liens involves understanding their purpose and implications. For instance, if a contractor has not been paid for work completed, they may file a lien against the property to secure payment. To use a lien effectively, the claimant must follow the legal procedures established by Texas law, which includes notifying the property owner and filing the lien with the appropriate county clerk. Proper use of liens can help protect financial interests and ensure that debts are honored.

Steps to Complete the Texas Liens

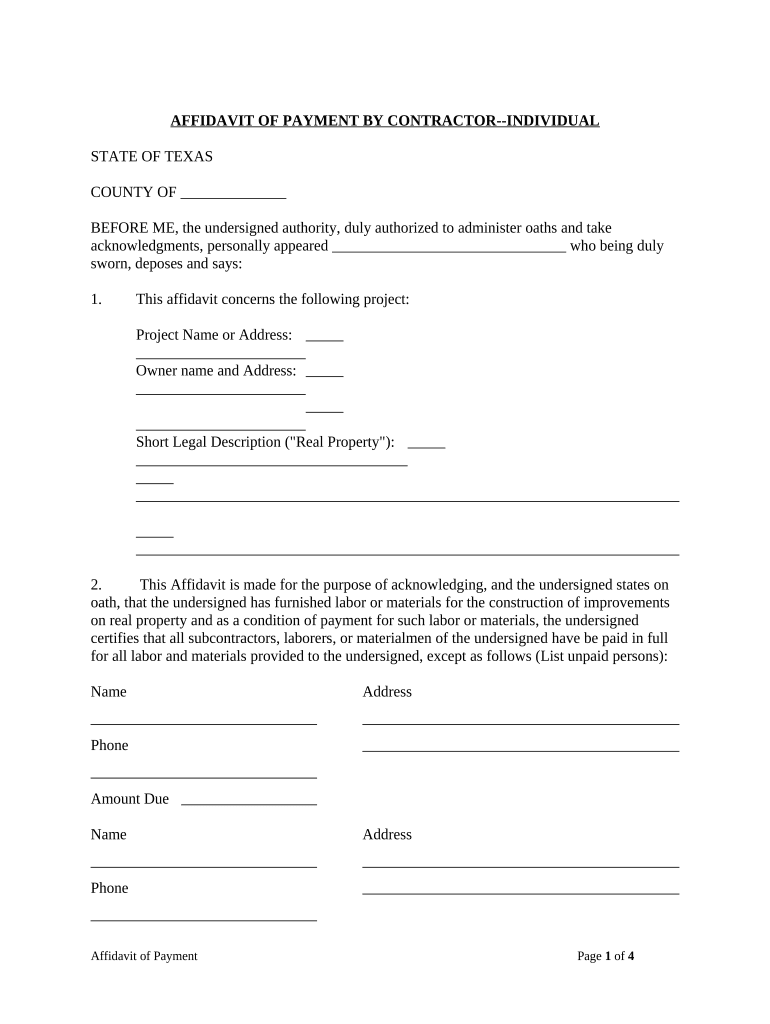

Completing the Texas liens process requires several key steps:

- Identify the type of lien needed, such as a mechanic's lien or tax lien.

- Gather necessary information, including property details and the amount owed.

- Prepare the lien document, ensuring it meets Texas legal requirements.

- File the lien with the county clerk's office where the property is located.

- Notify the property owner of the lien filing, as required by law.

Following these steps carefully can help ensure that the lien is valid and enforceable.

Legal Use of the Texas Liens

Legal use of Texas liens is governed by state law, which outlines the rights and responsibilities of both lienholders and property owners. A lien must be filed within a specific timeframe and must include accurate information to be enforceable. Additionally, lienholders must adhere to notification requirements to inform property owners of the lien. Understanding these legal parameters is essential for both parties to navigate potential disputes and uphold their rights.

Required Documents

Filing a Texas lien requires specific documentation to ensure compliance with state laws. Essential documents typically include:

- A completed lien form, detailing the nature of the claim.

- Proof of the debt, such as invoices or contracts.

- Property description, including the address and legal description.

- Any necessary notices sent to the property owner.

Having these documents prepared and organized can facilitate a smoother filing process and help avoid legal complications.

Penalties for Non-Compliance

Failure to comply with Texas lien laws can result in significant penalties. This may include the loss of the right to enforce the lien, financial penalties, or even legal action from the property owner. It is crucial for lienholders to understand their obligations, including filing deadlines and notification requirements, to avoid these consequences. Non-compliance not only jeopardizes the lienholder's claim but can also lead to costly disputes.

Quick guide on how to complete texas liens 497327287

Complete Texas Liens effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents quickly and without any hold-ups. Handle Texas Liens on any device using airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

The most effective method to modify and eSign Texas Liens with ease

- Locate Texas Liens and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced paperwork, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and eSign Texas Liens and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Texas liens and how do they affect property ownership?

Texas liens are legal claims placed on properties to secure the payment of debt, often associated with unpaid taxes or loans. When a lien is filed, it can affect the owner's ability to sell or refinance the property. Understanding Texas liens is crucial for property buyers and sellers to avoid potential legal issues.

-

How can airSlate SignNow help with managing Texas liens?

AirSlate SignNow offers a streamlined process for electronically signing and managing documents related to Texas liens. With our solution, you can quickly prepare, send, and store lien documents, ensuring that all paperwork is compliant and securely handled. This improves the efficiency of your transactions related to Texas liens.

-

What is the pricing model for using airSlate SignNow for Texas liens?

AirSlate SignNow offers various pricing plans that cater to businesses of all sizes wanting to manage Texas liens efficiently. Our pricing is competitive and designed to provide a cost-effective solution that scales with your needs. You can choose the plan that best fits your requirements and budget.

-

Can I integrate airSlate SignNow with other software to manage Texas liens?

Yes, airSlate SignNow seamlessly integrates with various software applications to enhance your workflow for managing Texas liens. Whether you are using CRM systems, document management tools, or other platforms, our integration capabilities ensure that you can handle Texas liens without disruptions. This allows for a more efficient data flow and record-keeping.

-

What features does airSlate SignNow offer for handling Texas liens?

Our platform provides features such as customizable templates, automated workflows, and real-time tracking for documents related to Texas liens. These functionalities simplify the process of creating, signing, and managing lien documents, ensuring compliance and speed. Additionally, our user-friendly interface makes it easy for all parties involved.

-

Is airSlate SignNow legally compliant for Texas lien documents?

Absolutely, airSlate SignNow is designed to be compliant with the legal requirements surrounding Texas lien documents. We ensure that all electronic signatures and document workflows meet state regulations, providing you with peace of mind as you manage your Texas liens. This helps you operate within legal parameters effectively.

-

What are the benefits of using airSlate SignNow for Texas liens?

Using airSlate SignNow for Texas liens offers numerous benefits, including reduced turnaround time, lower administrative costs, and enhanced document security. Our electronic signing solution eliminates delays associated with traditional paperwork, speeding up processes for lien agreements. Moreover, you gain the ability to track document status in real time.

Get more for Texas Liens

Find out other Texas Liens

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast