Payment Subcontractor Form

What is the Payment Subcontractor

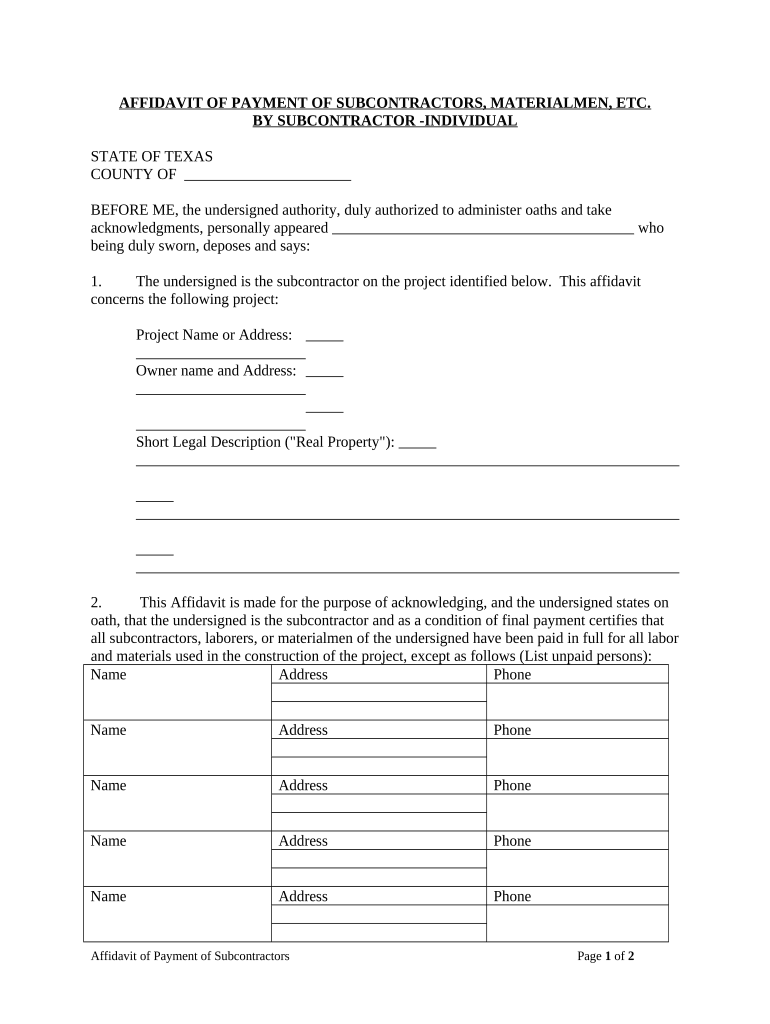

The payment subcontractor is a legal document used to outline the terms and conditions between a contractor and a subcontractor regarding payment for services rendered. This document is crucial in ensuring that all parties understand their financial obligations and rights. It typically includes details such as the scope of work, payment amounts, deadlines, and any penalties for late payments. Understanding this form is essential for maintaining clear communication and avoiding disputes in business transactions.

How to Use the Payment Subcontractor

Using the payment subcontractor involves several key steps. First, both parties should review the terms of the agreement to ensure clarity on the scope of work and payment details. Next, the contractor and subcontractor should fill out the form accurately, including all necessary information such as names, addresses, and specific payment terms. Once completed, both parties must sign the document to make it legally binding. This process ensures that both sides are in agreement and protects their interests.

Steps to Complete the Payment Subcontractor

Completing the payment subcontractor involves a systematic approach:

- Gather Information: Collect all necessary details about the project and the parties involved.

- Fill Out the Form: Accurately input the required information, including payment amounts and deadlines.

- Review Terms: Ensure that all terms are clear and agreed upon by both parties.

- Sign the Document: Both parties should sign the form to validate the agreement.

- Distribute Copies: Provide each party with a signed copy for their records.

Legal Use of the Payment Subcontractor

The legal use of the payment subcontractor is governed by various laws and regulations. In the United States, it is essential to ensure that the document complies with federal and state laws to be enforceable in court. This includes adhering to specific requirements regarding signatures, notarization, and witness provisions, depending on the jurisdiction. By following these legal guidelines, parties can protect their rights and ensure that the agreement holds up in legal proceedings.

Key Elements of the Payment Subcontractor

Several key elements must be included in the payment subcontractor to ensure its effectiveness:

- Parties Involved: Clearly identify the contractor and subcontractor.

- Scope of Work: Define the specific tasks to be completed by the subcontractor.

- Payment Terms: Outline the payment structure, including amounts and due dates.

- Dispute Resolution: Include provisions for resolving any disagreements that may arise.

- Termination Clause: Specify conditions under which the contract can be terminated.

State-Specific Rules for the Payment Subcontractor

Each state in the U.S. may have unique regulations regarding the use of payment subcontractors. It is important to be aware of these state-specific rules, as they can affect the enforceability of the contract. For example, some states may require additional documentation or specific language to be included in the subcontractor agreement. Consulting with a legal professional familiar with local laws can help ensure compliance and protect all parties involved.

Quick guide on how to complete payment subcontractor

Complete Payment Subcontractor effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly without delays. Manage Payment Subcontractor on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Payment Subcontractor effortlessly

- Find Payment Subcontractor and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important portions of your documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Decide how you want to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or disorganized files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and eSign Payment Subcontractor and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a payment subcontractor and how does it work with airSlate SignNow?

A payment subcontractor is a third-party entity that handles payment processing for services rendered. With airSlate SignNow, businesses can easily manage contracts and documents related to payment subcontractors, ensuring a seamless integration of payment workflows and electronic signatures.

-

How does airSlate SignNow support payment subcontractors?

airSlate SignNow provides a user-friendly platform that allows businesses to create, send, and sign agreements with payment subcontractors efficiently. The software also includes features for tracking document status, ensuring all necessary signatures are obtained in a timely manner.

-

What are the pricing options for airSlate SignNow for businesses utilizing payment subcontractors?

airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes. Whether your business frequently engages with payment subcontractors or just occasionally needs electronic signatures, there is a plan that will meet your budget and needs.

-

Can airSlate SignNow integrate with other tools for payment subcontractor management?

Yes, airSlate SignNow integrates seamlessly with various applications such as payment processing platforms and project management tools. This integration helps streamline workflows involving payment subcontractors and enhances overall operational efficiency.

-

What are the benefits of using airSlate SignNow for payment subcontractor agreements?

Using airSlate SignNow for payment subcontractor agreements simplifies and accelerates the signing process. With features like document tracking and secure storage, it ensures that all agreements are properly managed and easily accessible for future reference.

-

Is it secure to use airSlate SignNow for documents involving payment subcontractors?

Absolutely, airSlate SignNow prioritizes security with encryption and compliance with industry standards. This ensures that all documents related to payment subcontractors are protected from unauthorized access and remain confidential.

-

How can airSlate SignNow improve collaboration with payment subcontractors?

airSlate SignNow enhances collaboration with payment subcontractors through its intuitive interface that allows for real-time updates and comments. This functionality promotes clear communication and efficient resolution of any concerns regarding payment terms.

Get more for Payment Subcontractor

- Pd 1244 r2014 11 form

- General psychiatry assessment clinic referral form mount sinai

- Phone780 498 3999 in edmonton form

- Current openings amp opportunities justice institute of british columbia form

- Social insurance number application liste des formulaires

- Important notice this application form is not required if you apply in person at a service canada point

- General power of attorney form 2016 2019

- Customer support 18664759184 reference max approved form

Find out other Payment Subcontractor

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure