Texas Information Owner

What is the Texas Information Owner

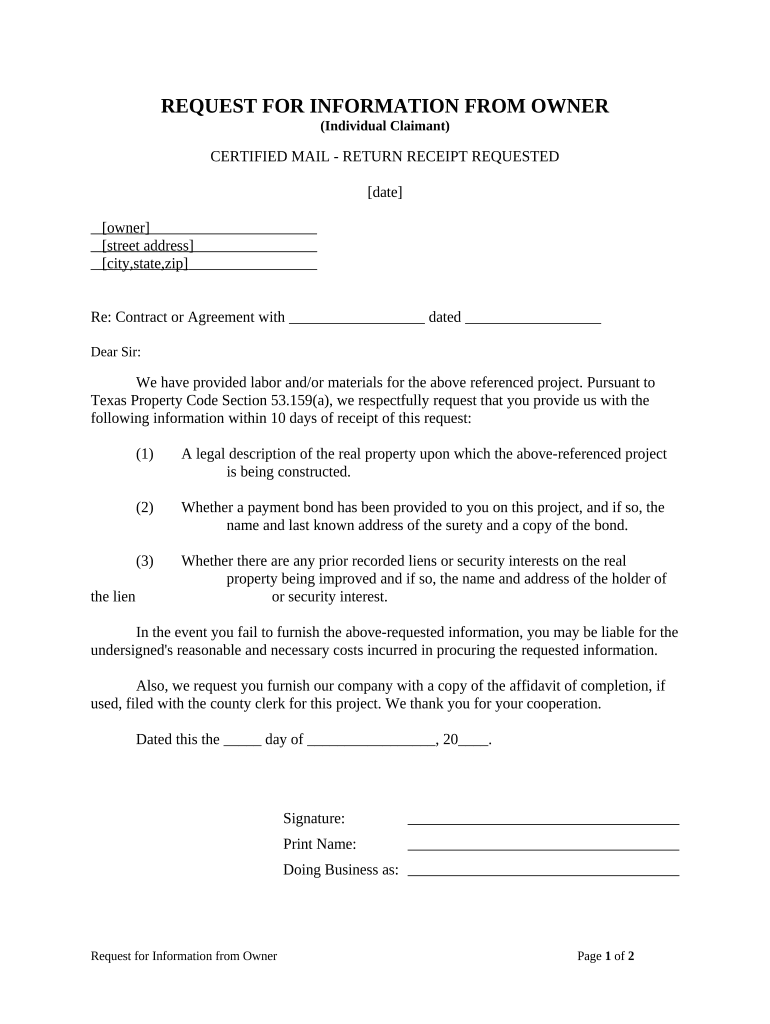

The Texas Information Owner is a legal document that identifies the individual or entity responsible for the information contained within a specific form or record. This designation is crucial for compliance with state regulations and ensures that the owner can be held accountable for the accuracy and integrity of the information provided. In many cases, this form is used in various business and legal contexts, including tax filings and regulatory submissions.

How to use the Texas Information Owner

Using the Texas Information Owner involves accurately filling out the form with the necessary details about the information owner. This includes providing their name, address, and any relevant identification numbers. It is essential to ensure that all information is correct and up to date, as inaccuracies can lead to compliance issues or legal complications. Once completed, the form may need to be submitted to a relevant authority or kept on file for record-keeping purposes.

Steps to complete the Texas Information Owner

Completing the Texas Information Owner requires a systematic approach to ensure all required information is accurately captured. Follow these steps:

- Gather necessary information about the owner, including full name, address, and identification numbers.

- Review the specific requirements for the form to ensure compliance with state regulations.

- Fill out the form carefully, checking for any errors or omissions.

- Sign and date the form as required.

- Submit the form to the appropriate authority or retain it for your records.

Legal use of the Texas Information Owner

The legal use of the Texas Information Owner is governed by state laws and regulations. It is essential for the information owner to understand their responsibilities, including the obligation to provide accurate information and maintain records. Failure to comply with these legal requirements can result in penalties or legal repercussions. Additionally, the use of electronic signatures is recognized under U.S. law, provided that the document meets specific criteria for validity.

Key elements of the Texas Information Owner

Several key elements are essential to the Texas Information Owner form. These include:

- Identification of the Owner: Clearly stating the name and address of the individual or entity responsible for the information.

- Nature of the Information: Describing the type of information being reported or submitted.

- Signature: The owner's signature is required to validate the document.

- Date: Including the date of completion is necessary for record-keeping and compliance.

Who Issues the Form

The Texas Information Owner form is typically issued by state regulatory agencies or specific governmental departments depending on the context in which it is used. It is important to check with the appropriate authority to ensure that you are using the correct version of the form and that it meets all necessary requirements for submission.

Quick guide on how to complete texas information owner

Finalize Texas Information Owner seamlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to generate, modify, and eSign your documents promptly without any hold-ups. Handle Texas Information Owner on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to alter and eSign Texas Information Owner effortlessly

- Find Texas Information Owner and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign feature, which only takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form hunting, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you wish. Modify and eSign Texas Information Owner and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the role of a Texas information owner?

A Texas information owner is responsible for the management and protection of sensitive data under Texas law. This role ensures compliance with state regulations regarding data handling and privacy, making it essential for businesses operating in Texas. By understanding these responsibilities, companies can better safeguard their documents within solutions like airSlate SignNow.

-

How does airSlate SignNow help Texas information owners manage documents?

airSlate SignNow provides an easy-to-use platform that allows Texas information owners to securely send and eSign documents. Its features are designed to streamline workflows, ensuring that all documents meet state compliance standards. By using this solution, owners can enhance operational efficiency while maintaining data integrity.

-

What pricing plans does airSlate SignNow offer for Texas information owners?

airSlate SignNow offers flexible pricing plans tailored to the needs of Texas information owners. Depending on your business size and document volume, you can choose from various subscription options that fit your budget. Each plan is designed to ensure you get the most value while securing your information effectively.

-

What features does airSlate SignNow provide for Texas information owners?

airSlate SignNow includes essential features like eSignature, audit trails, and customizable templates, which are crucial for Texas information owners. These features ensure that your documents are signed securely and recorded accurately, supporting compliance with Texas data regulations. This robust set of tools enhances both security and usability for your business.

-

What benefits do Texas information owners gain from using airSlate SignNow?

Texas information owners benefit from increased security, efficiency, and compliance by using airSlate SignNow. The platform simplifies the management of sensitive documents while ensuring that all legal requirements are met. This combination of benefits allows businesses to focus on their core activities without worrying about data mishandling.

-

Can airSlate SignNow integrate with other tools used by Texas information owners?

Yes, airSlate SignNow seamlessly integrates with a variety of business tools that Texas information owners may already be using. This includes popular applications for CRM, accounting, and project management, allowing for smooth workflows. Such integrations ensure that your document management processes are efficient and effective across platforms.

-

Is airSlate SignNow compliant with Texas data protection laws?

Absolutely! airSlate SignNow is designed to comply with Texas data protection laws, making it a reliable choice for Texas information owners. The platform incorporates robust security features and keeps audit trails that ensure compliance, giving peace of mind when handling sensitive documents.

Get more for Texas Information Owner

Find out other Texas Information Owner

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT