Quitclaim Deed from Husband and Wife to LLC Texas Form

What is the Quitclaim Deed From Husband And Wife To LLC Texas

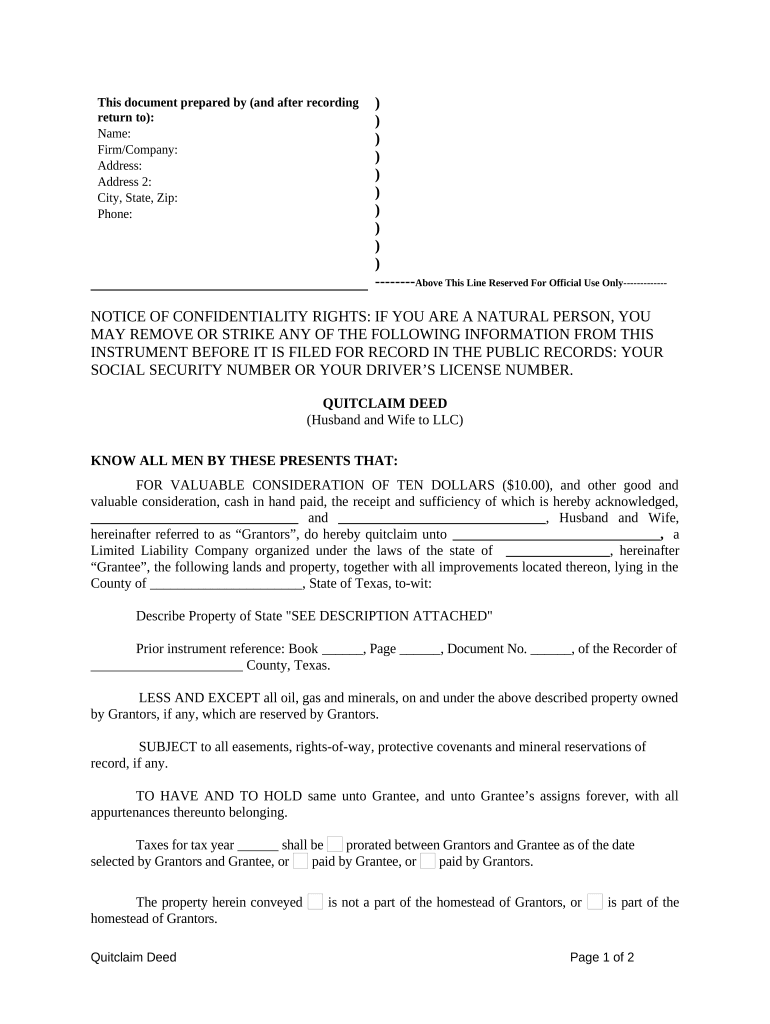

A quitclaim deed from husband and wife to an LLC in Texas is a legal document used to transfer ownership of property from a married couple to a limited liability company. This type of deed does not guarantee that the property is free of liens or encumbrances; it simply conveys whatever interest the couple has in the property. It is often used in real estate transactions where the couple wishes to transfer their property into an LLC for liability protection or tax benefits.

Steps to complete the Quitclaim Deed From Husband And Wife To LLC Texas

Completing a quitclaim deed involves several important steps to ensure that the transfer is legally binding. First, the couple must gather necessary information, including the legal description of the property and the names of the LLC. Next, they should fill out the quitclaim deed form accurately, including their names as grantors and the LLC's name as the grantee. After that, both spouses must sign the document in the presence of a notary public to validate the signatures. Finally, the completed deed must be filed with the appropriate county clerk's office to make the transfer official.

Key elements of the Quitclaim Deed From Husband And Wife To LLC Texas

Several key elements must be included in a quitclaim deed for it to be valid in Texas. These elements include the names of the grantors (the husband and wife), the name of the grantee (the LLC), a legal description of the property being transferred, and the signatures of both spouses. Additionally, the deed should include a notary acknowledgment to verify the identities of the signers. Ensuring all these elements are present is crucial for the deed to be enforceable.

Legal use of the Quitclaim Deed From Husband And Wife To LLC Texas

The legal use of a quitclaim deed from husband and wife to an LLC in Texas is primarily to facilitate the transfer of property ownership while limiting personal liability. By transferring property to an LLC, the owners can protect their personal assets from claims against the business. This type of deed is commonly used in real estate transactions, estate planning, and asset protection strategies. However, it is important to consult with a legal professional to ensure compliance with state laws and regulations.

State-specific rules for the Quitclaim Deed From Husband And Wife To LLC Texas

Texas has specific rules governing the use of quitclaim deeds. The deed must be in writing, and it must clearly identify the property being transferred. In Texas, a quitclaim deed does not require a warranty of title, which means the grantors are not guaranteeing that they have clear title to the property. Additionally, Texas law requires that the deed be signed by both spouses and notarized. Filing the deed with the county clerk's office is also necessary to complete the transfer legally.

How to use the Quitclaim Deed From Husband And Wife To LLC Texas

Using a quitclaim deed from husband and wife to an LLC involves several steps. First, the couple should determine the reasons for transferring the property to the LLC, such as asset protection or tax benefits. Next, they will need to complete the quitclaim deed form, ensuring all required information is included. Once the form is signed and notarized, it should be filed with the county clerk's office. This process formalizes the transfer and provides legal documentation of the ownership change.

Quick guide on how to complete quitclaim deed from husband and wife to llc texas

Effortlessly Prepare Quitclaim Deed From Husband And Wife To LLC Texas on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without hassle. Manage Quitclaim Deed From Husband And Wife To LLC Texas on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to Edit and Electronically Sign Quitclaim Deed From Husband And Wife To LLC Texas with Ease

- Find Quitclaim Deed From Husband And Wife To LLC Texas and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Mark important sections of the documents or conceal sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow caters to all your document management requirements with just a few clicks from any device of your choice. Modify and electronically sign Quitclaim Deed From Husband And Wife To LLC Texas to ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Husband And Wife To LLC Texas?

A Quitclaim Deed From Husband And Wife To LLC Texas is a legal document that allows a married couple to transfer their ownership interest in property to a limited liability company (LLC). This type of deed ensures that the couple relinquishes any claim on the property, simplifying the process for the LLC to hold the property. It's crucial to ensure that the deed is correctly executed to avoid future disputes.

-

How do I create a Quitclaim Deed From Husband And Wife To LLC Texas using airSlate SignNow?

With airSlate SignNow, creating a Quitclaim Deed From Husband And Wife To LLC Texas is straightforward. You can use our easy-to-navigate platform to input the necessary details and generate the deed quickly. Additionally, our electronic signature feature makes the signing process seamless and legally binding.

-

Is there a cost associated with obtaining a Quitclaim Deed From Husband And Wife To LLC Texas?

Yes, there may be costs associated with obtaining a Quitclaim Deed From Husband And Wife To LLC Texas. This can include fees for legal consultations, filing fees, and any service fees if you use online platforms like airSlate SignNow. However, airSlate SignNow offers competitive pricing to minimize your overall expenses.

-

What are the benefits of using a Quitclaim Deed From Husband And Wife To LLC Texas?

Using a Quitclaim Deed From Husband And Wife To LLC Texas has multiple benefits, including asset protection and liability limitation for the couple. By transferring property to an LLC, you shield your personal assets from potential legal claims related to the property. Additionally, it streamlines ownership and management of property among members.

-

Can I customize my Quitclaim Deed From Husband And Wife To LLC Texas with airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize their Quitclaim Deed From Husband And Wife To LLC Texas to fit their specific needs. You can add personalized clauses, ensure accuracy in property descriptions, and adjust the format to meet legal requirements before signing.

-

Do I need to have a lawyer draft my Quitclaim Deed From Husband And Wife To LLC Texas?

While it’s possible to draft a Quitclaim Deed From Husband And Wife To LLC Texas without a lawyer, consulting with a legal professional is recommended. A lawyer can ensure that the deed adheres to Texas laws and meets all requirements, providing peace of mind as you complete the transaction.

-

What integrations does airSlate SignNow offer for managing Quitclaim Deeds?

airSlate SignNow integrates seamlessly with various business apps, enhancing the management of Quitclaim Deeds From Husband And Wife To LLC Texas. You can connect it with cloud storage solutions, CRM software, and more to streamline document handling and storage. These integrations help maintain organization and accessibility.

Get more for Quitclaim Deed From Husband And Wife To LLC Texas

- Imm 5475 f form

- Imm 5768 e financial evaluation for parents and canadaca 102074498 form

- A tourist or visiting family or friends form

- For help completing this form please refer to the residence guide inz 1002

- Imm 1444 e form

- Images for what is itread instructions adult general passport application protected when completed for canadians 16 years of form

- Privacy notice for the border immigration and citizenship system at form

- Inz 1015 work visa application form

Find out other Quitclaim Deed From Husband And Wife To LLC Texas

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney