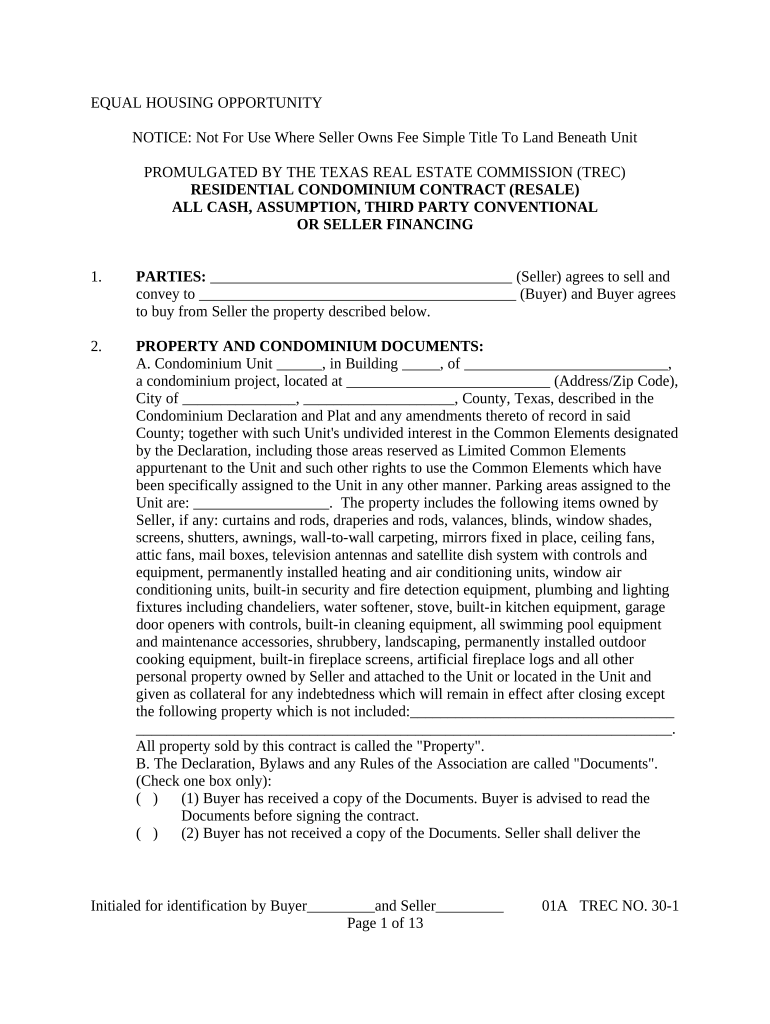

Texas Seller Financing Form

What is the Texas Seller Financing

The Texas seller financing option allows property sellers to finance the purchase of their property directly to buyers. This arrangement can be beneficial for both parties, as it provides an alternative to traditional bank financing. In this scenario, the seller acts as the lender, allowing buyers to make payments directly to them instead of a financial institution. This method can simplify the buying process, especially for those who may have difficulty securing a mortgage through conventional means.

Key elements of the Texas Seller Financing

Understanding the key elements of Texas seller financing is crucial for both buyers and sellers. These elements typically include:

- Purchase Price: The agreed-upon amount for the property.

- Down Payment: The initial payment made by the buyer, which can vary based on the agreement.

- Interest Rate: The rate at which interest will accrue on the unpaid balance, which should be clearly stated in the financing agreement.

- Loan Term: The duration over which the buyer will repay the loan, often ranging from a few years to several decades.

- Monthly Payments: The schedule and amount of payments the buyer will make to the seller.

- Default Terms: Conditions under which the seller can take action if the buyer fails to meet payment obligations.

Steps to complete the Texas Seller Financing

Completing a Texas seller financing agreement involves several important steps to ensure legal compliance and clarity for both parties:

- Negotiate Terms: Both parties should discuss and agree on the terms of the financing arrangement, including purchase price, interest rate, and payment schedule.

- Draft the Agreement: Create a written agreement that outlines all terms, conditions, and responsibilities of both the buyer and seller.

- Review Legal Requirements: Ensure the agreement complies with Texas state laws governing seller financing, including any necessary disclosures.

- Sign the Agreement: Both parties must sign the document to make it legally binding. This can be done electronically for convenience and security.

- Record the Agreement: Consider recording the seller financing agreement with the local county clerk’s office to protect the seller’s interest in the property.

Legal use of the Texas Seller Financing

Seller financing in Texas is governed by specific legal requirements that must be adhered to for the agreement to be enforceable. It is essential for both buyers and sellers to understand their rights and obligations under the law. Key legal considerations include:

- Disclosure Requirements: Sellers must provide buyers with specific disclosures regarding the terms of the financing arrangement.

- Compliance with State Laws: The agreement must comply with Texas Property Code regulations, including limits on interest rates and fees.

- Foreclosure Procedures: Sellers should be familiar with the legal process for foreclosure in Texas in case of buyer default.

How to use the Texas Seller Financing

Utilizing Texas seller financing effectively requires understanding how to structure the agreement and manage the relationship between buyer and seller. Here are some practical steps:

- Assess Buyer Qualifications: Sellers should evaluate the buyer’s financial situation to ensure they can meet payment obligations.

- Set Clear Terms: Clearly outline all terms of the financing agreement, including payment amounts, due dates, and consequences of default.

- Maintain Open Communication: Foster a positive relationship by keeping lines of communication open regarding payments and any potential issues.

- Document Everything: Keep accurate records of payments received and any correspondence related to the financing agreement.

Examples of using the Texas Seller Financing

Seller financing can be applied in various scenarios. Here are a few examples:

- First-Time Homebuyers: A seller may offer financing to help first-time buyers who may struggle to qualify for a traditional mortgage.

- Investment Properties: Investors may use seller financing to acquire properties without relying on banks, allowing for quicker transactions.

- Buyers with Poor Credit: Individuals with less-than-perfect credit histories can benefit from seller financing as it may be more accessible than conventional loans.

Quick guide on how to complete texas seller financing

Complete Texas Seller Financing effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without complications. Handle Texas Seller Financing on any platform with airSlate SignNow's Android or iOS applications and streamline any document-focused process today.

The easiest way to modify and eSign Texas Seller Financing with ease

- Obtain Texas Seller Financing and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Decide how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign Texas Seller Financing while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Texas seller financing?

Texas seller financing is an arrangement where the seller of a property finances the purchase directly for the buyer. This method is often used when buyers may not qualify for traditional financing options. It allows for more flexibility in terms of payment plans and can be beneficial for both parties.

-

How can airSlate SignNow facilitate Texas seller financing transactions?

airSlate SignNow streamlines the documents involved in Texas seller financing by allowing sellers and buyers to create, send, and eSign necessary contracts electronically. This digital process saves time and increases efficiency, making it easier for both parties to finalize the transaction securely.

-

What features does airSlate SignNow offer for Texas seller financing?

With airSlate SignNow, users can access customizable templates, cloud storage, and real-time tracking of document status. These features enhance the Texas seller financing experience, ensuring all parties can keep track of agreements and modifications easily.

-

Is airSlate SignNow cost-effective for Texas seller financing?

Yes, airSlate SignNow offers a cost-effective solution for managing Texas seller financing. With various pricing plans, businesses can choose one that fits their budget while still benefiting from essential features that simplify the financing process.

-

Can I integrate airSlate SignNow with other software for Texas seller financing?

Absolutely! airSlate SignNow supports integrations with various CRM and property management software. This compatibility enhances the Texas seller financing process by allowing seamless data transfer and document management across platforms.

-

What are the benefits of using airSlate SignNow for Texas seller financing?

Using airSlate SignNow for Texas seller financing offers numerous benefits, including time savings, reduced paperwork, and enhanced security. The electronic signature feature ensures that all parties can sign documents quickly and from anywhere, making the transaction smoother.

-

How secure is airSlate SignNow for Texas seller financing transactions?

AirSlate SignNow prioritizes security by using industry-standard encryption for all documents, providing a safe environment for Texas seller financing transactions. Users can also set permissions and access controls, ensuring that only authorized individuals can view or sign documents.

Get more for Texas Seller Financing

- Lymphedema intake form

- Patient service center valley baptist medical center valleybaptist form

- Referral intake form swedish hospital

- Washington federal foundation grant application form

- Guarantor form 204137528

- Confidential financial statement central state bank form

- My mercy birth plan expectant mother namebirth form

- Filing a motion for continuance form

Find out other Texas Seller Financing

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation