Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller Texas Form

What is the Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas

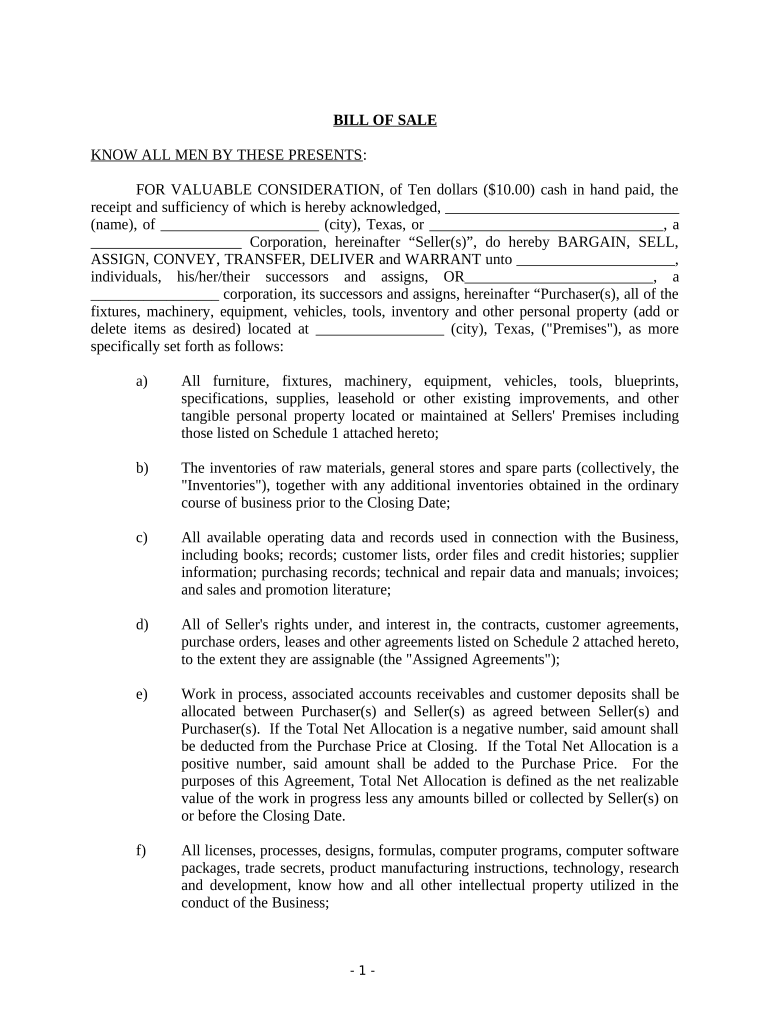

The Bill of Sale in connection with the sale of a business by an individual or corporate seller in Texas is a legal document that serves as proof of the transfer of ownership from the seller to the buyer. This form details the terms of the sale, including the purchase price, a description of the business being sold, and any assets included in the transaction. It is essential for both parties to have a clear understanding of the sale to avoid future disputes and ensure compliance with state laws.

How to use the Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas

Using the Bill of Sale involves several steps to ensure that the document serves its intended purpose effectively. First, both the seller and buyer should review the terms of the sale and agree on the details. Next, they must fill out the form accurately, including all necessary information such as the names of both parties, the business name, and the sale price. Once completed, both parties should sign the document, which can be done digitally to streamline the process. This signed document should then be kept on file for record-keeping and legal purposes.

Steps to complete the Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas

Completing the Bill of Sale requires careful attention to detail. The following steps can guide you through the process:

- Gather necessary information, including business details and seller/buyer identities.

- Clearly outline the terms of the sale, including the purchase price and any included assets.

- Fill out the form with accurate information, ensuring there are no discrepancies.

- Both parties should sign the document, either physically or through a secure digital platform.

- Retain a copy of the signed Bill of Sale for your records and provide one to the buyer.

Key elements of the Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas

Key elements of the Bill of Sale include:

- Identification of the parties: Full names and addresses of both the seller and buyer.

- Description of the business: Details about the business being sold, including its name and any relevant assets.

- Purchase price: The agreed-upon amount for the sale.

- Terms of sale: Any conditions or stipulations agreed upon by both parties.

- Signatures: Signatures of both parties to validate the agreement.

Legal use of the Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas

The legal use of the Bill of Sale is crucial for establishing the legitimacy of the transaction. This document serves as evidence that the seller has transferred ownership to the buyer, which can be important in legal disputes or for tax purposes. To ensure its legal standing, the Bill of Sale must be completed accurately and signed by both parties. Additionally, it should comply with Texas state laws regarding business transactions.

State-specific rules for the Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas

In Texas, there are specific rules that govern the use of the Bill of Sale. It is important to ensure that the document meets state requirements, which may include:

- Proper identification of both parties involved in the transaction.

- A clear description of the business and any assets being sold.

- Compliance with any local regulations or business licensing requirements.

- Retention of copies for both the buyer and seller for future reference.

Quick guide on how to complete bill of sale in connection with sale of business by individual or corporate seller texas

Complete Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it in the cloud. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas with ease

- Locate Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas?

A Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas is a legal document that outlines the terms of sale when an individual or corporation sells a business in Texas. This document serves to transfer ownership and specify the conditions of the sale, ensuring both parties are clear on their obligations.

-

Why do I need a Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas?

Having a Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas is essential to protect both the buyer and the seller. It formalizes the transaction, provides proof of ownership transfer, and can help avoid disputes in the future by clearly outlining terms and conditions.

-

How much does it cost to create a Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas?

The cost to create a Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas can vary based on how it is prepared. Using airSlate SignNow, you can create and eSign this document affordably, often at a fraction of the cost compared to hiring a lawyer, making it a cost-effective solution for your business needs.

-

What features does airSlate SignNow offer for creating a Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas?

airSlate SignNow provides user-friendly tools to create, customize, and eSign a Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas. Key features include document templates, secure cloud storage, and real-time tracking, ensuring a seamless experience for both buyers and sellers.

-

What are the benefits of using airSlate SignNow for a Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas?

Using airSlate SignNow for your Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas streamlines the entire process. It saves time, reduces paperwork, and ensures that your document is legally binding and compliant, which enhances the overall efficiency of your business transaction.

-

Can I integrate airSlate SignNow with other tools for managing my Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas?

Yes, airSlate SignNow integrates seamlessly with various tools and platforms, allowing you to include your Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas within your existing workflow. This capability enhances productivity and ensures that all related business processes are cohesive and organized.

-

Is it necessary to have a lawyer review my Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas?

While it is not strictly necessary to have a lawyer review your Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas, consulting a legal professional can provide additional peace of mind. They can ensure that your document meets all legal requirements and adequately protects your interests in the sale.

Get more for Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas

- Welcome to los angeles ears net allears form

- Irs form 3621

- Cc 188 new 0815 form

- Residential occupancy permit 12212018 form

- Buck hill waiver form

- Minneapolis police department victims domestic violence supplement bwjp form

- Caqh provider credentialing agreement pdf choice health choicehealthinc form

- Form fca1 firearm certificate application m

Find out other Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller Texas

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile