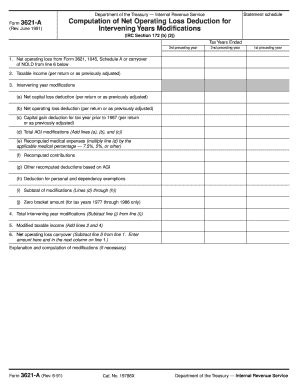

Irs Form 3621

What is the IRS Form 3621

The IRS Form 3621 is a document used primarily for tax purposes, specifically related to the claims for certain tax credits and deductions. This form is essential for individuals and businesses seeking to report specific financial information to the Internal Revenue Service (IRS). Understanding the purpose of this form is crucial for ensuring compliance with tax regulations and optimizing potential tax benefits.

How to Use the IRS Form 3621

Using the IRS Form 3621 involves several steps that require careful attention to detail. First, gather all necessary financial documents, including income statements and previous tax returns. Next, accurately fill out the form by providing the required information, such as personal identification details and specific financial data relevant to the claims you are making. Once completed, review the form for accuracy before submission to avoid any potential issues with the IRS.

Steps to Complete the IRS Form 3621

Completing the IRS Form 3621 can be broken down into a few straightforward steps:

- Collect all relevant financial documents, including W-2s and 1099s.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide detailed information regarding the tax credits or deductions you are claiming.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal Use of the IRS Form 3621

The legal use of the IRS Form 3621 is governed by IRS regulations. This form must be completed accurately to ensure it is considered valid by the IRS. Submitting incorrect or incomplete information may lead to penalties or delays in processing your tax return. It is essential to comply with all IRS guidelines and regulations when using this form to avoid any legal complications.

Filing Deadlines / Important Dates

Adhering to filing deadlines is crucial when submitting the IRS Form 3621. Typically, tax returns, including this form, are due by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Be aware of any changes to deadlines announced by the IRS, as they can vary from year to year. Keeping track of these important dates ensures timely submission and compliance with tax regulations.

Required Documents

To successfully complete the IRS Form 3621, certain documents are required. These typically include:

- Proof of income, such as W-2 forms or 1099 documents.

- Previous tax returns for reference.

- Documentation supporting any credits or deductions claimed.

Having these documents ready will facilitate a smoother completion process and ensure that all necessary information is accurately reported.

Form Submission Methods

The IRS Form 3621 can be submitted through various methods, including:

- Online submission via the IRS e-file system, which is often the quickest method.

- Mailing a paper copy of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, although this method may require an appointment.

Choosing the right submission method can impact the speed and efficiency of processing your tax return.

Quick guide on how to complete irs form 3621

Effortlessly prepare Irs Form 3621 on any device

Digital document management has become increasingly sought after by companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Irs Form 3621 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Irs Form 3621 effortlessly

- Locate Irs Form 3621 and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to preserve your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it directly to your PC.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Irs Form 3621 while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 3621

How to make an eSignature for your Irs Form 3621 in the online mode

How to create an eSignature for the Irs Form 3621 in Chrome

How to make an electronic signature for signing the Irs Form 3621 in Gmail

How to generate an eSignature for the Irs Form 3621 right from your smartphone

How to generate an electronic signature for the Irs Form 3621 on iOS devices

How to make an electronic signature for the Irs Form 3621 on Android OS

People also ask

-

What is IRS Form 3621 and how can airSlate SignNow help with it?

IRS Form 3621 is a tax form used for various reporting purposes. With airSlate SignNow, you can easily create, send, and e-sign IRS Form 3621, ensuring that your documents are completed accurately and efficiently. Our platform streamlines the entire process, making tax season less stressful.

-

Is airSlate SignNow compatible with IRS Form 3621?

Yes, airSlate SignNow is fully compatible with IRS Form 3621. Our document management system allows you to upload, edit, and electronically sign this form seamlessly. This ensures you can handle your tax documentation without any hassle.

-

What features does airSlate SignNow offer for managing IRS Form 3621?

airSlate SignNow provides features like document templates, customizable workflows, and secure e-signature options specifically for IRS Form 3621. These features simplify the process of preparing and submitting your form, ensuring you meet all deadlines and requirements.

-

How does airSlate SignNow ensure the security of IRS Form 3621?

Security is a top priority at airSlate SignNow. We use advanced encryption methods and secure data storage to protect your IRS Form 3621 and any other sensitive documents. You can trust that your information is safe and compliant with regulatory standards.

-

What is the pricing structure for using airSlate SignNow with IRS Form 3621?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those requiring IRS Form 3621 handling. Our cost-effective solutions ensure you only pay for what you need, with transparent pricing and no hidden fees.

-

Can I integrate airSlate SignNow with other software for IRS Form 3621 processing?

Absolutely! airSlate SignNow integrates seamlessly with many popular software applications, enhancing your ability to manage IRS Form 3621. These integrations streamline your workflow, allowing you to keep all your tax processes in one place.

-

What benefits does airSlate SignNow provide for filing IRS Form 3621?

Using airSlate SignNow for filing IRS Form 3621 offers numerous benefits, including improved efficiency, reduced errors, and enhanced collaboration. Our platform allows multiple users to access, edit, and sign the form, making it easier to finalize your submissions.

Get more for Irs Form 3621

Find out other Irs Form 3621

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe