Texas Creditors Form

What is the Texas Creditors

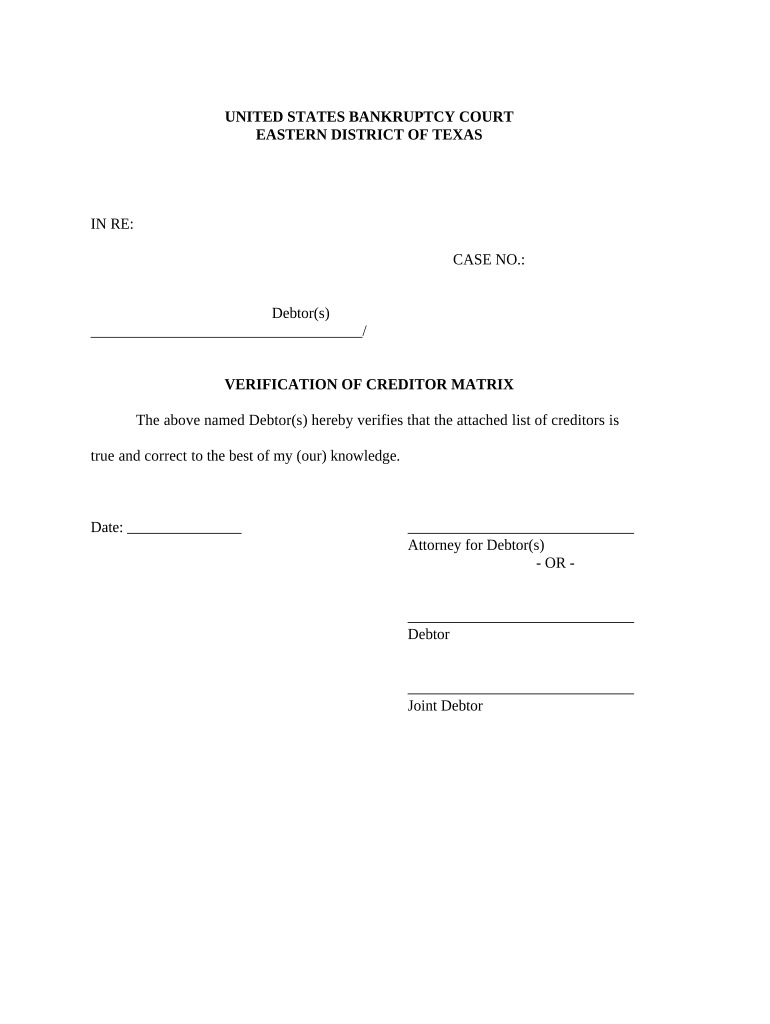

The Texas creditors form serves as a crucial document in the realm of debt collection and financial accountability. It is utilized by creditors to formally assert their claims against debtors in Texas. This form outlines the details of the debt, including the amount owed, the nature of the debt, and any relevant agreements or contracts. Understanding this form is essential for both creditors seeking to recover debts and debtors who need to be aware of their obligations.

How to use the Texas Creditors

Using the Texas creditors form involves several key steps. First, creditors must gather all necessary information regarding the debt, including the debtor's details and the specifics of the claim. Next, they should accurately fill out the form, ensuring that all information is correct and complete. Once completed, the form can be submitted to the appropriate court or agency, depending on the nature of the claim. It is important for creditors to retain copies of the form and any supporting documentation for their records.

Steps to complete the Texas Creditors

Completing the Texas creditors form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant information about the debtor and the debt.

- Fill out the form with accurate details, including names, addresses, and the amount owed.

- Attach any necessary documentation that supports the claim, such as contracts or invoices.

- Review the completed form for accuracy to avoid delays or rejections.

- Submit the form to the appropriate court or agency, either online or by mail.

Legal use of the Texas Creditors

The legal use of the Texas creditors form is governed by state laws and regulations. It is essential for creditors to understand the legal requirements surrounding debt collection in Texas. This includes adhering to the Fair Debt Collection Practices Act (FDCPA) and ensuring that all claims are valid and substantiated. Failure to comply with these regulations can result in penalties or legal challenges, making it crucial for creditors to utilize the form correctly.

Key elements of the Texas Creditors

Several key elements must be included in the Texas creditors form to ensure its validity. These elements typically consist of:

- The full name and contact information of the creditor.

- The full name and contact information of the debtor.

- A detailed description of the debt, including the amount owed.

- Any relevant dates, such as the date the debt was incurred.

- Signature of the creditor or authorized representative.

Form Submission Methods

The Texas creditors form can be submitted through various methods, depending on the specific requirements of the court or agency involved. Common submission methods include:

- Online submission through designated court websites.

- Mailing the completed form to the appropriate office.

- In-person submission at the relevant court or agency.

Penalties for Non-Compliance

Non-compliance with the regulations surrounding the Texas creditors form can lead to significant penalties. Creditors may face legal repercussions, including fines or the dismissal of their claims. Additionally, improper handling of the form can damage a creditor's reputation and relationship with clients. It is vital for creditors to ensure that all aspects of the form and the submission process are handled correctly to avoid these potential issues.

Quick guide on how to complete texas creditors

Complete Texas Creditors effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-conscious alternative to conventional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle Texas Creditors on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Texas Creditors without hassle

- Locate Texas Creditors and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize essential sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that reason.

- Generate your eSignature using the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or mistakes that necessitate new copies of documents. airSlate SignNow meets your document management needs in just a few clicks, from any device you prefer. Edit and eSign Texas Creditors while ensuring outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for texas creditors?

airSlate SignNow provides a comprehensive suite of eSignature solutions tailored for texas creditors. Key features include customizable templates, real-time document tracking, and secure cloud storage. These functionalities enhance efficiency and streamline the document signing process for creditors in Texas.

-

How can texas creditors benefit from using airSlate SignNow?

Texas creditors can signNowly reduce the time spent on paperwork by utilizing airSlate SignNow. The platform allows for quick eSigning and document management, which leads to faster transactions and improved cash flow. Additionally, it improves compliance and record-keeping for creditor documents.

-

What is the pricing structure for texas creditors using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate the needs of texas creditors. Pricing typically varies based on the number of users and features required. Generally, there are monthly and annual subscription options that provide cost-effective solutions for businesses in Texas.

-

Is airSlate SignNow compliant with Texas regulations for creditors?

Yes, airSlate SignNow adheres to Texas regulations and compliance standards that pertain to electronic signatures. This ensures that documents signed through the platform are legally binding and meet all necessary legal requirements for texas creditors. Compliance with regulations is critical for maintaining trust and integrity in creditor transactions.

-

Can airSlate SignNow integrate with other tools used by texas creditors?

Absolutely! airSlate SignNow supports various integrations with popular business tools, making it perfect for texas creditors. Whether you use CRM systems or financial software, these integrations enhance workflow efficiency and keep your operations streamlined.

-

How does airSlate SignNow ensure the security of documents for texas creditors?

Security is a top priority for airSlate SignNow, especially for texas creditors handling sensitive information. The platform utilizes advanced encryption protocols and secure cloud storage to safeguard your documents. Additionally, features such as user authentication and audit trails help maintain the integrity of your transactions.

-

What kind of support does airSlate SignNow offer for texas creditors?

airSlate SignNow provides dedicated customer support to assist texas creditors with any queries or issues. Users have access to a range of resources, including FAQs, tutorials, and live chat support. This ensures that creditors in Texas can maximize their use of the platform with ease.

Get more for Texas Creditors

- Next kin application form

- Form 1952i filing instructions

- You need a reasonable accommodation form

- Dissolution summary packet san diego superior court ca form

- Illinois grey market vehicles form

- Hearing officer facility location effective 81307 form

- Ea 115 info how to ask for a new hearing date judicial council forms

- Dissolution of marriage forms for married

Find out other Texas Creditors

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure