Tx Creditors Form

What is the Tx Creditors

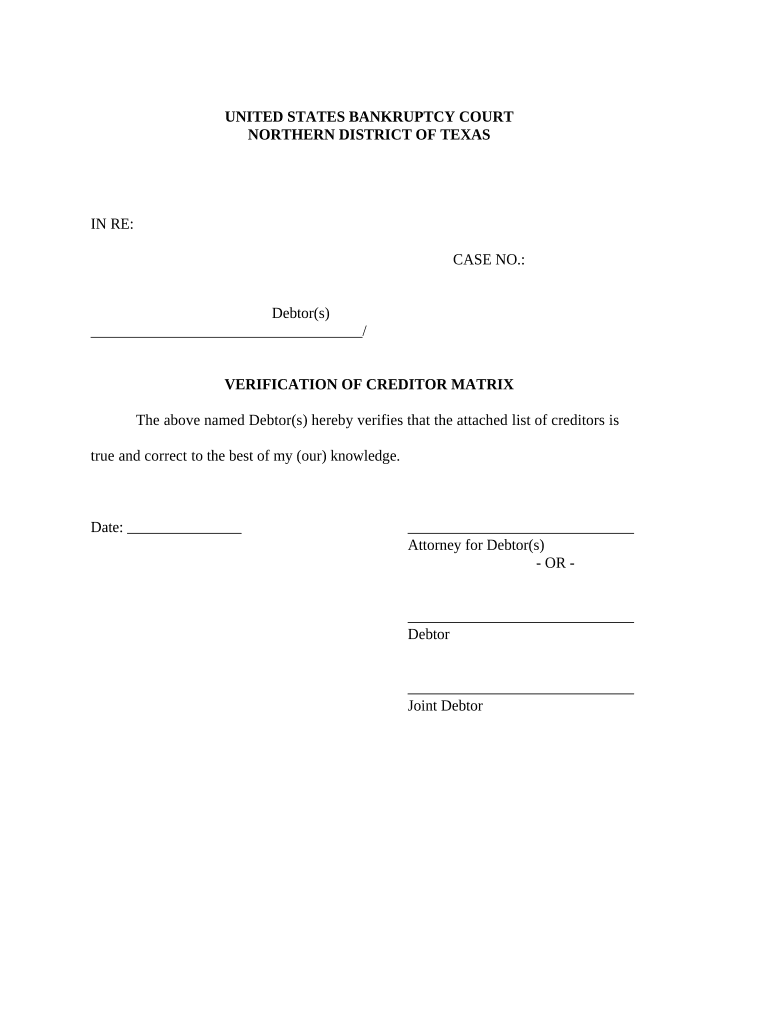

The Texas creditors sample serves as a crucial document for individuals and businesses seeking to establish or verify creditor claims within the state of Texas. This form outlines the necessary information regarding debts owed, including the names of creditors, amounts due, and any relevant terms of repayment. It is essential for parties involved in financial transactions to understand the implications of this document, as it can impact credit ratings and legal standing in financial matters.

How to use the Tx Creditors

Using the Texas creditors sample involves a systematic approach to ensure all required information is accurately captured. Begin by gathering necessary details about each creditor, including their contact information and the specific amounts owed. Next, fill out the form carefully, ensuring that all entries are clear and legible. Once completed, the document can be submitted to the appropriate parties, such as creditors or legal representatives, to formalize the claims. Utilizing a digital platform like signNow can streamline this process, allowing for easy eSigning and secure document management.

Steps to complete the Tx Creditors

Completing the Texas creditors sample involves several key steps:

- Gather all relevant information about your creditors, including names, addresses, and amounts owed.

- Access the Texas creditors sample form, either in digital format or as a printable PDF.

- Fill in the required fields, ensuring accuracy and clarity in your entries.

- Review the completed form for any errors or omissions.

- Sign the document electronically or manually, depending on your submission method.

- Submit the form to the relevant parties, keeping a copy for your records.

Legal use of the Tx Creditors

The legal use of the Texas creditors sample is paramount in ensuring that all creditor claims are recognized and enforceable under Texas law. When properly completed and submitted, this document can serve as evidence of debt in legal proceedings. It is important to comply with all relevant regulations and guidelines to ensure the document's validity. Utilizing a platform that adheres to legal standards for electronic signatures can further enhance the document's legitimacy.

Key elements of the Tx Creditors

Several key elements must be included in the Texas creditors sample to ensure its effectiveness:

- Creditor Information: Full name and contact details of each creditor.

- Debtor Information: Full name and contact details of the debtor.

- Amount Owed: A detailed account of the total debt owed to each creditor.

- Terms of Repayment: Any specific terms or conditions related to the repayment of the debt.

- Signature: A signature from the debtor, confirming the accuracy of the information provided.

Examples of using the Tx Creditors

The Texas creditors sample can be utilized in various scenarios, including:

- Individuals seeking to consolidate debts and communicate with creditors.

- Businesses that need to formalize outstanding debts owed to suppliers or service providers.

- Legal representatives preparing documentation for court cases involving debt disputes.

- Financial advisors assisting clients in managing and documenting their creditor relationships.

Quick guide on how to complete tx creditors

Accomplish Tx Creditors effortlessly on any gadget

Digital document management has gained traction among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Tx Creditors on any device using airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to modify and electronically sign Tx Creditors with ease

- Locate Tx Creditors and then click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Adjust and electronically sign Tx Creditors and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Texas creditors sample templates in airSlate SignNow?

Texas creditors sample templates in airSlate SignNow are pre-designed documents tailored for creditor use in Texas. These samples help streamline the process of managing creditor agreements and ensure compliance with local laws.

-

How can airSlate SignNow benefit Texas creditors?

airSlate SignNow offers Texas creditors a user-friendly platform for sending and eSigning important documents. By utilizing Texas creditors sample templates, users can save time and reduce errors while ensuring that all legal requirements are met.

-

What features does airSlate SignNow offer for Texas creditors?

AirSlate SignNow includes features like customizable Texas creditors sample templates, real-time tracking, and document sharing capabilities. These features enhance efficiency and allow creditors to manage their documentation effortlessly.

-

Is there a cost associated with using airSlate SignNow for Texas creditors?

Yes, airSlate SignNow offers competitive pricing plans designed to fit the needs of Texas creditors. The cost is reasonable, especially considering the time and resources saved through using Texas creditors sample templates.

-

Can airSlate SignNow integrate with other software for Texas creditors?

Absolutely! airSlate SignNow integrates seamlessly with various business applications that Texas creditors commonly use. This compatibility allows for better workflow management and efficient document processing.

-

Are Texas creditors sample templates customizable?

Yes, Texas creditors sample templates in airSlate SignNow can be easily customized to fit specific requirements. This flexibility enables creditors to tailor documents according to individual needs or legal stipulations.

-

How secure is airSlate SignNow for Texas creditors?

AirSlate SignNow prioritizes security for all users, including Texas creditors. With advanced encryption and secure cloud storage, your Texas creditors sample documents are protected from unauthorized access.

Get more for Tx Creditors

- Fillable proof of attendance form

- 2019 schedule l form 990 or 990 ez internal revenue

- Federal form 990 or 990 ez sch c political campaign and

- 2019 instructions for schedule c 2019 instructions for schedule c profit or loss from business form

- 2019 form 1045 application for tentative refund

- About schedule e form 1040 supplemental income irs

- Ampquotwhere to file your taxesampquot for form 5074internal revenue

- Fillable online parishschool ffr commitment cc auth form

Find out other Tx Creditors

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT