Non Foreign Affidavit under IRC 1445 Texas Form

What is the Non Foreign Affidavit Under IRC 1445 Texas

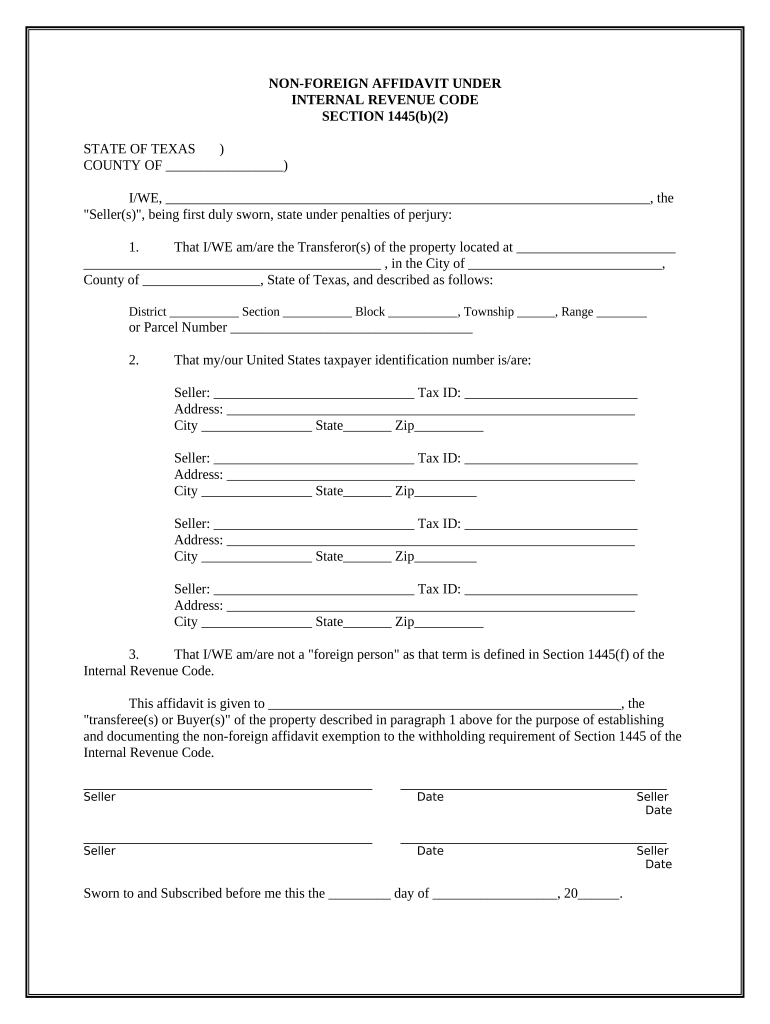

The Non Foreign Affidavit Under IRC 1445 is a legal document used in Texas to certify that a seller of real property is not a foreign person, as defined by the Internal Revenue Code. This affidavit is crucial for buyers to ensure compliance with tax withholding requirements when purchasing property. By confirming the seller's non-foreign status, the buyer can avoid potential withholding taxes that would otherwise apply if the seller were a foreign entity. This form is particularly relevant in real estate transactions where the buyer needs to provide proof of the seller's residency status to the IRS.

How to Use the Non Foreign Affidavit Under IRC 1445 Texas

Using the Non Foreign Affidavit Under IRC 1445 involves several key steps. First, the seller must complete the affidavit, providing necessary personal information such as their name, address, and taxpayer identification number. The seller must also affirm their non-foreign status by signing the document. Once completed, the affidavit should be presented to the buyer, who will retain it for their records and may need to submit it to the IRS if required. It is essential for both parties to understand the implications of this affidavit in the context of the transaction to ensure compliance with federal tax laws.

Steps to Complete the Non Foreign Affidavit Under IRC 1445 Texas

Completing the Non Foreign Affidavit Under IRC 1445 requires careful attention to detail. The following steps outline the process:

- Gather necessary information, including the seller's full name, address, and taxpayer identification number.

- Fill out the affidavit form, ensuring all fields are accurately completed.

- Sign the affidavit in the presence of a notary public to validate the document.

- Provide the completed affidavit to the buyer as part of the transaction documentation.

- Retain a copy of the signed affidavit for personal records and potential future reference.

Key Elements of the Non Foreign Affidavit Under IRC 1445 Texas

The Non Foreign Affidavit Under IRC 1445 contains several key elements that are essential for its validity. These include:

- Seller Information: Full name, address, and taxpayer identification number of the seller.

- Affirmation of Non-Foreign Status: A clear statement confirming that the seller is not a foreign person.

- Signature: The seller must sign the affidavit, often in the presence of a notary.

- Date: The date of signing the affidavit must be included to establish the timeline of the transaction.

Legal Use of the Non Foreign Affidavit Under IRC 1445 Texas

The legal use of the Non Foreign Affidavit Under IRC 1445 is integral to real estate transactions in Texas. By providing this affidavit, sellers affirm their residency status, which protects buyers from potential tax liabilities associated with foreign sellers. It serves as a safeguard against IRS penalties and ensures compliance with tax regulations. Proper execution of this affidavit is crucial for both parties, as it establishes a clear understanding of the seller's tax obligations and residency status.

Filing Deadlines / Important Dates

While the Non Foreign Affidavit Under IRC 1445 does not have a specific filing deadline, it is essential to complete it before the closing of the real estate transaction. This ensures that the buyer has the necessary documentation to avoid any withholding tax issues. It is advisable for both parties to be aware of the closing date and ensure that all required documents, including the affidavit, are prepared and signed in advance to facilitate a smooth transaction.

Quick guide on how to complete non foreign affidavit under irc 1445 texas

Effortlessly Prepare Non Foreign Affidavit Under IRC 1445 Texas on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, as you can access the correct format and safely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without holdups. Handle Non Foreign Affidavit Under IRC 1445 Texas on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to Modify and Electronically Sign Non Foreign Affidavit Under IRC 1445 Texas with Ease

- Locate Non Foreign Affidavit Under IRC 1445 Texas and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your document, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Non Foreign Affidavit Under IRC 1445 Texas to ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 Texas?

A Non Foreign Affidavit Under IRC 1445 Texas is a document that certifies that a seller is not a foreign person, thereby exempting the buyer from withholding taxes on the transaction. This affidavit is crucial for real estate transactions in Texas to comply with federal tax regulations, ensuring that buyers are not held liable for taxes on behalf of foreign sellers.

-

How can airSlate SignNow help with Non Foreign Affidavit Under IRC 1445 Texas?

airSlate SignNow provides an easy-to-use platform that allows users to create, send, and electronically sign Non Foreign Affidavit Under IRC 1445 Texas documents seamlessly. Additionally, our solution ensures compliance with legal standards while streamlining the entire document management process, making it simple for both buyers and sellers.

-

Are there any costs associated with using airSlate SignNow for Non Foreign Affidavit Under IRC 1445 Texas?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. We provide a cost-effective solution tailored for users requiring an efficient way to manage Non Foreign Affidavit Under IRC 1445 Texas documents without the burden of excessive costs.

-

What features does airSlate SignNow offer for managing Non Foreign Affidavit Under IRC 1445 Texas?

Key features include template creation for Non Foreign Affidavit Under IRC 1445 Texas documents, secure electronic signing, real-time tracking, and integration with other platforms. These features enhance the document workflow efficiency and ensure that you can manage essential documents with ease.

-

Is it easy to integrate airSlate SignNow with other applications for handling Non Foreign Affidavit Under IRC 1445 Texas?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing users to streamline their workflows while managing Non Foreign Affidavit Under IRC 1445 Texas. This means you can connect with your existing systems, improving productivity and efficiency.

-

What are the benefits of using airSlate SignNow for Non Foreign Affidavit Under IRC 1445 Texas?

Using airSlate SignNow for Non Foreign Affidavit Under IRC 1445 Texas provides numerous benefits, including time savings, enhanced accuracy, and improved compliance. Additionally, your business can benefit from a more organized document management process that reduces the chances of errors in critical transactions.

-

How secure is the process of signing a Non Foreign Affidavit Under IRC 1445 Texas with airSlate SignNow?

airSlate SignNow prioritizes security and compliance, utilizing advanced encryption technology to protect your documents and data throughout the signing process. This ensures that your Non Foreign Affidavit Under IRC 1445 Texas documents remain secure, giving peace of mind to all parties involved.

Get more for Non Foreign Affidavit Under IRC 1445 Texas

- Sikaran the fighting art of the filipino farmer original balangkas of sikaran order form

- Fill nri undertaking lettet form

- Interactions 1 reading answer form

- Microfinance loan application form

- 84 east j street chula vista california 91910 619 form

- 2016 pacon employment application form

- Standing order mandate bnporguk bnp org form

- Florida landlord tenant act form

Find out other Non Foreign Affidavit Under IRC 1445 Texas

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document