Living Trust for Husband and Wife with One Child Texas Form

What is the Living Trust For Husband And Wife With One Child Texas

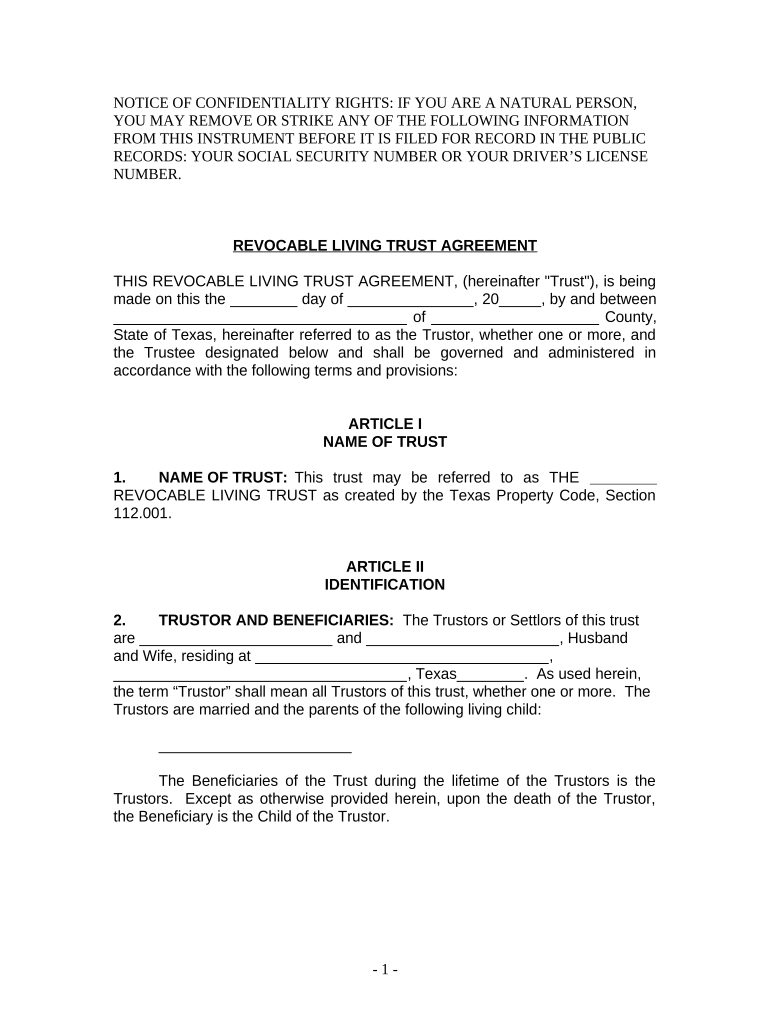

A living trust for husband and wife with one child in Texas is a legal arrangement that allows couples to manage their assets during their lifetime and specify how those assets will be distributed upon their passing. This type of trust is particularly useful for ensuring that the couple's child is taken care of after both parents have passed away. It can help avoid the probate process, which can be lengthy and costly, by allowing assets to be transferred directly to beneficiaries without court intervention.

Key Elements of the Living Trust For Husband And Wife With One Child Texas

Several key elements define a living trust for husband and wife with one child in Texas:

- Trustees: The couple typically serves as the initial trustees, managing the trust assets while they are alive.

- Beneficiaries: The couple's child is usually named as the primary beneficiary, receiving the assets upon the death of both parents.

- Asset Management: The trust outlines how assets are to be managed and distributed, providing clear instructions to the trustees.

- Revocability: This type of trust is usually revocable, meaning the couple can change the terms or dissolve the trust at any time while they are alive.

Steps to Complete the Living Trust For Husband And Wife With One Child Texas

Completing a living trust for husband and wife with one child in Texas involves several steps:

- Gather Information: Collect details about all assets, including property, bank accounts, and investments.

- Choose a Trustee: Decide who will manage the trust, typically the couple themselves.

- Draft the Trust Document: Create a legal document that outlines the terms of the trust, including beneficiaries and asset distribution.

- Sign the Document: Both spouses must sign the trust document in the presence of a notary to ensure its validity.

- Fund the Trust: Transfer ownership of assets into the trust, which may require changing titles or account names.

Legal Use of the Living Trust For Husband And Wife With One Child Texas

The legal use of a living trust for husband and wife with one child in Texas is governed by state laws that recognize the validity of trusts. This type of trust is legally binding and can be enforced in court if necessary. It is essential to ensure that the trust is properly executed and funded to avoid complications in the future. Legal counsel can provide guidance on compliance with Texas laws and help navigate any potential issues.

State-Specific Rules for the Living Trust For Husband And Wife With One Child Texas

Texas has specific rules regarding living trusts that couples should be aware of:

- Witness Requirements: Texas law requires that the trust document be signed by the grantors and witnessed by at least two individuals.

- Notarization: While notarization is not mandatory, it is highly recommended to enhance the trust's validity.

- Asset Title Changes: To ensure assets are protected by the trust, titles must be changed to reflect the trust as the owner.

Quick guide on how to complete living trust for husband and wife with one child texas

Complete Living Trust For Husband And Wife With One Child Texas seamlessly on any gadget

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can locate the right template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any holdups. Handle Living Trust For Husband And Wife With One Child Texas on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to modify and electronically sign Living Trust For Husband And Wife With One Child Texas effortlessly

- Obtain Living Trust For Husband And Wife With One Child Texas and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, monotonous form searching, or mistakes that necessitate reprinting new document versions. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Living Trust For Husband And Wife With One Child Texas and ensure outstanding communication at any phase of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With One Child in Texas?

A Living Trust For Husband And Wife With One Child in Texas is a legal arrangement that allows you to manage and distribute your assets during your lifetime and after your death. This type of trust can help avoid probate, ensuring that your child receives their inheritance smoothly. It provides peace of mind knowing that your assets will be handled according to your wishes.

-

How does a Living Trust For Husband And Wife With One Child benefit us in Texas?

Creating a Living Trust For Husband And Wife With One Child in Texas provides numerous benefits such as avoiding probate, reducing estate taxes, and providing clarity about asset distribution. Additionally, it ensures your child is taken care of according to your preferences, which can be crucial in the event of unexpected circumstances. This trust allows for more flexibility in managing your assets as well.

-

What is the cost of setting up a Living Trust For Husband And Wife With One Child in Texas?

The cost of setting up a Living Trust For Husband And Wife With One Child in Texas can vary depending on complexities and whether you hire an attorney or use an online service. Generally, fees may range from a few hundred to several thousand dollars. Using cost-effective solutions like airSlate SignNow can help streamline the process, potentially reducing overall expenses.

-

Can we modify our Living Trust For Husband And Wife With One Child in Texas?

Yes, a Living Trust For Husband And Wife With One Child in Texas is revocable, meaning you can modify it as your circumstances change. This flexibility allows you to adjust beneficiaries or asset distributions as desired. Keeping your trust updated is crucial to ensure it reflects your current wishes and family needs.

-

What happens if we don't create a Living Trust For Husband And Wife With One Child in Texas?

Without a Living Trust For Husband And Wife With One Child in Texas, your assets may go through probate, delaying distribution and potentially incurring additional costs. Inability to specify asset management can lead to disputes among family members. This can be particularly problematic when trying to secure your child's future and inheritance.

-

Does a Living Trust For Husband And Wife With One Child in Texas cover all types of assets?

Yes, a Living Trust For Husband And Wife With One Child in Texas can cover various types of assets, including real estate, bank accounts, and personal property. However, it's essential to fund the trust properly by transferring ownership of these assets to the trust. This comprehensive coverage ensures all your intended assets are handled according to your wishes.

-

Does airSlate SignNow provide assistance with Living Trust For Husband And Wife With One Child in Texas?

Yes, airSlate SignNow offers tools to help you create and manage a Living Trust For Husband And Wife With One Child in Texas efficiently. With our easy-to-use, cost-effective platform, you can prepare documents online and get them eSigned quickly. This simplifies the process, ensuring that you can focus on what matters most – your family.

Get more for Living Trust For Husband And Wife With One Child Texas

Find out other Living Trust For Husband And Wife With One Child Texas

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe