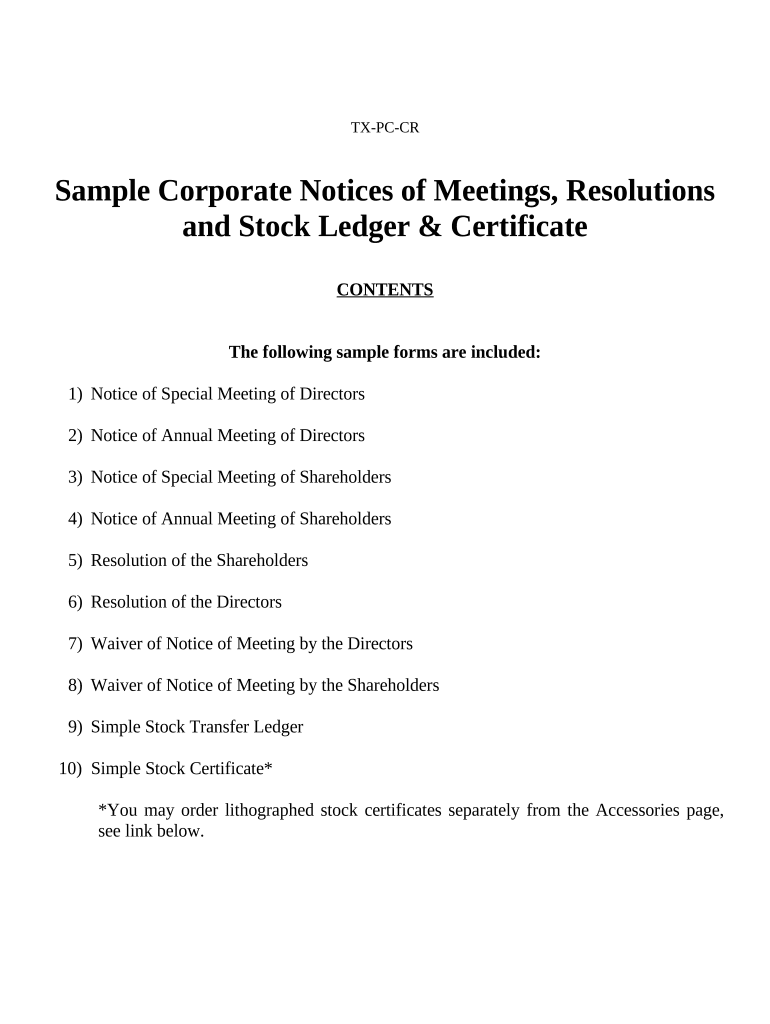

Texas Professional Corporation Form

What is the Texas Professional Corporation

A Texas Professional Corporation is a specific type of business entity designed for licensed professionals, such as doctors, lawyers, and accountants, allowing them to operate their practices in a corporate structure. This form provides liability protection, meaning that the personal assets of the owners are generally shielded from the debts and liabilities of the corporation. It is essential for professionals to understand that while a Texas Professional Corporation offers certain protections, it does not eliminate personal liability for malpractice or professional misconduct.

How to obtain the Texas Professional Corporation

To establish a Texas Professional Corporation, individuals must first ensure they meet the eligibility criteria, which typically includes holding a valid professional license in Texas. The process begins with choosing a unique name for the corporation that complies with state regulations. Next, the Articles of Incorporation must be filed with the Texas Secretary of State, accompanied by the required filing fee. Once the Articles are approved, the corporation must obtain any necessary business licenses or permits specific to their profession.

Steps to complete the Texas Professional Corporation

Completing the Texas Professional Corporation involves several key steps:

- Choose a name that complies with Texas naming requirements.

- File the Articles of Incorporation with the Texas Secretary of State.

- Pay the required filing fee.

- Obtain a Federal Employer Identification Number (EIN) from the IRS.

- Draft corporate bylaws and hold an initial board meeting.

- Apply for any necessary licenses or permits related to your profession.

Legal use of the Texas Professional Corporation

The Texas Professional Corporation must operate within the legal framework established by Texas law. This includes adhering to regulations regarding the professional services offered, maintaining proper corporate records, and fulfilling annual reporting requirements. It is important for professionals to consult legal counsel to ensure compliance with all applicable laws and regulations, as non-compliance can lead to penalties or loss of professional licenses.

Key elements of the Texas Professional Corporation

Several key elements define a Texas Professional Corporation:

- Professional Licensing: All shareholders must be licensed professionals in the field the corporation serves.

- Limited Liability: Protects personal assets from business liabilities.

- Corporate Structure: Requires formalities such as bylaws, meetings, and record-keeping.

- Tax Treatment: May be subject to corporate taxation, depending on the structure chosen.

State-specific rules for the Texas Professional Corporation

Texas has specific rules governing the formation and operation of Professional Corporations. These include requirements for the number of directors, the necessity of a registered agent, and the obligation to file annual reports. Additionally, certain professions may have additional regulations that must be followed, such as maintaining specific insurance coverage or adhering to ethical standards set by professional boards.

Quick guide on how to complete texas professional corporation

Effortlessly Prepare Texas Professional Corporation on Any Device

Managing documents online has gained traction with both companies and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it digitally. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without hassles. Handle Texas Professional Corporation on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented workflow today.

The simplest way to modify and eSign Texas Professional Corporation effortlessly

- Obtain Texas Professional Corporation and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate printing fresh copies. airSlate SignNow addresses your requirements in document management in just a few clicks from any device you choose. Modify and eSign Texas Professional Corporation while ensuring outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Texas professional corporation?

A Texas professional corporation is a specific type of business entity designed for licensed professionals in Texas, such as doctors or lawyers. By forming a Texas professional corporation, individuals can limit their personal liability while benefiting from corporate tax advantages. Additionally, it ensures compliance with state regulations governing professional practices.

-

How can airSlate SignNow benefit my Texas professional corporation?

airSlate SignNow offers an easy-to-use eSignature solution that can streamline document management for your Texas professional corporation. With features like secure document storage and customizable templates, you can efficiently handle contracts, client agreements, and other essential documents. This not only saves time but also enhances your professionalism.

-

What features does airSlate SignNow provide for Texas professional corporations?

airSlate SignNow provides various features tailored to Texas professional corporations, including legally binding eSignatures, document templates, and automated workflows. You can track document status in real-time and receive instant notifications, ensuring that your important documents are signed promptly. These tools help maintain organization and improve efficiency.

-

Is airSlate SignNow cost-effective for a Texas professional corporation?

Yes, airSlate SignNow is designed to be a cost-effective solution for Texas professional corporations. With flexible pricing plans, you can choose one that fits your budget while still accessing powerful eSignature features. This allows you to manage your documents without overspending on administrative tasks.

-

Can I integrate airSlate SignNow with other tools used by my Texas professional corporation?

Absolutely! airSlate SignNow offers seamless integrations with popular tools that many Texas professional corporations use, such as Google Drive, Dropbox, and CRM systems. This allows you to centralize your document management and enhance collaboration across your organization, making operations smoother and more efficient.

-

What industries can benefit from a Texas professional corporation with airSlate SignNow?

Various industries can benefit from establishing a Texas professional corporation, including healthcare, law, accounting, and engineering. By using airSlate SignNow, professionals in these fields can streamline their documentation processes, ensuring compliance and enhancing client interactions. Our eSignature solution is versatile and suits a range of professional practices.

-

How secure is airSlate SignNow for my Texas professional corporation's documents?

Security is a top priority at airSlate SignNow. We use advanced encryption and compliance with regulations such as GDPR and eIDAS to protect your Texas professional corporation's documents. You can trust that your sensitive information is safe while using our platform for electronic signatures and document management.

Get more for Texas Professional Corporation

- Hsmv 72034 2015 2019 form

- P 916 322 3350 f 916 574 8637 www rn ca form

- Notice of trespass from campus salemstateedu form

- Newport news police department applicant background form

- Carty eye associates ltd patient registration form

- Marianthes story painted words spoken memories americanimmigrationcouncil form

- Mcefsboc scholarships for high school students form

- Illinois department of agriculture serology test request form l4

Find out other Texas Professional Corporation

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free