Satisfaction of Deed of Trust Mortgage Individual Lender or Holder Texas Form

What is the Satisfaction Of Deed Of Trust Mortgage Individual Lender Or Holder Texas

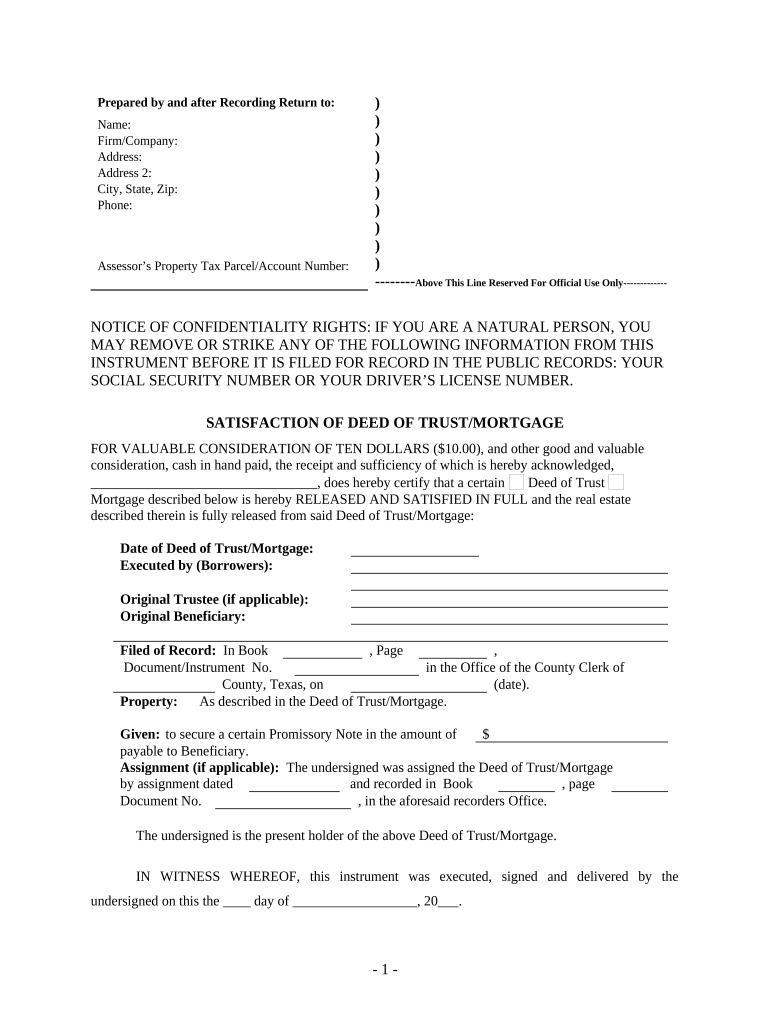

The Satisfaction of Deed of Trust Mortgage for an Individual Lender or Holder in Texas is a legal document that signifies the full repayment of a mortgage loan. This document serves as proof that the borrower has fulfilled their obligations under the mortgage agreement, effectively releasing the lien on the property. In Texas, this process is essential for ensuring that the property is clear of any encumbrances related to the mortgage, allowing the borrower to regain full ownership rights without any claims from the lender. The satisfaction document must be properly executed and recorded with the county clerk's office to be legally binding.

Steps to Complete the Satisfaction Of Deed Of Trust Mortgage Individual Lender Or Holder Texas

Completing the Satisfaction of Deed of Trust Mortgage involves several important steps:

- Gather necessary information, including the original deed of trust, loan number, and property details.

- Prepare the satisfaction document, ensuring it includes the names of both the borrower and lender, property description, and a statement confirming the loan has been paid in full.

- Obtain signatures from all parties involved, typically the lender or holder of the deed of trust.

- File the completed satisfaction document with the appropriate county clerk's office where the original deed of trust was recorded.

- Request a copy of the recorded satisfaction document for personal records.

Legal Use of the Satisfaction Of Deed Of Trust Mortgage Individual Lender Or Holder Texas

The legal use of the Satisfaction of Deed of Trust Mortgage in Texas is crucial for both borrowers and lenders. For borrowers, it serves as evidence that their debt has been settled, protecting them from future claims on the property. For lenders, executing this document is a formal acknowledgment that they no longer hold any interest in the property. It is important to ensure that the document complies with Texas state laws, including proper notarization and recording, to avoid any potential disputes regarding property ownership.

Key Elements of the Satisfaction Of Deed Of Trust Mortgage Individual Lender Or Holder Texas

Key elements of the Satisfaction of Deed of Trust Mortgage include:

- Identifying Information: Names and addresses of the borrower and lender, along with the loan number.

- Property Description: A legal description of the property associated with the mortgage.

- Statement of Satisfaction: A clear declaration that the mortgage has been paid in full.

- Signatures: Required signatures from the lender or holder, and possibly the borrower.

- Notarization: A notary public's acknowledgment to verify the authenticity of the signatures.

State-Specific Rules for the Satisfaction Of Deed Of Trust Mortgage Individual Lender Or Holder Texas

In Texas, specific rules govern the execution and recording of the Satisfaction of Deed of Trust Mortgage. The document must be filed within a certain timeframe after the mortgage has been paid off, typically within 30 days. Additionally, the satisfaction must be recorded in the county where the property is located. Texas law also requires that the lender provide a copy of the satisfaction to the borrower upon request. Failure to comply with these regulations may result in penalties for the lender and continued encumbrance on the property for the borrower.

How to Use the Satisfaction Of Deed Of Trust Mortgage Individual Lender Or Holder Texas

Using the Satisfaction of Deed of Trust Mortgage involves several practical steps. Once the mortgage is paid off, the borrower should request the satisfaction document from the lender. After receiving the document, the borrower should review it for accuracy, ensuring all information is correct. The next step is to file the satisfaction with the county clerk's office to officially remove the lien from the property records. Keeping a copy of the filed satisfaction is essential for future reference, especially if any disputes regarding the property arise.

Quick guide on how to complete satisfaction of deed of trust mortgage individual lender or holder texas

Simplify Satisfaction Of Deed Of Trust Mortgage Individual Lender Or Holder Texas effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed forms, as you can obtain the necessary template and safely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly and without delays. Manage Satisfaction Of Deed Of Trust Mortgage Individual Lender Or Holder Texas on any device using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to modify and eSign Satisfaction Of Deed Of Trust Mortgage Individual Lender Or Holder Texas with ease

- Locate Satisfaction Of Deed Of Trust Mortgage Individual Lender Or Holder Texas and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential sections of your documents or obscure sensitive details using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of submission for your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Satisfaction Of Deed Of Trust Mortgage Individual Lender Or Holder Texas and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Satisfaction Of Deed Of Trust Mortgage Individual Lender Or Holder in Texas?

The Satisfaction Of Deed Of Trust Mortgage Individual Lender Or Holder in Texas is a legal document that confirms the repayment of a mortgage loan. This document marks the end of the borrower's obligation, releasing the lender's claim on the property. It's crucial for property owners to obtain this document to ensure they have clear title to their property.

-

How can I obtain a Satisfaction Of Deed Of Trust Mortgage Individual Lender Or Holder in Texas?

To obtain a Satisfaction Of Deed Of Trust Mortgage Individual Lender Or Holder in Texas, you should contact your lender after paying off your mortgage. They are required by law to provide this document upon request once the loan is paid in full. Utilizing services like airSlate SignNow can streamline the process by facilitating the eSigning of necessary documents.

-

What are the benefits of using airSlate SignNow for managing Satisfaction Of Deed Of Trust documents?

Using airSlate SignNow for managing Satisfaction Of Deed Of Trust documents provides a range of benefits, including ease of use, cost-effectiveness, and efficiency. The platform enables quick eSigning and secure storage of your vital documents. This can greatly reduce the time taken to manage your Satisfaction Of Deed Of Trust Mortgage Individual Lender Or Holder in Texas.

-

Is there a fee associated with obtaining a Satisfaction Of Deed Of Trust from a lender in Texas?

Typically, there is no fee for receiving a Satisfaction Of Deed Of Trust Mortgage Individual Lender Or Holder in Texas once the mortgage is paid off. However, some lenders may charge a small administrative fee. It's best to check with your lender for specific policies regarding fees for this service.

-

How long does it take to receive a Satisfaction Of Deed Of Trust Mortgage from a lender in Texas?

The time to receive a Satisfaction Of Deed Of Trust Mortgage Individual Lender Or Holder in Texas can vary depending on the lender's processing times. Generally, you can expect to receive the document within 30 days after the mortgage payoff is processed. Leveraging airSlate SignNow can help you expedite your document management processes.

-

Can I eSign a Satisfaction Of Deed Of Trust document in Texas?

Yes, in Texas, you can eSign a Satisfaction Of Deed Of Trust Mortgage Individual Lender Or Holder document. The state recognizes electronic signatures as legally binding, provided that all parties consent to use this method. airSlate SignNow makes it easy to eSign and securely store these important documents.

-

What happens if I don't receive my Satisfaction Of Deed Of Trust after paying off my mortgage?

If you don't receive your Satisfaction Of Deed Of Trust Mortgage Individual Lender Or Holder in Texas after paying off your mortgage, it's essential to follow up with your lender. You have the right to request this document, and if they fail to provide it, you may seek legal recourse. Using airSlate SignNow can help track document requests and communications with your lender.

Get more for Satisfaction Of Deed Of Trust Mortgage Individual Lender Or Holder Texas

- Tenancy summons and return of service r 62 1appendix xi b form

- Divorce complaint dissolution of marriage connecticut form

- Form mt 15220mortgage recording tax taxnygov

- Std 204 cagov form

- Application for certificate of title for a motor vehicle pdffiller form

- California department of tax and fee administration train form

- Govform8932 for the latest information

- City of yonkers certificate of nonresidence and form

Find out other Satisfaction Of Deed Of Trust Mortgage Individual Lender Or Holder Texas

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later