Tax Alaska 2016

What is the Tax Alaska

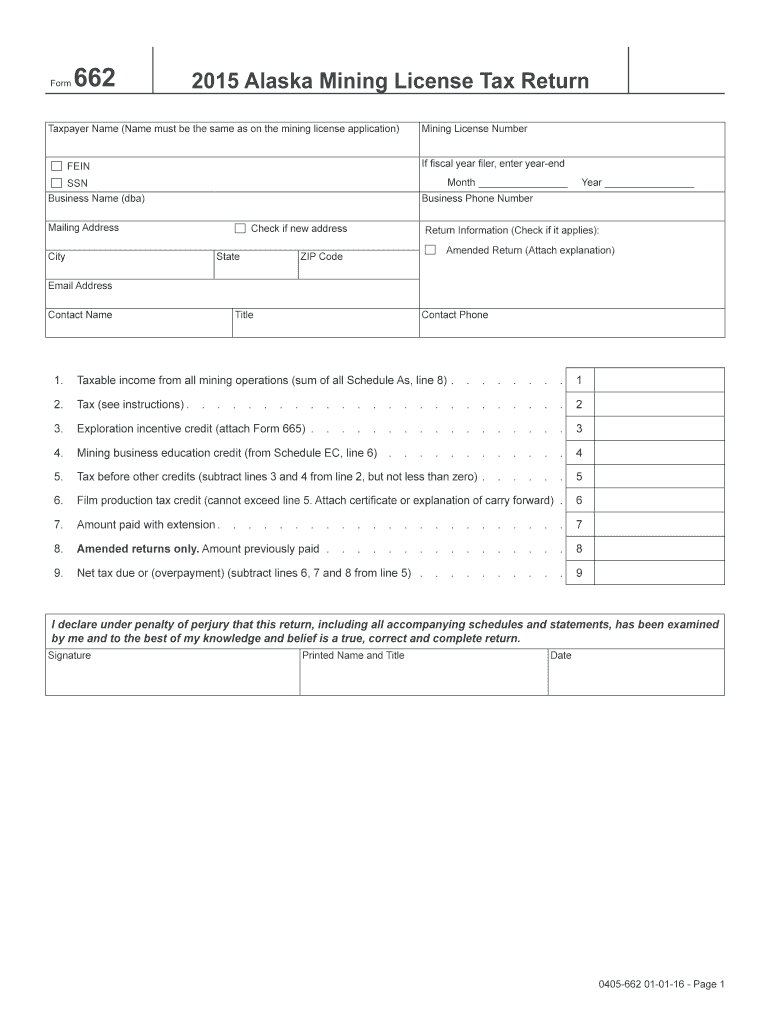

The Tax Alaska form is a specific document required for individuals and businesses operating within the state of Alaska to report their income and calculate their tax obligations. This form is essential for ensuring compliance with state tax laws, which can vary significantly from federal regulations. Understanding the purpose and requirements of the Tax Alaska form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Tax Alaska

Using the Tax Alaska form involves several steps. First, gather all necessary financial documents, including income statements and expense records. Next, accurately fill out the form, ensuring that all information is complete and correct. After completing the form, review it thoroughly for any errors before submission. Depending on your preference, you can submit the form electronically or via mail. Utilizing a reliable eSignature solution can streamline this process, making it easier to sign and send your documents securely.

Steps to complete the Tax Alaska

Completing the Tax Alaska form requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents, including W-2s, 1099s, and any other income records.

- Review the instructions provided with the form to understand the specific requirements.

- Fill out the form accurately, ensuring that all income and deductions are reported.

- Double-check all entries for accuracy, including Social Security numbers and financial figures.

- Sign the form electronically or manually, depending on your submission method.

- Submit the completed form by the required deadline to avoid penalties.

Legal use of the Tax Alaska

The legal use of the Tax Alaska form is governed by state tax laws. To ensure that your submission is compliant, it is important to adhere to all regulations, including filing deadlines and documentation requirements. Utilizing electronic signatures can enhance the legal validity of your submission, provided that the eSignature solution complies with relevant laws such as the ESIGN Act and UETA. This compliance ensures that your electronic submissions are treated with the same legal standing as traditional paper forms.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form are critical for compliance. Typically, the deadline for individual tax returns is April 15, but it may vary based on specific circumstances or extensions. Businesses may have different deadlines depending on their fiscal year. It is essential to stay informed about these dates to avoid late fees and penalties. Mark your calendar with important dates related to tax filing, payment deadlines, and any potential extensions.

Required Documents

To complete the Tax Alaska form accurately, certain documents are required. These may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of deductible expenses

- Previous year’s tax return for reference

- Any relevant receipts or financial statements

Having these documents ready will facilitate a smoother and more accurate filing process.

Quick guide on how to complete tax alaska 6967271

Complete Tax Alaska effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your files swiftly without delays. Handle Tax Alaska on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Tax Alaska with ease

- Locate Tax Alaska and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or conceal sensitive data using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and then click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Alter and electronically sign Tax Alaska and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967271

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967271

How to generate an eSignature for the Tax Alaska 6967271 online

How to generate an eSignature for the Tax Alaska 6967271 in Chrome

How to create an eSignature for signing the Tax Alaska 6967271 in Gmail

How to make an electronic signature for the Tax Alaska 6967271 from your mobile device

How to generate an eSignature for the Tax Alaska 6967271 on iOS

How to generate an eSignature for the Tax Alaska 6967271 on Android OS

People also ask

-

What is airSlate SignNow's role in managing Tax Alaska documents?

airSlate SignNow provides an efficient solution for handling Tax Alaska documents by allowing users to eSign, send, and manage these documents effortlessly. Our platform streamlines the tax documentation process, ensuring compliance and reducing paperwork.

-

How much does airSlate SignNow cost for businesses focused on Tax Alaska?

Pricing for airSlate SignNow varies based on the number of users and features needed, making it a cost-effective choice for managing Tax Alaska documentation. Businesses can choose plans that suit their specific needs, ensuring they get the best value for their investment.

-

Can airSlate SignNow help in tracking Tax Alaska document statuses?

Yes, airSlate SignNow includes tracking features that allow users to monitor the status of Tax Alaska documents. With real-time notifications, you can stay updated on when documents are opened, signed, or completed.

-

What features does airSlate SignNow offer for Tax Alaska compliance?

airSlate SignNow offers a variety of features tailored to ensure Tax Alaska compliance, including customizable templates and secure cloud storage. These features help businesses maintain accurate records and adhere to local tax regulations efficiently.

-

Is airSlate SignNow compatible with other tools for Tax Alaska management?

Absolutely! airSlate SignNow seamlessly integrates with many popular tools and platforms, enhancing your Tax Alaska management process. These integrations include accounting software, CRM systems, and more to streamline your workflow.

-

How does airSlate SignNow enhance the efficiency of Tax Alaska workflows?

By using airSlate SignNow, businesses can automate and simplify their Tax Alaska workflows, reducing the time spent on manual processes. This efficiency leads to quicker turnaround times for document signing and reduces the chances of errors.

-

What benefits does eSigning provide for Tax Alaska documents?

eSigning Tax Alaska documents with airSlate SignNow offers numerous benefits, including faster processing times and reduced operational costs. This feature eliminates the need for printing and scanning, allowing for a more environmentally friendly approach.

Get more for Tax Alaska

Find out other Tax Alaska

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA