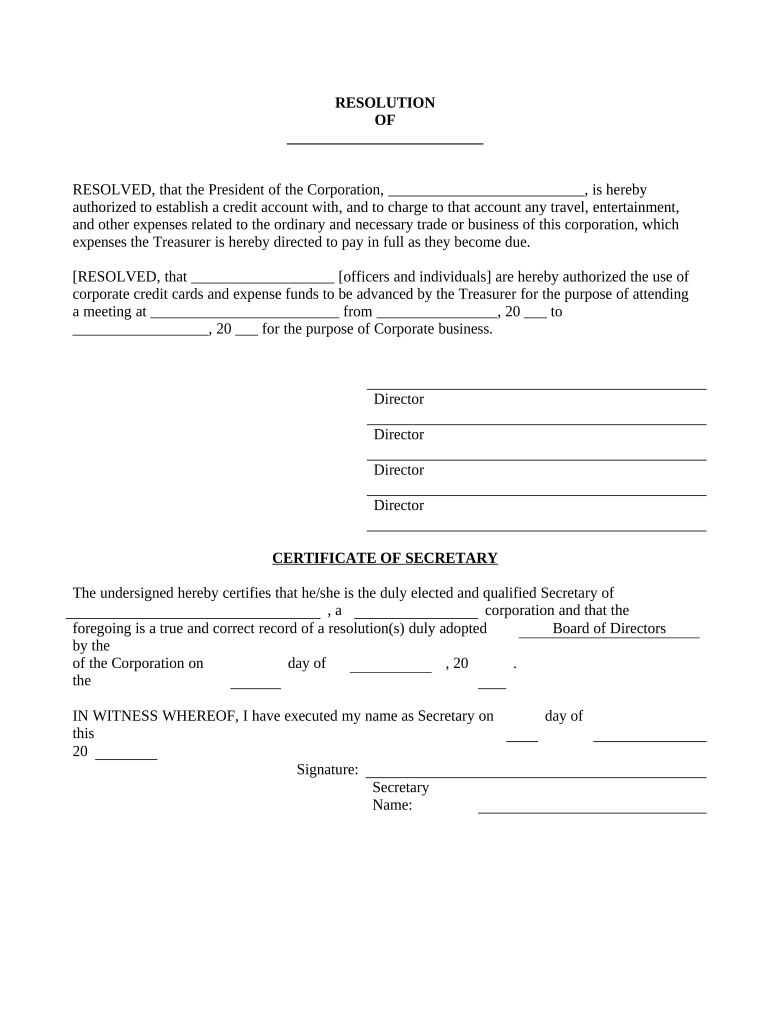

Travel Expenses Form

What is the Travel Expenses

Travel expenses refer to the costs incurred by an employee or individual while traveling for work-related purposes. These expenses can include transportation, lodging, meals, and other costs directly associated with business travel. Understanding what qualifies as travel expenses is crucial for both employees and employers, as it helps ensure accurate reimbursement and compliance with tax regulations.

Key elements of the Travel Expenses

The key elements of travel expenses typically include:

- Transportation Costs: This includes airfare, train tickets, car rentals, and mileage for personal vehicles used for business travel.

- Lodging: Expenses related to hotel stays or other accommodations during travel.

- Meals: Costs for meals consumed while traveling, often subject to per diem limits.

- Incidentals: Additional expenses such as parking fees, tolls, and tips that may arise during travel.

Steps to complete the Travel Expenses

Completing a travel expenses form involves several steps to ensure all relevant information is captured accurately:

- Gather Documentation: Collect receipts and records for all expenses incurred during travel.

- Fill Out the Form: Input details such as dates of travel, locations, and specific expenses.

- Attach Supporting Documents: Include copies of receipts and any other required documentation.

- Submit the Form: Send the completed form to the appropriate department for review and reimbursement.

Legal use of the Travel Expenses

Proper legal use of travel expenses is essential for compliance with tax laws and company policies. Employers must adhere to regulations set forth by the IRS regarding what constitutes a deductible travel expense. Employees should familiarize themselves with these rules to ensure they are not claiming ineligible expenses, which could lead to penalties or audits.

Required Documents

When submitting a travel expenses form, certain documents are typically required to support the claims made. These documents may include:

- Receipts for transportation, lodging, and meals.

- Itineraries or travel confirmations.

- Company travel policy documentation, if applicable.

Application Process & Approval Time

The application process for travel expenses usually involves submitting the completed form along with required documentation to the designated department. Approval times can vary based on company policies and the volume of submissions. It is advisable to check with the finance or HR department for specific timelines and any additional requirements that may apply.

Quick guide on how to complete travel expenses

Effortlessly Prepare Travel Expenses on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Handle Travel Expenses on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest method to modify and eSign Travel Expenses effortlessly

- Locate Travel Expenses and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which only takes seconds and carries the same legal validity as an ink signature.

- Review the details and then click on the Done button to preserve your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Travel Expenses and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the authorisation to travel to work in wales tmplte letter?

The authorisation to travel to work in wales tmplte letter is a document that allows employees to confirm their travel permissions related to work commitments in Wales. By using this template, businesses can easily create the necessary paperwork, ensuring compliance with local regulations and providing clarity for employees.

-

How can airSlate SignNow help with the authorisation to travel to work in wales tmplte letter?

airSlate SignNow streamlines the process of creating and signing the authorisation to travel to work in wales tmplte letter. With its user-friendly interface and powerful eSignature capabilities, you can quickly prepare, send, and obtain signatures on this important document, facilitating faster approvals and ensuring that your team is always in compliance.

-

What are the pricing options for using airSlate SignNow for our template letters?

airSlate SignNow offers various pricing plans to cater to business needs, including a free trial for new users. By choosing the right plan, you can access features that support creating and managing your authorisation to travel to work in wales tmplte letter, ensuring you find the best fit for your budget.

-

Is it easy to customize the authorisation to travel to work in wales tmplte letter on airSlate SignNow?

Yes, customizing the authorisation to travel to work in wales tmplte letter on airSlate SignNow is straightforward. The platform allows you to edit templates easily, enabling you to add or modify sections as needed to fit your specific requirements or business policies.

-

What are the key features of airSlate SignNow for managing template letters?

airSlate SignNow includes features such as document editing, electronic signatures, real-time tracking, and templates management. These features make it efficient to work with the authorisation to travel to work in wales tmplte letter, ensuring a seamless process from creation to signature.

-

Can I integrate airSlate SignNow with other tools I use in my business?

Absolutely! airSlate SignNow offers integrations with popular business applications like Google Drive, Salesforce, and more. This connectivity allows you to streamline workflows and easily manage documents, including the authorisation to travel to work in wales tmplte letter, across different platforms.

-

What benefits will my business gain from using airSlate SignNow for template letters?

By using airSlate SignNow for the authorisation to travel to work in wales tmplte letter, your business will enjoy increased efficiency, reduced paperwork, and enhanced compliance. The digital transformation ensures that you can manage documents quickly while offering a secure environment for sensitive information.

Get more for Travel Expenses

- Tams residency documentation request form

- Court county of communityalternatives form

- 2017 schedule j form

- Application for financial assistance childrenamp39s hospitals and childrensmn form

- Name date pd eampm unit i worksheet 5 electric fields form

- 2017 schedule r form

- Bir 2305 form 2014 2019

- Motion to opt out friend of the court macomb county foc macombgov form

Find out other Travel Expenses

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document