Issue Shares Form

What is the shares resolution?

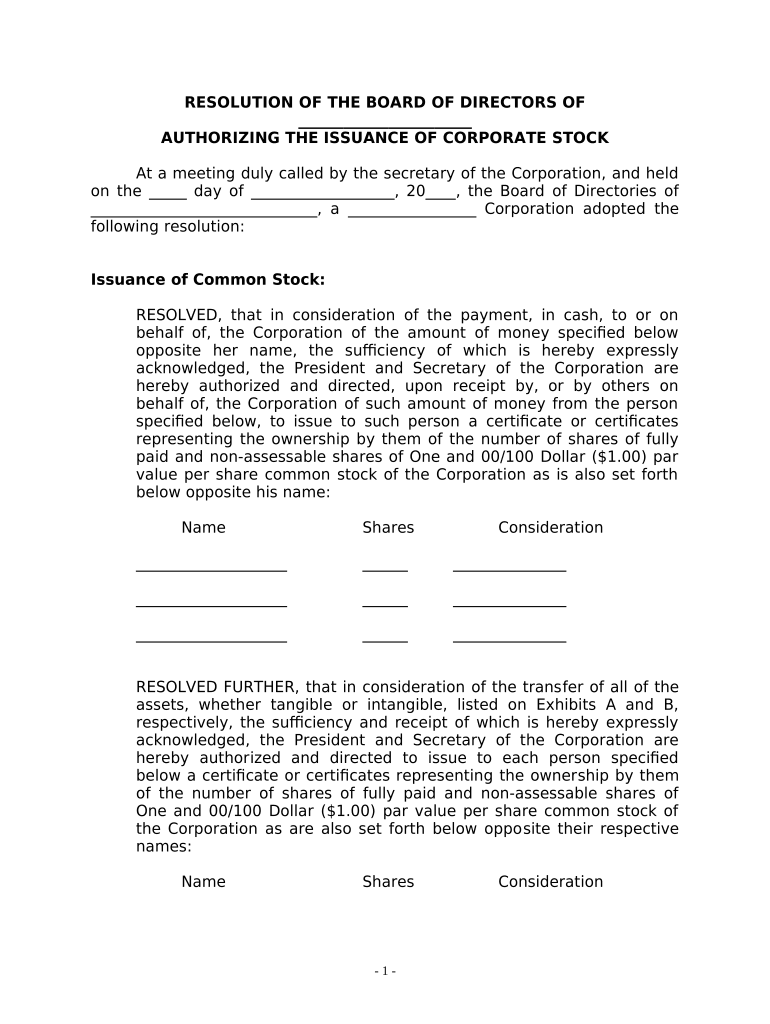

A shares resolution is a formal document used by corporations to authorize the issuance of shares. This resolution is typically adopted by the board of directors and outlines the specifics of the share issuance, including the number of shares, the class of shares, and any conditions attached to the issuance. It serves as a crucial record of corporate decisions and is essential for maintaining compliance with corporate governance standards.

Key elements of a shares resolution

When drafting a shares resolution, several key elements must be included to ensure its validity and effectiveness:

- Title: Clearly state that the document is a shares resolution.

- Date: Include the date on which the resolution is adopted.

- Details of the Issuance: Specify the number of shares being issued, the class of shares, and the terms of issuance.

- Authorization: Include a statement that the board of directors authorizes the issuance of shares.

- Signatures: Provide space for the signatures of the board members who approve the resolution.

Steps to complete the shares resolution

Completing a shares resolution involves several straightforward steps:

- Gather Information: Collect all necessary details regarding the share issuance, including the number of shares and their class.

- Draft the Resolution: Write the resolution, ensuring all key elements are included as outlined above.

- Review: Have the draft reviewed by legal counsel or a corporate secretary to ensure compliance with applicable laws and regulations.

- Adopt the Resolution: Present the resolution to the board of directors for approval during a meeting.

- Document the Decision: Once approved, ensure the resolution is documented in the corporate minutes and signed by the appropriate parties.

Legal use of the shares resolution

The shares resolution must comply with state laws and the corporation's bylaws to be legally binding. It is essential to ensure that the resolution is properly adopted and documented to avoid any potential legal issues. This document not only serves as a record of the decision but also provides evidence of compliance with corporate governance requirements. In the event of a dispute, having a well-drafted shares resolution can protect the corporation and its directors.

Examples of using the shares resolution

Shares resolutions can be utilized in various scenarios, including:

- Issuing new shares to raise capital for business expansion.

- Converting existing debt into equity by issuing shares to creditors.

- Granting shares as part of employee compensation packages.

Each of these examples highlights the importance of having a properly executed shares resolution to document the corporate actions taken.

Required documents for shares resolution

To complete a shares resolution, certain documents may be required:

- Corporate Bylaws: To ensure compliance with internal governance rules.

- Board Meeting Minutes: To record the discussion and approval of the resolution.

- Shareholder Agreements: If applicable, to outline any rights or restrictions associated with the shares being issued.

Having these documents on hand can facilitate a smoother process when drafting and adopting the shares resolution.

Quick guide on how to complete issue shares

Effortlessly prepare Issue Shares on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the necessary form and securely keep it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage Issue Shares on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to edit and electronically sign Issue Shares with ease

- Find Issue Shares and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow manages all your document needs within a few clicks from your chosen device. Edit and electronically sign Issue Shares and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a shares resolution?

A shares resolution is a formal document used by a company’s board to define and approve key decisions regarding shares. This includes information on issuing new shares or transferring ownership. Understanding shares resolutions is essential for maintaining proper corporate governance.

-

How can airSlate SignNow assist with shares resolution?

airSlate SignNow streamlines the process of creating and signing shares resolutions. With easy-to-use templates and eSigning capabilities, businesses can quickly draft, distribute, and finalize their shares resolution documents. This efficiency helps you manage important corporate decisions without delay.

-

Is there a cost associated with using airSlate SignNow for shares resolution?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Pricing is based on the features you need, including those specifically for managing shares resolutions. This ensures you get the right tools at a cost-effective rate.

-

What features does airSlate SignNow offer for creating shares resolution documents?

airSlate SignNow provides a robust set of features aimed at simplifying shares resolution creation. This includes customizable templates, real-time collaboration, and secure eSignatures. These features ensure your documents are both compliant and easily accessible.

-

Can airSlate SignNow integrate with other software solutions for shares resolution management?

Absolutely! airSlate SignNow integrates seamlessly with numerous software solutions, enhancing your shares resolution management process. This includes CRM tools, project management software, and cloud storage services, ensuring that all your documents are connected.

-

What are the benefits of using airSlate SignNow for shares resolution over traditional methods?

Using airSlate SignNow for shares resolution eliminates the hassle of paper-based processes. It improves speed, reduces errors, and enhances security through encrypted eSigning. This modern approach helps businesses stay compliant and organized.

-

Is airSlate SignNow secure for handling sensitive shares resolution documents?

Yes, airSlate SignNow employs top-tier security protocols to protect sensitive shares resolution documents. Features such as SSL encryption, two-factor authentication, and secure storage ensure that your data is safe throughout the eSigning process.

Get more for Issue Shares

- Trust property form

- Sellers disclosure noticetrec trectexasgov form

- Parents to child with reserved life estate 481372265 form

- Appoint if more than one attorney in fact is appointed add jointlyquot form

- Grantor does hereby quitclaim unto form

- Missouri personal representatives deed to individualus legal forms

- Ampquotnew mexico statutory form power of attorney important information

- Pet adoption agreement the mia foundation form

Find out other Issue Shares

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer