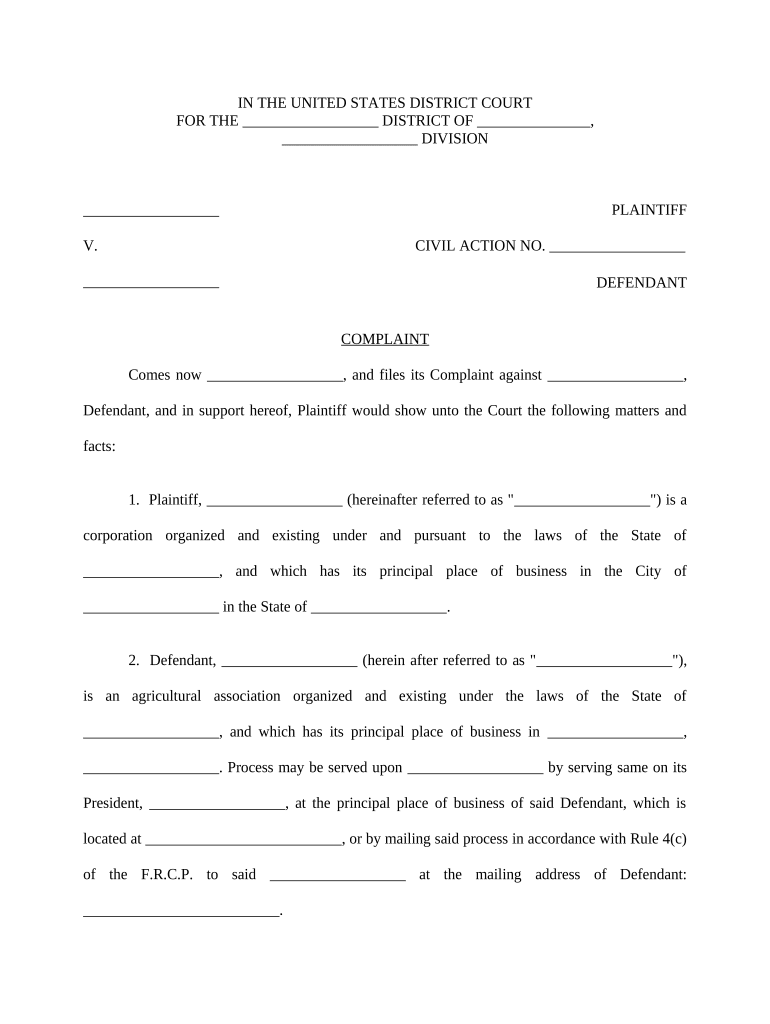

Insurance Contract Form

What is the insurance contract?

An insurance contract is a legally binding agreement between an insurer and an insured party. This document outlines the terms and conditions under which the insurer agrees to provide financial protection against specific risks in exchange for premium payments. It typically includes details such as the coverage limits, exclusions, and the rights and responsibilities of both parties. Understanding the components of an insurance contract is essential for ensuring that both the insurer and the insured are aware of their obligations and entitlements.

Key elements of the insurance contract

Several critical elements define the structure and enforceability of an insurance contract. These include:

- Declarations: This section provides essential information, such as the names of the parties involved, the policy number, and the coverage period.

- Insuring Agreement: This outlines the specific coverage provided, detailing what risks are insured and under what circumstances.

- Exclusions: This part specifies what is not covered by the policy, helping to clarify the limits of the insurer's obligations.

- Conditions: These are the rules and requirements that both parties must follow, including payment terms and procedures for filing claims.

Steps to complete the insurance contract

Completing an insurance contract involves several important steps to ensure accuracy and compliance. Follow these steps for a smooth process:

- Gather necessary information: Collect all required personal and financial details, including identification and any relevant documentation.

- Review the policy options: Evaluate different coverage options and select the one that best fits your needs.

- Fill out the application: Carefully complete the insurance contract form, ensuring all information is accurate and complete.

- Submit the application: Send the completed form to the insurer, either digitally or via traditional mail, following their submission guidelines.

- Receive confirmation: Await confirmation from the insurer regarding the acceptance of the insurance contract.

Legal use of the insurance contract

The legal validity of an insurance contract hinges on several factors. To be enforceable, the contract must meet specific legal requirements, including:

- Offer and acceptance: There must be a clear offer from the insurer and acceptance by the insured.

- Consideration: Both parties must provide something of value, typically the premium payment in exchange for coverage.

- Capacity: Both parties must have the legal ability to enter into a contract, meaning they are of sound mind and of legal age.

- Legality: The contract's purpose must be lawful, ensuring it does not promote illegal activities.

How to use the insurance contract

Using an insurance contract effectively involves understanding its terms and applying them to real-life situations. Here are some tips for utilizing your insurance contract:

- Know your coverage: Familiarize yourself with what is covered and any exclusions to avoid surprises when filing a claim.

- Maintain documentation: Keep a copy of your insurance contract and any related correspondence for future reference.

- Communicate with your insurer: Stay in touch with your insurance provider for updates and clarifications regarding your policy.

- Review regularly: Periodically assess your coverage needs and make adjustments to your policy as necessary.

Examples of using the insurance contract

Understanding practical applications of an insurance contract can enhance its effectiveness. Here are a few examples:

- Homeowners insurance: A homeowner files a claim after a storm damages their roof, using the insurance contract to understand their coverage limits and the claims process.

- Auto insurance: An individual involved in an accident refers to their insurance contract to determine liability and coverage for repairs.

- Health insurance: A policyholder reviews their contract to understand the benefits and co-pays associated with a medical procedure.

Quick guide on how to complete insurance contract

Complete Insurance Contract effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your paperwork quickly without delays. Manage Insurance Contract on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Insurance Contract with ease

- Access Insurance Contract and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that reason.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Insurance Contract and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an insurance contract and how is it used in airSlate SignNow?

An insurance contract is a legally binding agreement between an insurer and the insured. In airSlate SignNow, it can be used to facilitate the signing and management of insurance documents quickly and securely. Our platform allows businesses to send and eSign insurance contracts seamlessly, ensuring compliance and efficiency.

-

How does airSlate SignNow simplify the signing process for insurance contracts?

airSlate SignNow simplifies the signing process by providing an intuitive interface that allows users to eSign insurance contracts from any device. It eliminates the need for paper documents, reduces turnaround times, and ensures that all signatures are legally valid. This streamlining of the process is highly beneficial for busy professionals.

-

What are the pricing options for using airSlate SignNow with insurance contracts?

airSlate SignNow offers flexible pricing plans designed to fit different business needs when managing insurance contracts. Our plans start at a competitive rate with the option to scale as your business grows. Additionally, we provide a free trial so you can explore how eSigning insurance contracts can enhance your operations.

-

Can airSlate SignNow integrate with other software for managing insurance contracts?

Yes, airSlate SignNow integrates seamlessly with various CRM and document management systems. This means you can easily manage your insurance contracts alongside other business applications, enhancing your workflow and increasing productivity. Our integration options are designed to be flexible and user-friendly.

-

What security measures are in place for signing insurance contracts on airSlate SignNow?

Security is a top priority for airSlate SignNow, especially when it comes to handling sensitive information like insurance contracts. We implement robust encryption, multi-factor authentication, and compliant storage solutions to ensure that your documents remain secure throughout the signing process. Trust and confidentiality are paramount.

-

How can airSlate SignNow enhance the customer experience when dealing with insurance contracts?

With airSlate SignNow, the customer experience is enhanced by providing a fast, efficient, and user-friendly platform for signing insurance contracts. Clients can easily track the status of their documents, receive reminders, and access everything they need in one place. This transparency contributes to higher satisfaction and trust.

-

What features make airSlate SignNow a good choice for managing insurance contracts?

AirSlate SignNow offers various features that make it ideal for managing insurance contracts, including customizable templates, automated workflows, and real-time notifications. These capabilities help streamline the signing process and improve overall document management, making it easier for businesses to handle multiple contracts simultaneously.

Get more for Insurance Contract

- University of louisville school of dentistry health history form

- Rowan university acknowledgement release and agreement not form

- Application for parental leavepart 1 request form

- College credit plus application 2020 2021 ohio university form

- Hipaa privacy incident reportdocx form

- Mandatory for children 17 amp under form

- Pdf sick leave blank form

- Deficiency plan form

Find out other Insurance Contract

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors